Ono Pharmaceutical (TSE:4528) Valuation Spotlight as PRISM BioLab Collaboration Achieves Drug Discovery Milestone

Reviewed by Simply Wall St

Ono Pharmaceutical (TSE:4528) and PRISM BioLab have reached a key milestone in their oncology research collaboration. PRISM received a milestone payment as their joint efforts, using PRISM's PepMetics platform, advanced potential clinical candidates.

See our latest analysis for Ono Pharmaceutical.

Ono Pharmaceutical’s collaboration success comes after several expansion moves, including opening a new European office, as investor optimism continues to build. The stock’s share price has surged 23.5% so far this year, with its one-year total shareholder return matching that strength. However, the longer-term track record is less impressive, which highlights the renewed momentum driving recent gains.

If you want to spot more companies showing solid momentum in the healthcare space, explore See the full list for free..

With shares up sharply but some analyst targets now lagging the current price, the central question is clear: has Ono Pharmaceutical’s surge left the stock undervalued, or is the market already pricing in much of its future growth potential?

Price-to-Earnings of 19.9x: Is it justified?

Ono Pharmaceutical currently trades at a price-to-earnings (P/E) ratio of 19.9x, making its shares seem expensive relative to certain industry benchmarks given the last close of ¥2,058.

The price-to-earnings ratio reflects what investors are willing to pay for each yen of the company’s earnings. For pharmaceutical companies, this is a crucial gauge, as it compares profit expectations against the share price.

Ono Pharmaceutical’s P/E ratio stands above both the Japanese pharmaceuticals industry average of 15.4x and the stock’s fair P/E estimate of 17.6x. This indicates the market may be attributing a premium for recent momentum or potential future prospects. However, compared to direct peers, its valuation is not the highest in the group, as peer averages come in at 21.3x. If the market were to reset towards the fair P/E, the stock’s valuation may face pressure to align more closely with its underlying earnings trajectory.

Explore the SWS fair ratio for Ono Pharmaceutical

Result: Price-to-Earnings of 19.9x (OVERVALUED)

However, declining annual revenue and net income growth remain risks that could put pressure on Ono Pharmaceutical’s momentum if not addressed in upcoming results.

Find out about the key risks to this Ono Pharmaceutical narrative.

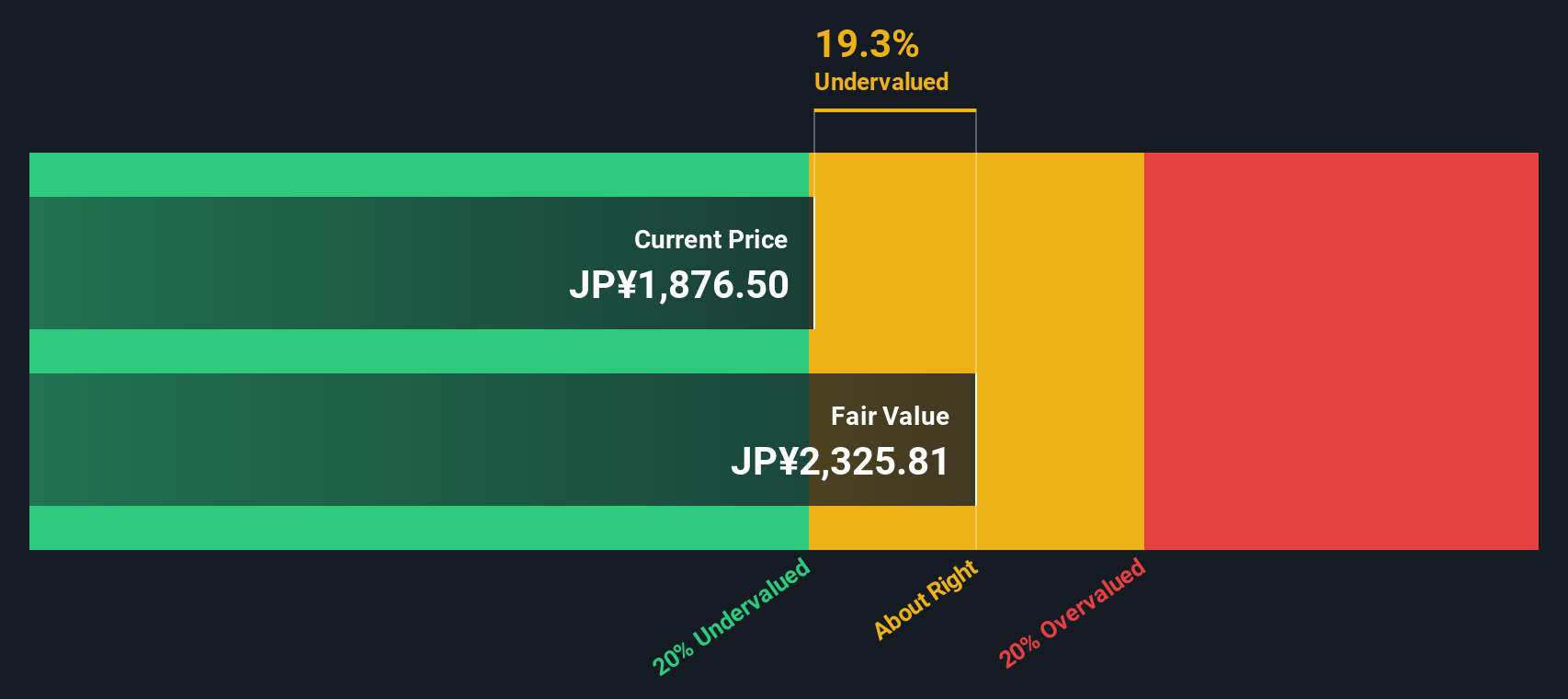

Another View: Discounted Cash Flow Perspective

Taking a step back from earnings ratios, the SWS DCF model offers a different angle. By estimating the present value of expected future cash flows, this approach suggests Ono Pharmaceutical may actually be undervalued, with shares trading 13% below the model’s fair value estimate. Does this mean the market has been too focused on recent growth metrics?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ono Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ono Pharmaceutical Narrative

If you want a different perspective, you can dive into the data and build your own outlook for Ono Pharmaceutical in just a few minutes. Do it your way.

A great starting point for your Ono Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take advantage of tools that help you confidently spot your next opportunity. Your portfolio could benefit from exploring these standout investment angles today.

- Capitalize on rising demand in AI technology by tapping into these 26 AI penny stocks powering automation, robotics, and intelligent software solutions.

- Boost your income strategy with these 16 dividend stocks with yields > 3% offering robust yields and historically reliable cash flow.

- Experience the edge of financial innovation by jumping into these 81 cryptocurrency and blockchain stocks transforming payments, security, and decentralized markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4528

Ono Pharmaceutical

Produces, purchases, and sells pharmaceuticals and diagnostic reagents worldwide.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives