Assessing Shionogi (TSE:4507) Valuation After Recent Share Price Retreat

Reviewed by Kshitija Bhandaru

Shionogi (TSE:4507) shares have seen some movement recently, sparking investor interest in what might be driving the change. Looking past daily price shifts, some are examining underlying business fundamentals to gauge long-term value.

See our latest analysis for Shionogi.

Shionogi’s share price has pulled back about 9% over the past month, following a recent stretch of strong performance. Even with this dip, momentum remains positive in the broader view, as its total shareholder return reached 18% over the last year and 59% over five years. This suggests investors are weighing both growth opportunities and evolving risks as the landscape shifts.

If the market’s latest moves have you curious, now could be a good moment to discover fast growing stocks with high insider ownership.

With solid returns in recent years but only modest recent growth, investors must now consider if Shionogi’s shares are trading below their true worth or if future gains are already reflected in the current price.

Price-to-Earnings of 11.4x: Is it justified?

Shionogi is currently trading on a price-to-earnings ratio of 11.4x, which positions the shares as attractively priced compared to both sector peers and the company’s recent performance trajectory.

The price-to-earnings multiple reflects the ratio of the company’s current share price to its earnings per share. It serves as a benchmark for how the market values future profit potential. For healthcare and pharmaceutical firms like Shionogi, it is a core metric to gauge whether current valuations account for growth prospects and profitability.

Relative to the industry average of 15x and a peer average of 25.4x, Shionogi’s ratio looks low. When also compared to the estimated fair price-to-earnings ratio of 21x, the market appears to be heavily discounting the company’s future earnings. This suggests investors may be underestimating Shionogi’s profit outlook if sector growth and margins are sustained.

Explore the SWS fair ratio for Shionogi

Result: Price-to-Earnings of 11.4x (UNDERVALUED)

However, slow net income growth and potential shifts in sector sentiment could present challenges to Shionogi’s current undervaluation narrative.

Find out about the key risks to this Shionogi narrative.

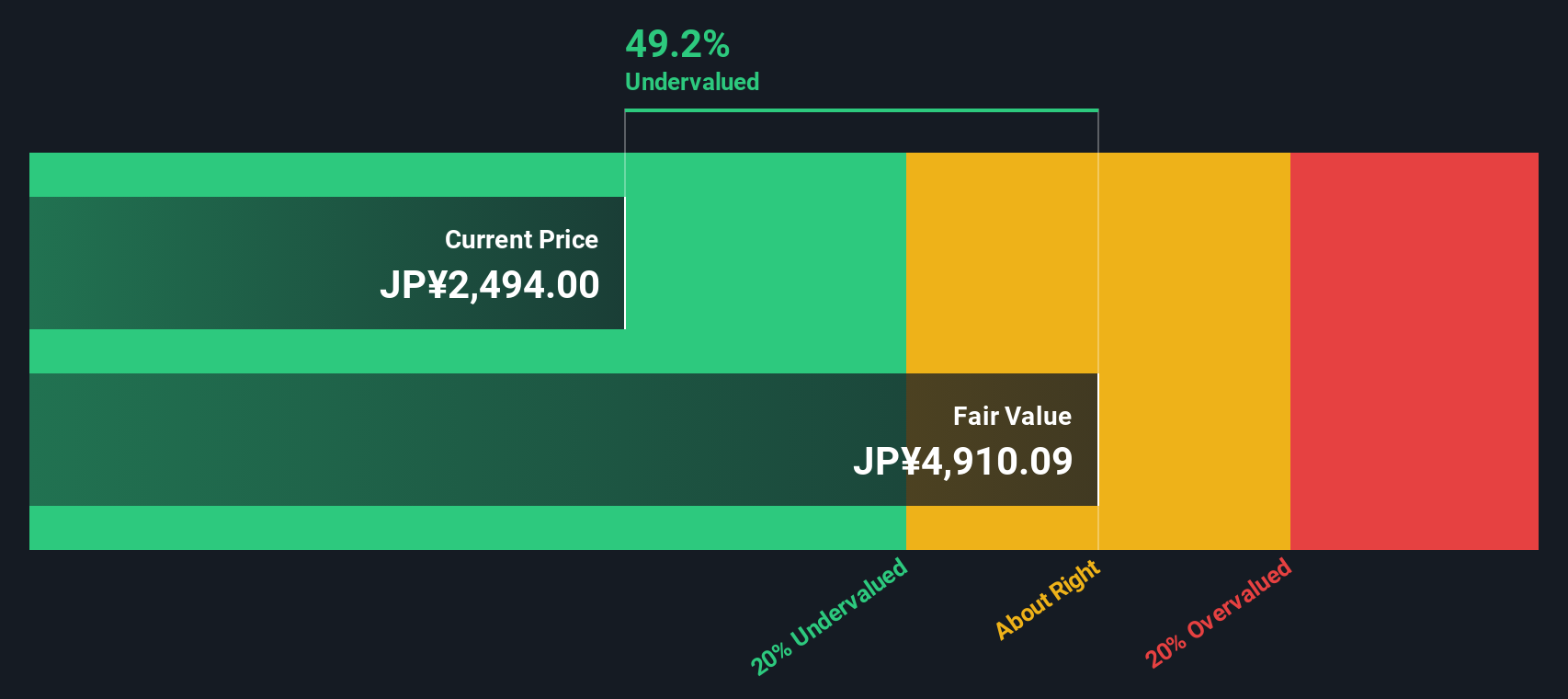

Another View: Our DCF Model Suggests Deeper Value

While the current price-to-earnings ratio points to undervaluation, our SWS DCF model paints an even starker picture. It estimates Shionogi's fair value at ¥4910.05, which is 51% above the current trading level. This raises the question of whether the market is overlooking Shionogi's future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shionogi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shionogi Narrative

If these conclusions differ from your own perspective, or you would rather draw insights directly from the numbers, the tools are in your hands. You can craft your own in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Shionogi.

Looking for more investment ideas?

There is a world of stocks beyond Shionogi. You could miss the next big opportunity if you stop here. Uncover stocks aligned to your goals, backed by clear data and smart insights.

- Boost your portfolio’s yield potential by checking out these 18 dividend stocks with yields > 3% with attractive payouts and sustainable growth prospects.

- Tap into tomorrow’s medical breakthroughs through these 33 healthcare AI stocks, where healthcare innovation and artificial intelligence intersect for strong momentum and future promise.

- Position yourself at the front of market trends and spot strong value plays in these 877 undervalued stocks based on cash flows based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4507

Shionogi

Engages in the research, development, manufacture, and distribution of pharmaceuticals, diagnostic reagents, and medical devices in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives