Will Positive Phase 3 Results for Sibeprenlimab Shift Otsuka Holdings' (TSE:4578) Investment Narrative?

Reviewed by Sasha Jovanovic

- On November 9, 2025, Otsuka Pharmaceutical reported 12-month interim results from its Phase 3 VISIONARY trial of sibeprenlimab for IgA nephropathy at the American Society of Nephrology Kidney Week, with summary data published in The New England Journal of Medicine.

- The interim analysis showed sibeprenlimab achieved a substantial reduction in proteinuria versus placebo, supporting Otsuka's recent U.S. FDA Priority Review and highlighting its innovative approach to tackling a rare kidney disease.

- We'll now explore how these positive late-stage trial results and regulatory milestones for sibeprenlimab impact Otsuka Holdings' investment outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Otsuka Holdings Investment Narrative Recap

To view Otsuka Holdings as a compelling opportunity, an investor must have confidence in the company’s ability to successfully renew its core product portfolio through innovation in late-stage drug development and to offset revenue and margin risks from patent expirations. The latest positive Phase 3 results and FDA Priority Review for sibeprenlimab provide a near-term catalyst, with regulatory approval now taking center stage as the most important short-term event, while ongoing dependency on a small basket of legacy products remains the chief risk.

Among recent announcements, the September 2025 receipt of the FDA’s Complete Response Letter for REXULTI in PTSD contrasts sharply with the progress of sibeprenlimab, highlighting both the risks of regulatory setbacks and the importance of late-stage pipeline success in shaping near-term and future revenues.

By contrast, investors should be aware that continued revenue reliance on a limited number of core drugs could...

Read the full narrative on Otsuka Holdings (it's free!)

Otsuka Holdings' outlook anticipates ¥2,581.8 billion in revenue and ¥306.9 billion in earnings by 2028. This scenario assumes a 2.4% annual revenue growth rate, but a decrease in earnings of ¥102.0 billion from the current ¥408.9 billion.

Uncover how Otsuka Holdings' forecasts yield a ¥9400 fair value, a 14% upside to its current price.

Exploring Other Perspectives

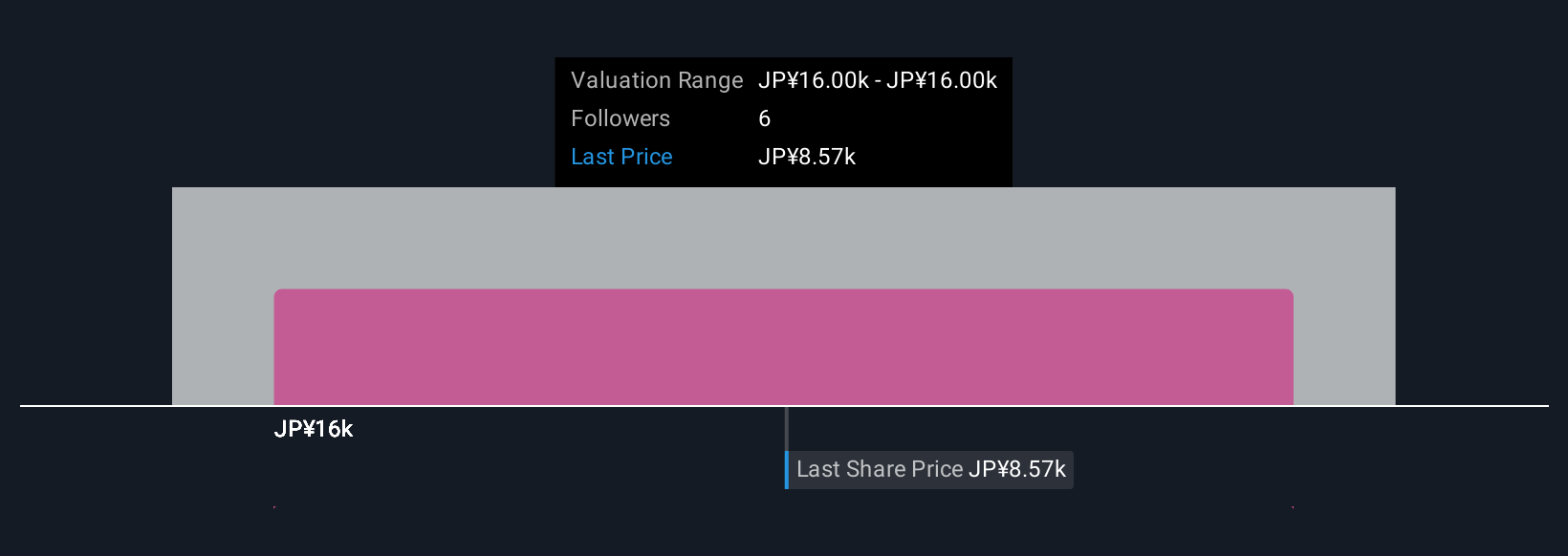

Only one fair value estimate from the Simply Wall St Community valued Otsuka at ¥16,001.78, sharply above current levels. With FDA approval for sibeprenlimab the near-term catalyst, see how other investors’ viewpoints may reshape the outlook.

Explore another fair value estimate on Otsuka Holdings - why the stock might be worth as much as 93% more than the current price!

Build Your Own Otsuka Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otsuka Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Otsuka Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otsuka Holdings' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4578

Otsuka Holdings

Engages in the pharmaceuticals, nutraceuticals, consumer products, and other businesses worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives