Ono Pharmaceutical (TSE:4528) Profit Margin Drops Sharply, Raising New Questions for Bullish Narratives

Reviewed by Simply Wall St

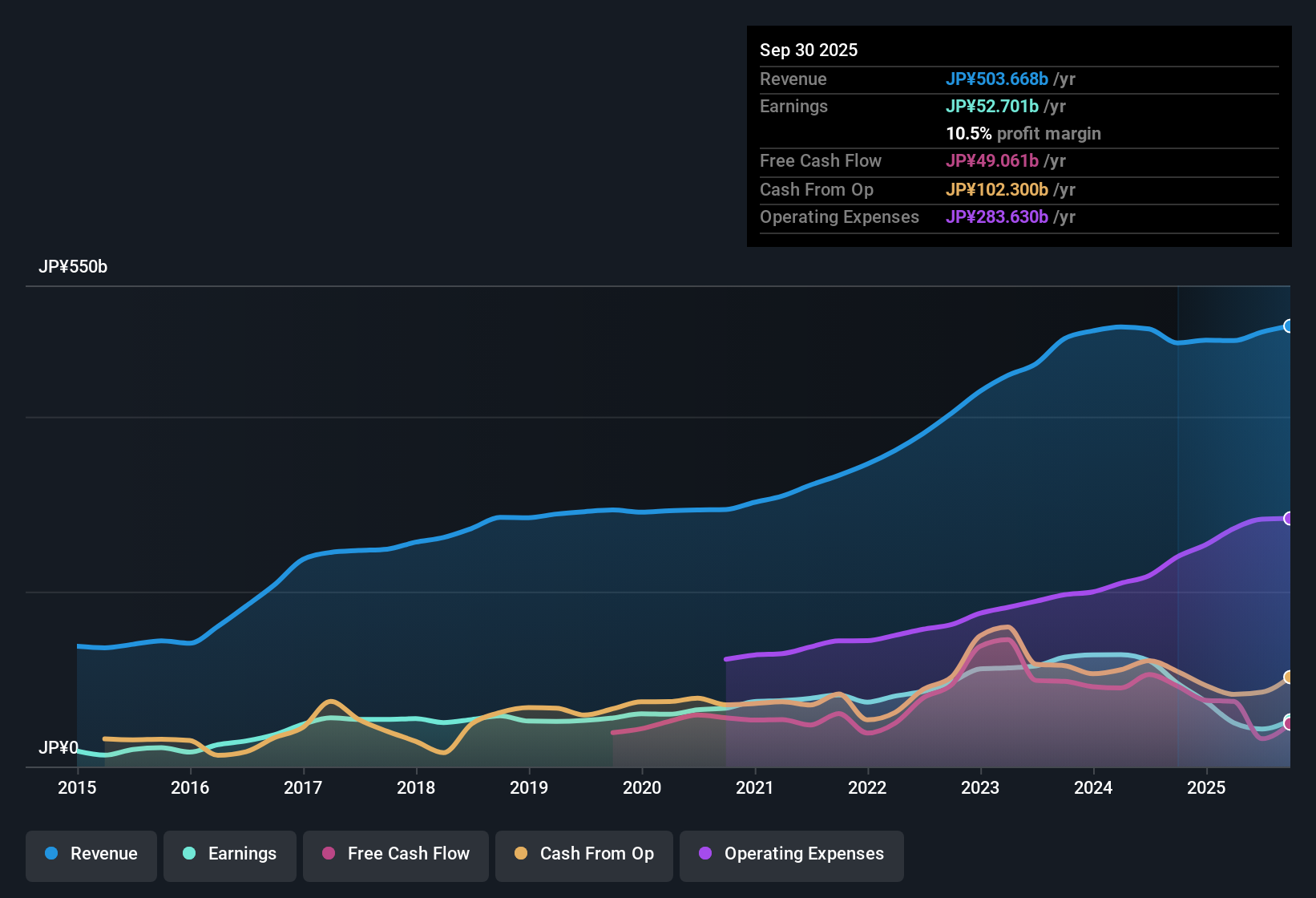

Ono Pharmaceutical (TSE:4528) reported net profit margins of 9.6%, down from 19.6% a year earlier, with earnings declining by an average of 0.03% annually over the last five years. Looking ahead, both earnings and revenue are forecast to fall by 2.2% per year through the next three years, and negative earnings growth was posted relative to the prior year. For investors, these tighter margins and weaker profit trends are partially offset by a price-to-earnings ratio of 18.2x, which is under the peer group average but above the broader Japanese pharma sector. Meanwhile, a share price below estimated fair value and an attractive dividend could bolster sentiment.

See our full analysis for Ono Pharmaceutical.Next, we will see how the numbers measure up against some of the most widely tracked narratives for Ono, highlighting where they reinforce the consensus and where they raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Compression Signals Shifting Profits

- Net profit margins came in at 9.6%, a substantial drop from 19.6% the year prior, showing a sharp decline in profitability even before factoring in the expected 2.2% annual decrease in earnings and revenue over the next three years.

- Prevailing market analysis points out that recent news cycles in the pharmaceutical sector have emphasized competitive pressure and increasing costs, both of which are likely weighing on Ono’s bottom line.

- With financials already reflecting negative year-over-year earnings growth, investors are watching closely to see whether ongoing R&D spending or headwinds from generic competition will push margins even lower.

- Some commentary has noted that margin pressure is being closely mirrored across large-cap Japanese pharma peers, suggesting these sector challenges may persist throughout the forecast period unless offset by new product successes.

Valuation Multiple Sits Between Industry and Peers

- The current price-to-earnings ratio of 18.2x puts Ono above the Japanese pharma industry’s average of 15.3x but below the peer median of 27.7x, positioning the company as potentially better value relative to its closest competitors even as sector-wide multiples remain under scrutiny.

- The prevailing market view suggests that such a P/E ratio, combined with Ono’s recognized “high quality” earnings, could attract investors looking for both stability and income, but tension remains given guidance for falling earnings.

- Given the share price of 1,876.5 is also below the DCF fair value estimate of 2,325.81, value-oriented buyers may see upside, particularly if forecast declines prove milder than anticipated.

- However, the market remains cautious because Ono’s premium to the sector average implies expectations for resilience or future catalysts. If those do not materialize, the stock could underperform versus leaner rivals.

Dividend Remains a Draw Amid Downturn

- The company’s “attractive dividend” continues to stand out in combination with a share price below fair value estimates, making Ono a potential target for income-focused investors even as profit margins contract.

- According to the prevailing sector narrative, reliable dividends help cushion the blow of earnings and revenue declines. Yet, the company’s ability to maintain payouts will depend on how effectively it manages further profitability pressures.

- What is notable is that despite the margin rollback, management has prioritized returning value to shareholders, a stance that differentiates Ono from peers that may cut payouts faster in downturns.

- Yet if the negative earnings trend continues or accelerates, further dividend growth or even current payout levels could come into question for the first time in recent years.

For a broader perspective on how Ono’s fundamentals fit into evolving investor narratives, check the full company consensus analysis for additional context and comparisons. 📊 Read the full Ono Pharmaceutical Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ono Pharmaceutical's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Ono’s shrinking profit margins, falling earnings forecasts, and industry pressures point to unpredictable growth and increasing risk for shareholders.

If you want more reliable performance, use stable growth stocks screener (2094 results) to focus on companies delivering consistent revenue and earnings expansion across all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4528

Ono Pharmaceutical

Produces, purchases, and sells pharmaceuticals and diagnostic reagents worldwide.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives