How Investors Are Reacting To Ono Pharmaceutical (TSE:4528) Winning Japanese Approval for New Braftovi Cancer Therapy

Reviewed by Sasha Jovanovic

- Ono Pharmaceutical recently received supplemental approval in Japan for Braftovi (encorafenib) capsule in combination with cetuximab and chemotherapy for treating unresectable, advanced, or recurrent colorectal cancer with BRAF mutation, following positive Phase III trial results.

- This milestone reflects Ono's ongoing progress in advancing new cancer therapies, supported by rigorous global clinical study data and regulatory recognition.

- We'll explore how regulatory progress in oncology, particularly with the Braftovi approval, shapes Ono Pharmaceutical's investment narrative further.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Ono Pharmaceutical's Investment Narrative?

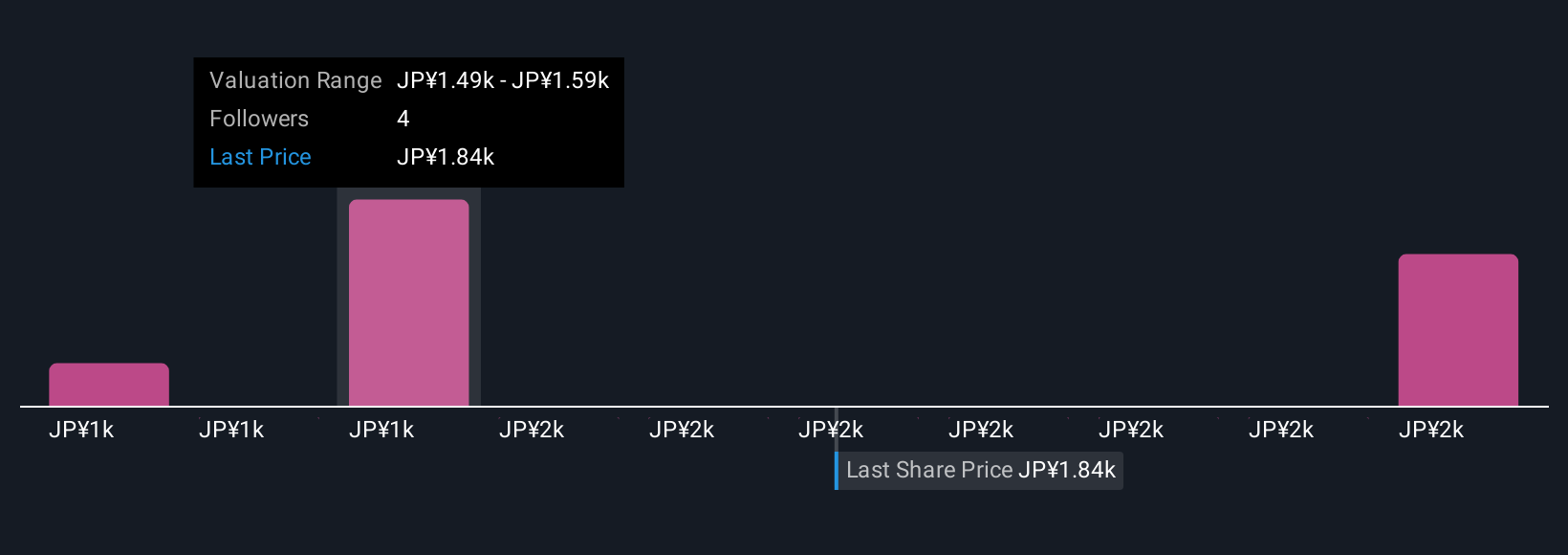

To remain confident in Ono Pharmaceutical as a shareholder, you need to see the company as an innovator able to convert R&D and regulatory wins into sustainable growth, even amid slowing financial momentum and profit pressure. The supplemental Braftovi approval brings fresh evidence of real progress in next generation cancer therapies and has reinforced recent share price gains, but for now it may not shift the core short-term catalysts, which still hinge on meaningful earnings stabilization or a visible return to growth. That said, regulatory tailwinds from new approvals could ease the risk of continued top-line and margin declines if they translate to commercial success faster than anticipated. At the same time, the risk of ongoing revenue and earnings contraction remains front and center given negative growth forecasts and cost concerns, even with the company’s active pipeline and headline news.

Yet, with revenue expected to decline and margins under pressure, investors should watch for signs the business can deliver more than one-off wins.

Exploring Other Perspectives

Explore 3 other fair value estimates on Ono Pharmaceutical - why the stock might be worth as much as 14% more than the current price!

Build Your Own Ono Pharmaceutical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ono Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ono Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ono Pharmaceutical's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4528

Ono Pharmaceutical

Produces, purchases, and sells pharmaceuticals and diagnostic reagents worldwide.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives