How General Proximity Partnership and STING Agonist Trial Will Impact Daiichi Sankyo (TSE:4568) Investors

Reviewed by Sasha Jovanovic

- On November 12, 2025, General Proximity announced a multi-target collaboration with Daiichi Sankyo's Boston Research Institute to apply its OmniTAC platform to discover new oncology therapies, while Daiichi Sankyo also recently commenced a first-in-human trial for its STING agonist ADC, DS3610, in advanced solid tumors.

- This collaboration highlights the industry's increased focus on induced proximity medicines and Daiichi Sankyo's commitment to advancing treatments for challenging and traditionally undruggable cancer targets.

- We'll explore how the new oncology research alliance supports Daiichi Sankyo's innovation strategy and shapes its investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Daiichi Sankyo Company Investment Narrative Recap

To own a stake in Daiichi Sankyo today, investors need conviction that its leadership in innovative oncology therapies will translate into future growth, despite revenue concentration in a few blockbusters and increasing R&D expenses. The recent multi-target collaboration with General Proximity and initiation of the DS3610 trial broaden the company’s research portfolio, yet neither event significantly alters the short-term outlook, which remains focused on late-stage data from ENHERTU and Datroway or any abrupt competitive or regulatory risk to these assets.

Of the recent announcements, the new first-in-human trial for DS3610 stands out as most relevant: it supports expansion beyond existing revenue drivers and demonstrates ongoing investment in next-generation platforms. However, with profitability still closely tied to ENHERTU and Datroway, near-term revenue and margin fluctuations may still hinge on these lead products and their competitive positions.

But as interest grows around breakthrough science, investors should also keep in mind the heightened risk if future clinical data for lead drugs or pipeline candidates ...

Read the full narrative on Daiichi Sankyo Company (it's free!)

Daiichi Sankyo Company is projected to reach ¥2,659.1 billion in revenue and ¥447.9 billion in earnings by 2028. This outlook relies on an estimated annual revenue growth rate of 11.4% and reflects an earnings increase of ¥152.0 billion from the current level of ¥295.9 billion.

Uncover how Daiichi Sankyo Company's forecasts yield a ¥5517 fair value, a 57% upside to its current price.

Exploring Other Perspectives

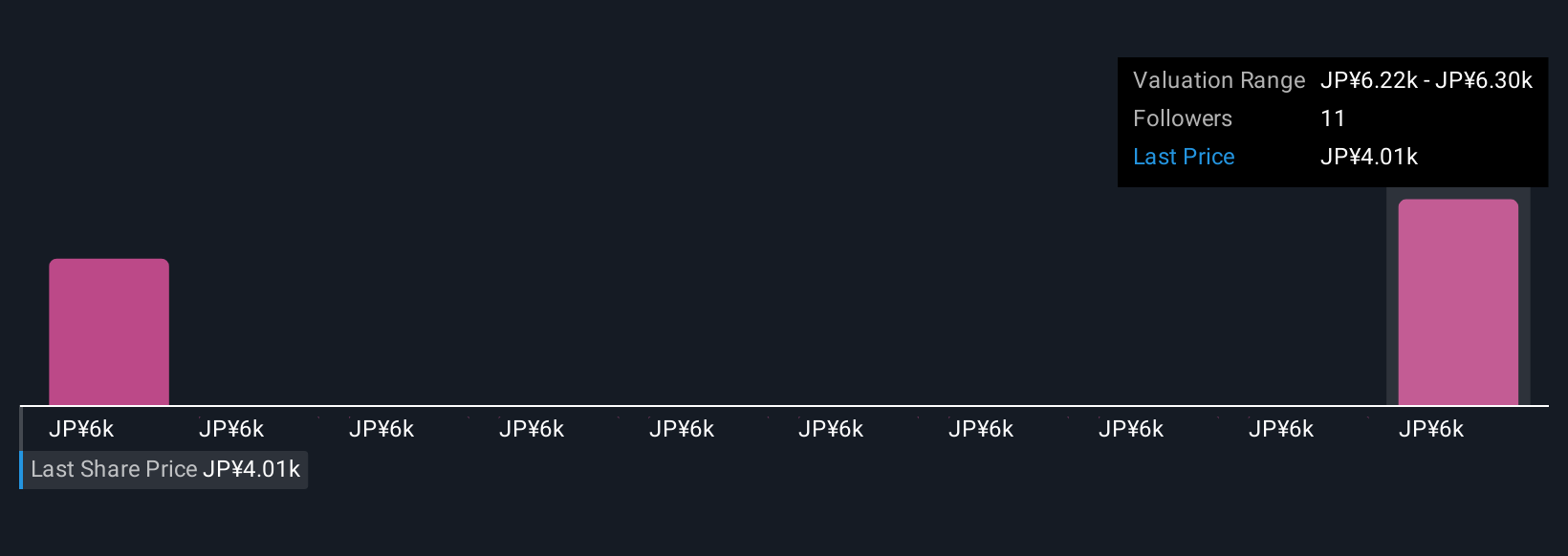

Simply Wall St Community members have published two fair value estimates for Daiichi Sankyo ranging from ¥5,517 to ¥6,597 per share, a span that underscores contrasting views on the company’s outlook. Yet, with top-line and profit growth still driven by just a few blockbuster drugs, your opinion on the risks of concentration could matter as much as your growth assumptions.

Explore 2 other fair value estimates on Daiichi Sankyo Company - why the stock might be worth as much as 88% more than the current price!

Build Your Own Daiichi Sankyo Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daiichi Sankyo Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Daiichi Sankyo Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daiichi Sankyo Company's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives