Nippon Shinyaku (TSE:4516): Evaluating Valuation Following Clinical Pipeline Progress and Technology Adoption

Reviewed by Simply Wall St

Nippon Shinyaku (TSE:4516) has been active lately, announcing updates across several clinical trials for rare diseases. The company has also adopted a new technology platform designed to modernize its drug safety operations.

See our latest analysis for Nippon Shinyaku.

This wave of clinical trial updates and the adoption of new technology come after a challenging year for Nippon Shinyaku. Despite a recent boost in share price, with a 1.68% rise over the last day, momentum remains mixed given the year-to-date decline of nearly 19%. Total shareholder return over the past year sits at -17.63%, and longer-term investors have seen losses deepen further. The three-year total shareholder return is -56.35%. While recent pipeline progress may be renewing interest, the stock’s performance reflects lingering uncertainty and shifting risk perceptions among investors.

If you’re watching for what's next in healthcare innovation, now’s your chance to discover other standout names with See the full list for free.

With the stock trading below analyst price targets and recent clinical milestones making headlines, the key question now is whether Nippon Shinyaku is undervalued at current levels or if the market is already accounting for its future potential.

Price-to-Earnings of 7.2x: Is it justified?

Nippon Shinyaku is currently trading at a price-to-earnings (P/E) ratio of 7.2x, which is well below both the industry and broader market averages. At yesterday's closing price of ¥3,271, the stock appears comparatively inexpensive according to this metric.

The price-to-earnings ratio measures how much investors are willing to pay today for a yen of current earnings. For pharmaceutical companies, this multiple can reflect investor confidence in future profit growth, new products, or resilience amidst sector headwinds. A low P/E may signal that the market is skeptical about sustained growth or is underestimating the business's mid-term outlook.

Compared to the Japanese pharmaceuticals industry average of 14.9x, Nippon Shinyaku’s P/E is extremely low. When viewed next to the estimated fair P/E ratio of 12.2x, the difference becomes even more pronounced. The current multiple offers a significant discount, a level the market could eventually move toward if sentiment or fundamentals shift.

Explore the SWS fair ratio for Nippon Shinyaku

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, uncertainty remains as declining net income and muted medium-term growth may still weigh on market sentiment, even though there is valuation support.

Find out about the key risks to this Nippon Shinyaku narrative.

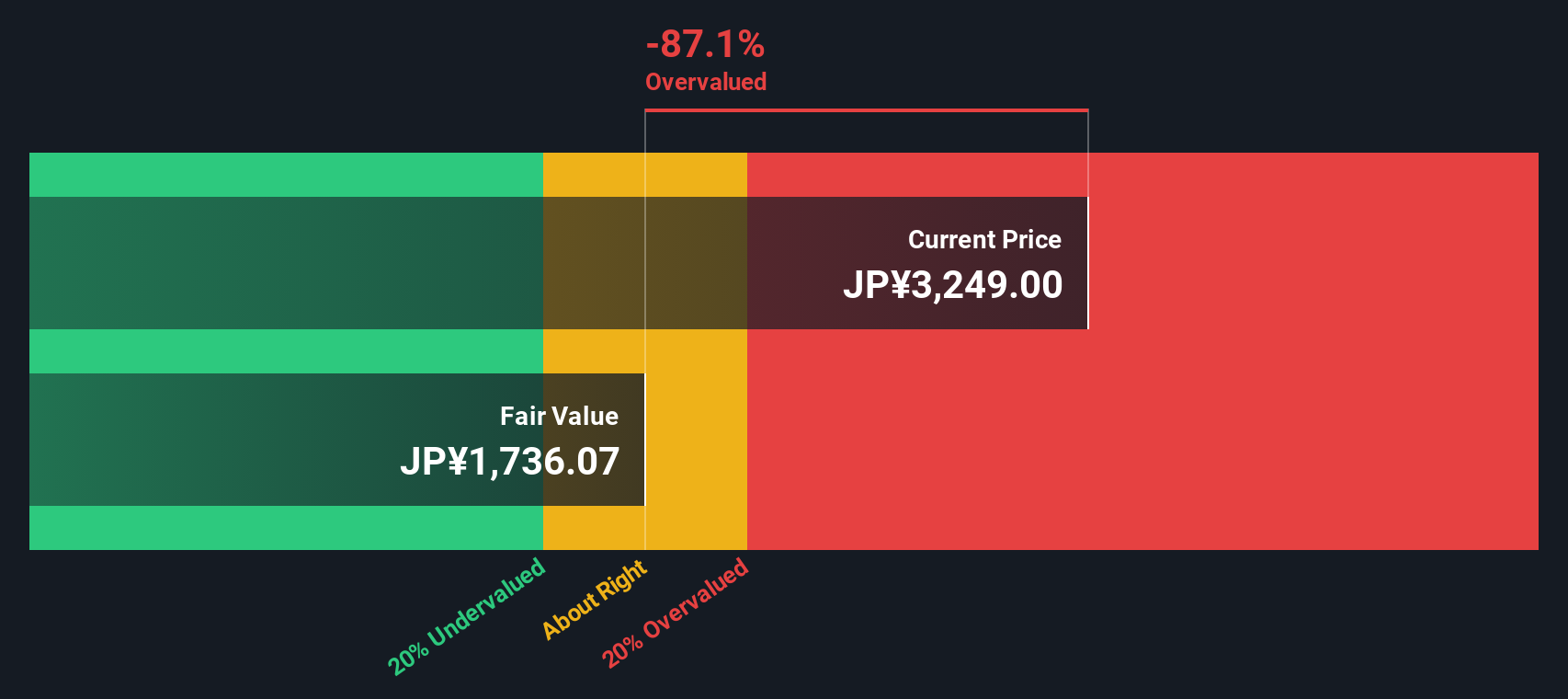

Another View: Discounted Cash Flow Offers a Different Perspective

The SWS DCF model provides a contrasting narrative for Nippon Shinyaku. According to this valuation, the shares, at ¥3,271, are trading significantly above the model’s fair value estimate of ¥1,736. This suggests the stock could be overvalued if these long-term cash flow assumptions occur. Which outlook more accurately represents the situation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Shinyaku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Shinyaku Narrative

If you’re looking for a different angle or want to dig deeper into the numbers, you can easily put together your own analysis in just a few minutes. Do it your way

A great starting point for your Nippon Shinyaku research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why wait for the crowd to catch on when you can get ahead with stocks poised for strong potential? Use these screeners right now to power up your strategy and never miss the next opportunity.

- Secure your portfolio with ongoing income by tapping into these 24 dividend stocks with yields > 3% offering attractive yields above 3%.

- Capitalize on the AI revolution by spotting early movers among these 26 AI penny stocks positioned for rapid growth in artificial intelligence.

- Ride the momentum of digital transformation by checking out these 81 cryptocurrency and blockchain stocks that are shaping the new age of finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shinyaku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4516

Nippon Shinyaku

Manufactures and sells pharmaceuticals and foodstuffs in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives