- South Korea

- /

- Machinery

- /

- KOSE:A064350

Undervalued Global Stocks Estimated Below Intrinsic Value In July 2025

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely monitoring economic indicators such as job growth and inflation rates. In this environment of market optimism and economic growth, identifying undervalued stocks becomes crucial for those seeking opportunities that may be trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Leapmotor Technology (SEHK:9863) | HK$57.90 | HK$115.32 | 49.8% |

| RVRC Holding (OM:RVRC) | SEK45.98 | SEK90.84 | 49.4% |

| Medy-Tox (KOSDAQ:A086900) | ₩163100.00 | ₩322233.66 | 49.4% |

| Hibino (TSE:2469) | ¥2338.00 | ¥4674.12 | 50% |

| Duk San NeoluxLtd (KOSDAQ:A213420) | ₩33400.00 | ₩65880.80 | 49.3% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥851.17 | 49.6% |

| CI Games (WSE:CIG) | PLN2.47 | PLN4.93 | 49.9% |

| Carl Zeiss Meditec (XTRA:AFX) | €53.00 | €105.92 | 50% |

| Astroscale Holdings (TSE:186A) | ¥676.00 | ¥1348.76 | 49.9% |

| ams-OSRAM (SWX:AMS) | CHF12.42 | CHF24.71 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Hd Hyundai MipoLtd (KOSE:A010620)

Overview: Hd Hyundai Mipo Co., Ltd. is a South Korean company that specializes in manufacturing, repairing, and remodeling ships, with a market cap of ₩7.40 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which generated ₩5.79 billion.

Estimated Discount To Fair Value: 15.6%

Hd Hyundai Mipo Ltd. is trading at ₩179,300, approximately 15.6% below its estimated fair value of ₩212,342.98, indicating it may be undervalued based on cash flows. The company's earnings are expected to grow significantly at 40.7% annually over the next three years, outpacing the Korean market's growth rate of 20.8%. However, its return on equity is forecasted to remain relatively low at 17% in three years' time.

- According our earnings growth report, there's an indication that Hd Hyundai MipoLtd might be ready to expand.

- Dive into the specifics of Hd Hyundai MipoLtd here with our thorough financial health report.

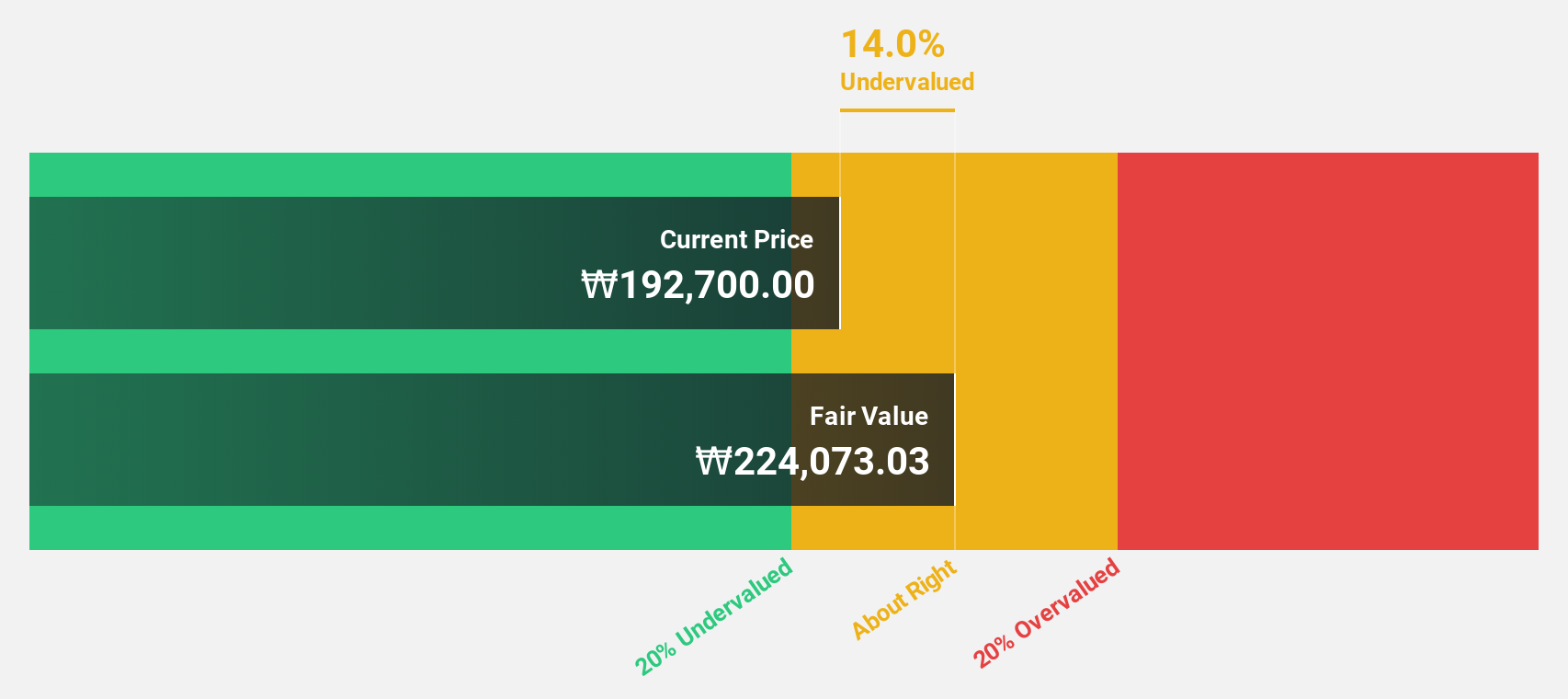

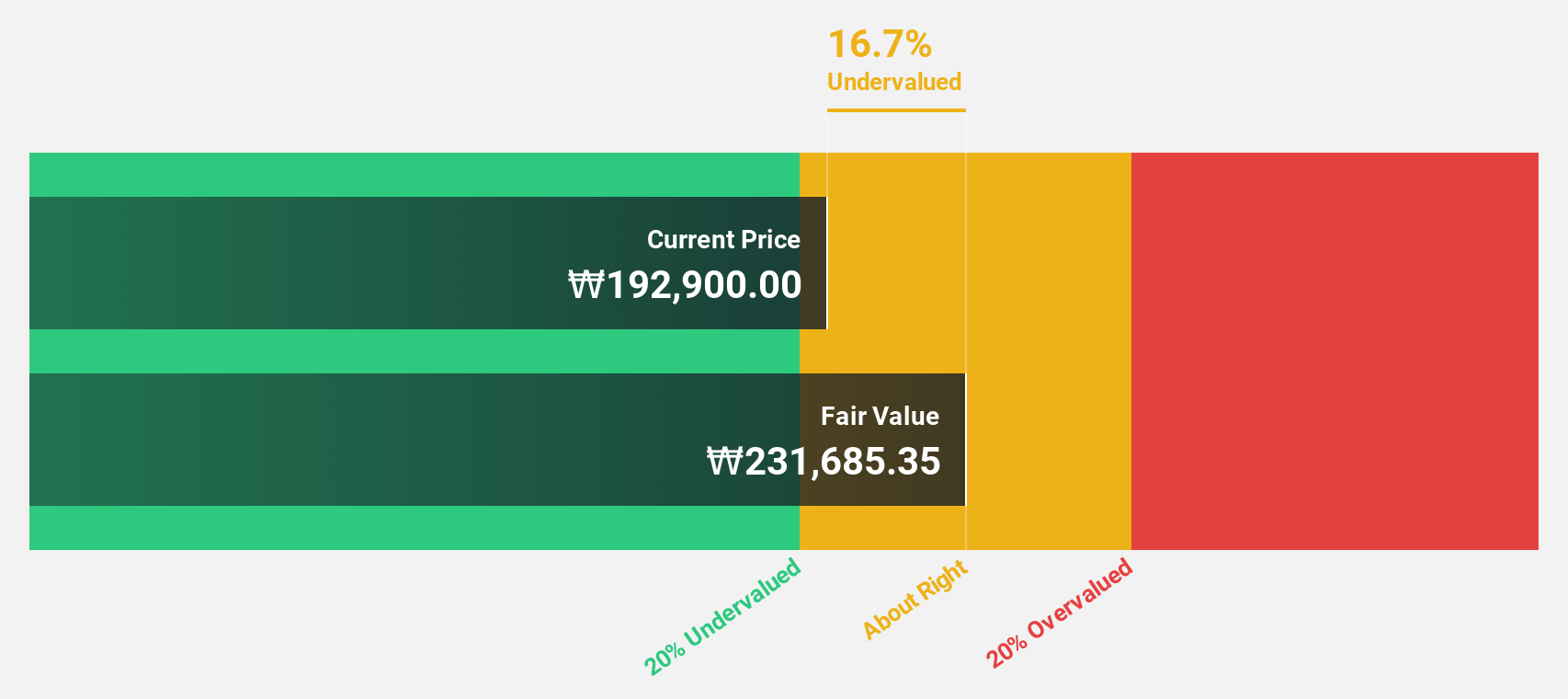

Hyundai Rotem (KOSE:A064350)

Overview: Hyundai Rotem Company manufactures and sells railway vehicles, defense systems, and plants and machinery both in South Korea and internationally, with a market cap of ₩21.16 trillion.

Operations: The company's revenue is derived from three main segments: Defense Sector (₩2.71 billion), Plant Division (₩478 million), and Railway Sector (₩1.62 billion).

Estimated Discount To Fair Value: 44.6%

Hyundai Rotem is currently trading at ₩185,200, significantly below its estimated fair value of ₩334.22, suggesting it is undervalued based on cash flows. The company's earnings are projected to grow 28.43% annually over the next three years, surpassing the Korean market's growth rate of 20.8%. Despite recent share price volatility, Hyundai Rotem's revenue and profit growth forecasts remain robust compared to market averages.

- Our expertly prepared growth report on Hyundai Rotem implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Hyundai Rotem.

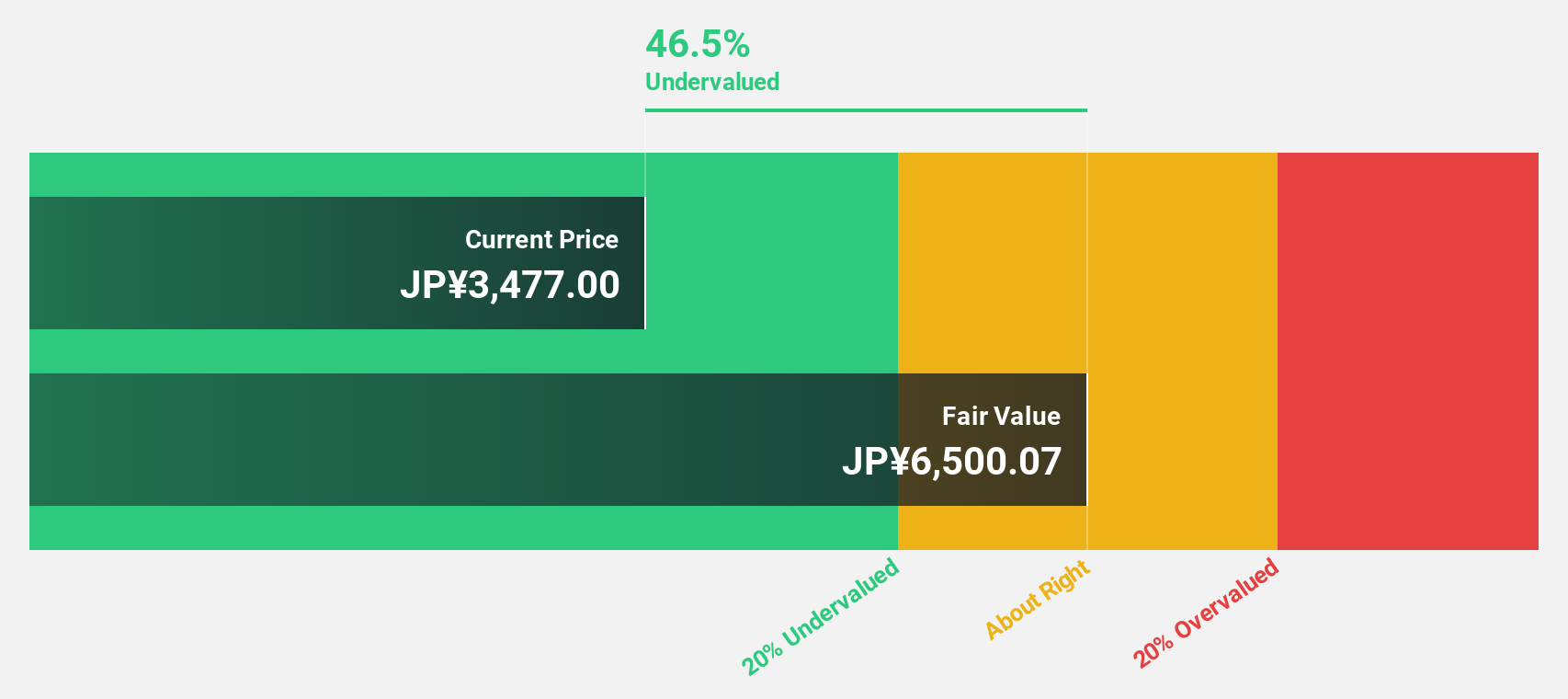

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a global pharmaceutical manufacturer and seller operating in Japan, North America, Europe, and other international markets with a market cap of approximately ¥5.99 trillion.

Operations: Daiichi Sankyo generates revenue through its pharmaceutical products sold across Japan, North America, Europe, and other international markets.

Estimated Discount To Fair Value: 46.2%

Daiichi Sankyo is trading at ¥3250, significantly below its estimated fair value of ¥6036.4, highlighting its potential undervaluation based on cash flows. Recent earnings growth of 47.3% and a forecasted annual profit increase of 12% outpace the Japanese market's average growth rate of 7.7%. However, the company's dividend yield is not well covered by free cash flows, and share price volatility remains a concern despite promising revenue forecasts.

- The growth report we've compiled suggests that Daiichi Sankyo Company's future prospects could be on the up.

- Click here to discover the nuances of Daiichi Sankyo Company with our detailed financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 477 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Rotem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A064350

Hyundai Rotem

Manufactures and sells railway vehicles, defense systems, and plants and machinery in South Korea and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives