Eisai (TSE:4523): Assessing Valuation Following UK Approval of New Leqembi Maintenance Dosing Schedule

Reviewed by Simply Wall St

Eisai (TSE:4523) just received approval from the UK MHRA for a new, once-every-four-weeks IV maintenance dosing schedule of Leqembi, their Alzheimer's treatment. This update brings added convenience for patients and highlights ongoing global regulatory momentum.

See our latest analysis for Eisai.

Eisai’s regulatory win for Leqembi comes as the stock shows modest year-to-date share price gains of just over 5%, despite a string of high-profile legal settlements and new treatment approvals in major markets. With a 1-year total shareholder return still negative and long-term performance underwhelming, momentum recently is building but remains fragile. The latest innovations are putting future growth potential back in focus.

If this kind of steady progress has you curious about where else breakthroughs could drive value, consider exploring other healthcare stocks showing fresh promise See the full list for free.

With shares still trading at a notable discount to analyst price targets even after recent headlines, investors may wonder if Eisai is undervalued or if the market has already factored in the latest wave of innovation and growth.

Most Popular Narrative: 8.5% Undervalued

Eisai's current share price sits well below the narrative’s estimate of fair value, providing an opportunity to examine what is driving this perceived gap.

Structural reforms and operational efficiencies, including a reduced R&D expense ratio and improved SG&A leverage, are increasing profitability and supporting management's ambition to achieve an 8% ROE target by FY2026. This suggests margin expansion and greater earnings stability ahead.

Curious about the calculations behind that valuation? The key is a mix of ambitious profit margin expansion and revenue growth assumptions. Want to see the specific targets and forecasts propelling this narrative’s outlook? Click through and discover which financial levers matter most in this fair value estimate.

Result: Fair Value of $5,026.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising global drug pricing pressure and Eisai’s heavy reliance on a few key products could quickly impact future earnings and growth potential.

Find out about the key risks to this Eisai narrative.

Another View: Market Ratios Tell a Different Story

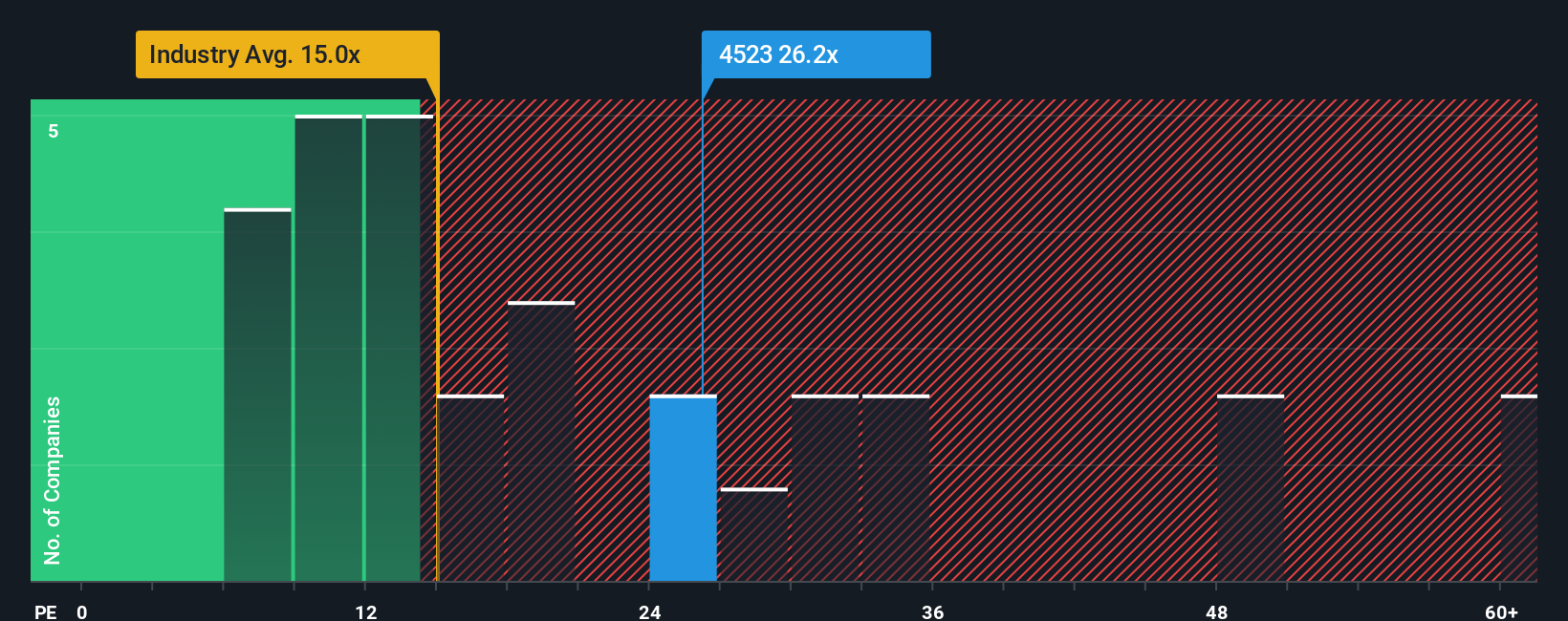

While the fair value suggests Eisai is undervalued, the current price-to-earnings ratio of 26.3x paints a different picture. Compared to its industry peers averaging 15.5x and a fair ratio of 22.8x, Eisai shares actually look expensive on this measure. This raises the question: could investors be overlooking key risks, or are they simply paying up for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eisai Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily craft your own Eisai analysis in just a few minutes with our tools, and see how your view stacks up. Do it your way

A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your next opportunity with these investment themes that are attracting attention. Missing out could mean skipping tomorrow’s big winners. Let Simply Wall Street help you make your smartest move yet.

- Spot breakthrough tech by checking out these 25 AI penny stocks which are fueling rapid advances in artificial intelligence and automation.

- Grow your long-term income stream by targeting these 16 dividend stocks with yields > 3% that deliver steady yields above 3% for reliable returns.

- Ride the momentum of tomorrow’s disruptors with these 26 quantum computing stocks as they make strides in quantum computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives