As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are turning their attention to the stability offered by dividend stocks. In this environment, a good dividend stock is often characterized by its ability to provide consistent income and potential resilience against market volatility, making it an attractive option for those seeking steady returns amidst uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.37% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

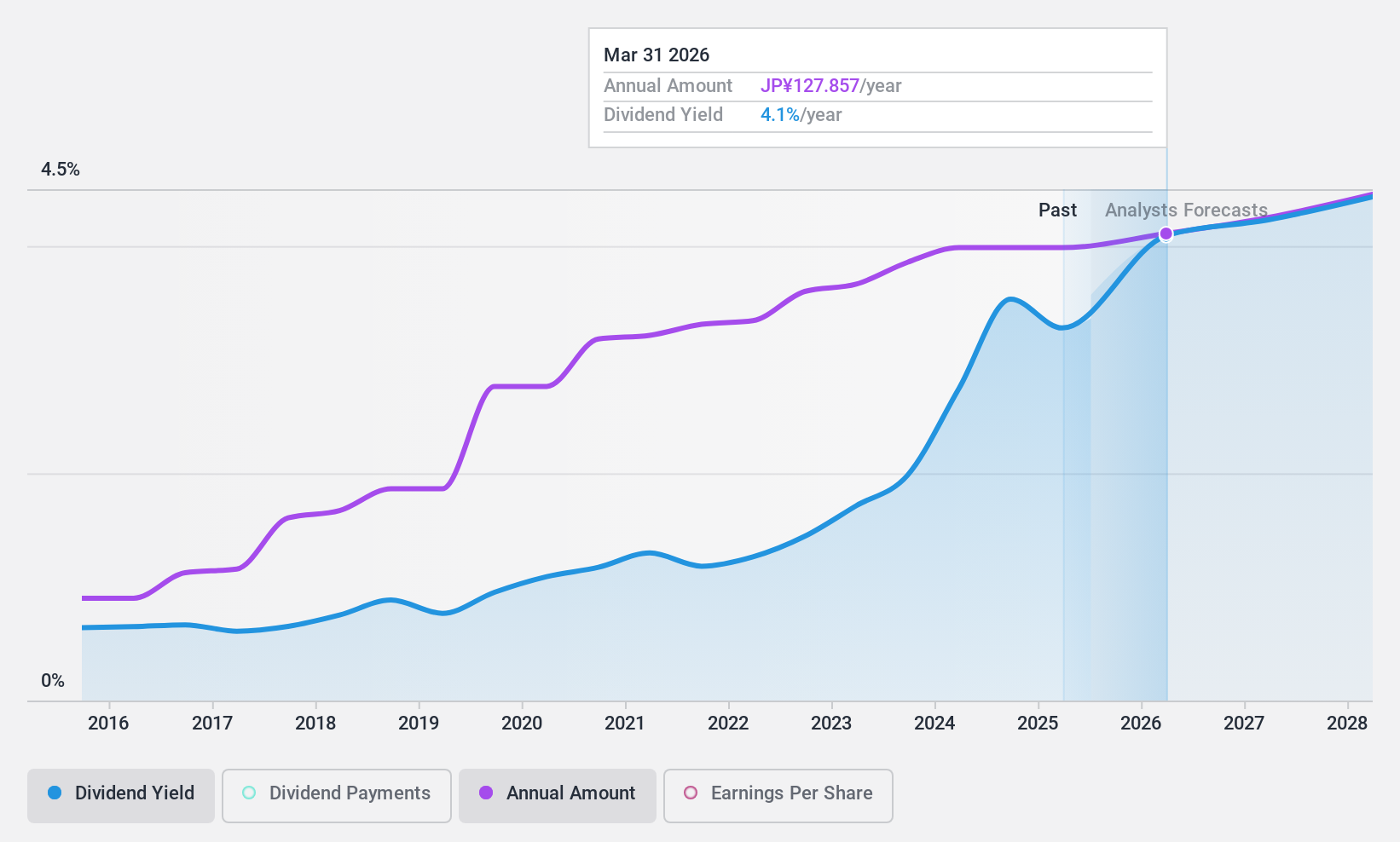

Nippon Shinyaku (TSE:4516)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Shinyaku Co., Ltd. is a company that manufactures and sells pharmaceuticals and foodstuffs both in Japan and internationally, with a market cap of ¥269.99 billion.

Operations: Nippon Shinyaku Co., Ltd.'s revenue is primarily derived from its Pharmaceuticals segment, which accounts for ¥132.61 billion, and its Functional Food segment, contributing ¥21.66 billion.

Dividend Yield: 3.1%

Nippon Shinyaku has demonstrated reliable and growing dividends over the past decade, supported by a low payout ratio of 32.1%, indicating coverage by earnings. However, with a high cash payout ratio of 102.4%, dividends are not well covered by free cash flows, raising sustainability concerns. Trading at a price-to-earnings ratio of 10.3x below the JP market average, it offers good relative value despite its dividend yield being lower than top-tier payers in Japan at 3.12%.

- Click to explore a detailed breakdown of our findings in Nippon Shinyaku's dividend report.

- In light of our recent valuation report, it seems possible that Nippon Shinyaku is trading behind its estimated value.

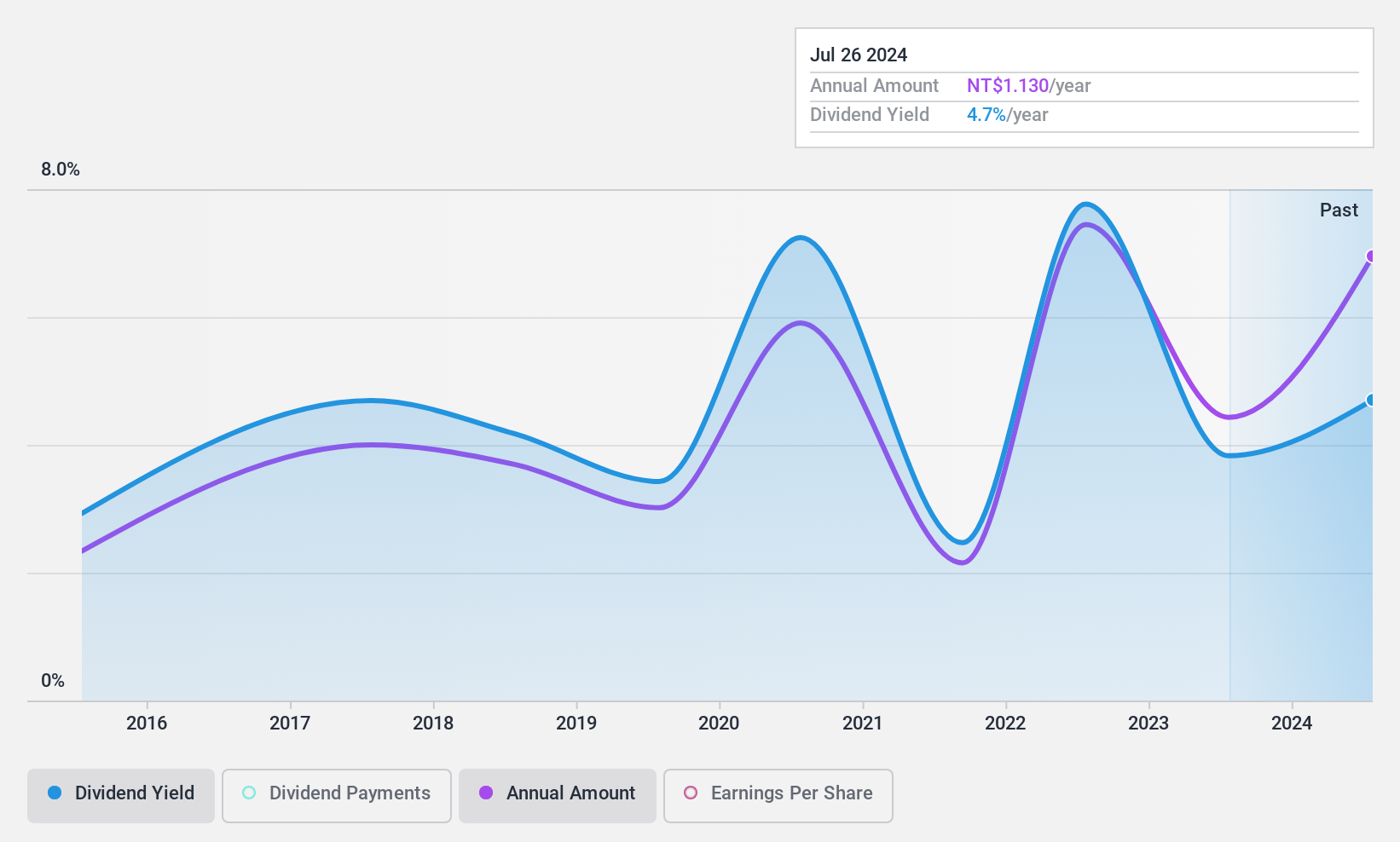

First Insurance (TWSE:2852)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The First Insurance Co., Ltd. provides a variety of insurance products and related services to both commercial and personal line customers in Taiwan, with a market cap of NT$74.84 billion.

Operations: The company's revenue is primarily generated from its Property and Casualty Insurance segment, amounting to NT$7.75 billion.

Dividend Yield: 4.5%

First Insurance's dividend payments have been volatile over the past decade, though they have increased overall. The company's dividends are well covered by earnings with a payout ratio of 37.4% and cash flows at 58%, suggesting reasonable sustainability despite an unstable track record. Recent earnings growth, highlighted by a net income rise to TWD 778.26 million for the nine months ended September 2024, supports its ability to maintain payouts.

- Delve into the full analysis dividend report here for a deeper understanding of First Insurance.

- Insights from our recent valuation report point to the potential undervaluation of First Insurance shares in the market.

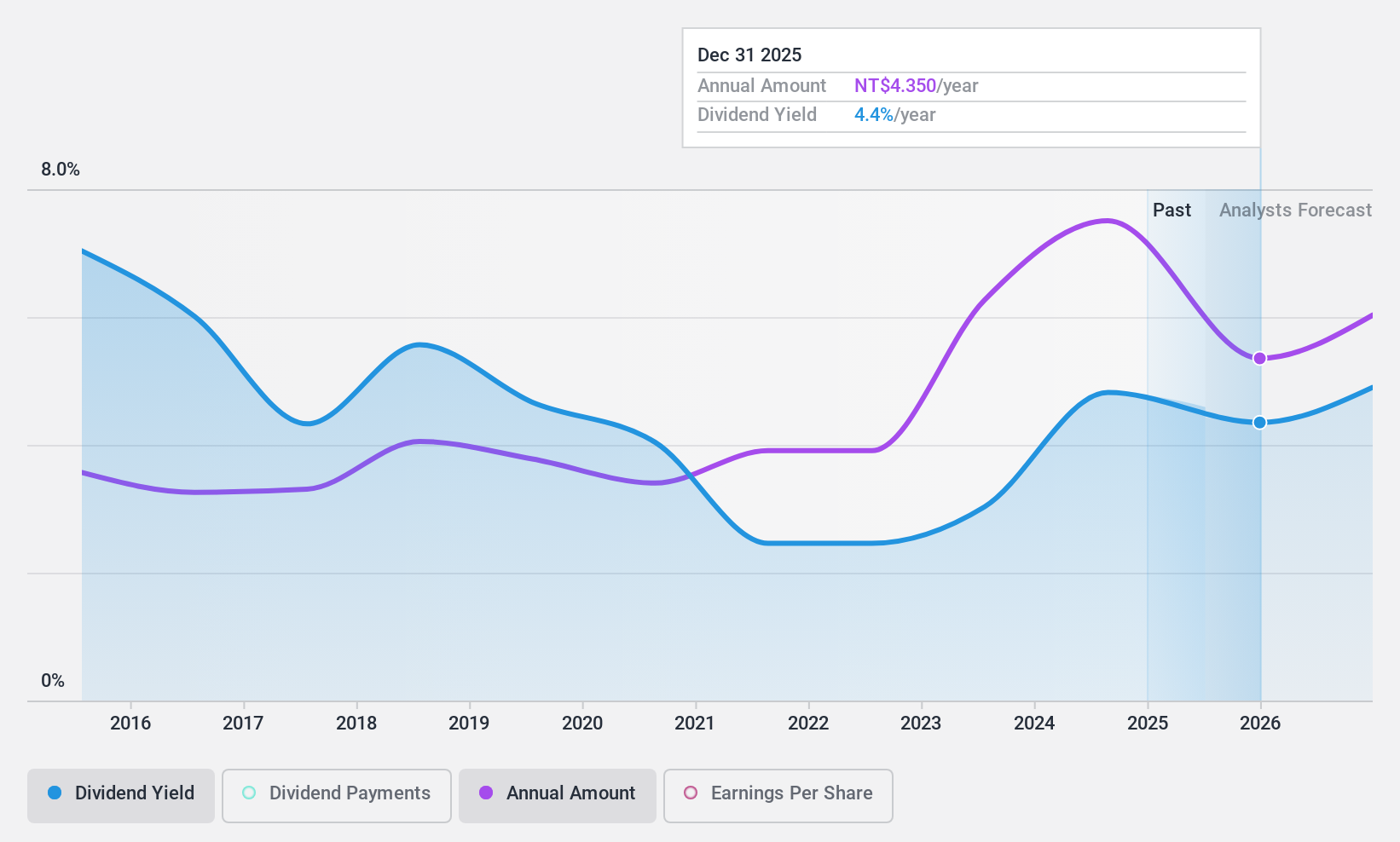

Yulon Finance (TWSE:9941)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yulon Finance Corporation offers a range of financial services in Taiwan, China, and internationally with a market cap of NT$56.74 billion.

Operations: Yulon Finance Corporation generates revenue primarily from its Leasing Segment, which accounts for NT$18.96 billion, and its Financing Segment, contributing NT$20.47 billion.

Dividend Yield: 5.8%

Yulon Finance offers a compelling dividend profile with stable and growing payments over the past decade. The company's dividends are well-covered by earnings, with a payout ratio of 68.2%, and cash flows, maintaining a low cash payout ratio of 40%. Despite recent declines in net income to TWD 4.23 billion for the nine months ended September 2024, its attractive dividend yield of 5.81% remains among the top in Taiwan's market.

- Unlock comprehensive insights into our analysis of Yulon Finance stock in this dividend report.

- Our valuation report unveils the possibility Yulon Finance's shares may be trading at a discount.

Summing It All Up

- Embark on your investment journey to our 1949 Top Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2852

First Insurance

Engages in the provision of a range of insurance products and related services in Taiwan.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives