How Investors May Respond To Astellas Pharma (TSE:4503) Phase 2 Zolbetuximab Setback in Pancreatic Cancer

Reviewed by Sasha Jovanovic

- In October 2025, Astellas Pharma announced that its Phase 2 GLEAM trial investigating zolbetuximab in combination with chemotherapy for metastatic pancreatic adenocarcinoma did not meet the primary endpoint of overall survival, though the safety profile remained consistent with previous studies.

- The outcome of this trial poses challenges to the expansion of zolbetuximab’s use beyond its current approval in CLDN18.2 positive gastric and GEJ cancers across multiple major markets.

- We'll explore how this setback in the GLEAM trial may influence Astellas Pharma's oncology pipeline prospects and future growth assumptions.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Astellas Pharma Investment Narrative Recap

Astellas Pharma’s long-term investment case hinges on its ability to drive growth through expanding indications for core oncology and specialty care products, while effectively managing risks from generic competition, pricing pressures, and pipeline execution. The recent Phase 2 GLEAM trial setback for zolbetuximab in pancreatic cancer does challenge part of the company’s oncology pipeline ambitions, but does not affect the leading short term catalysts, which remain strong uptake and label expansion of established brands like XTANDI, PADCEV, and IZERVAY. The primary near-term risk continues to be the looming loss of exclusivity for key revenue drivers, especially as generic and biosimilar competition looms in major markets.

Among recent announcements, Astellas secured additional public reimbursement for VYLOY (zolbetuximab) in Ontario and Quebec, supporting ongoing growth in its approved indication for CLDN18.2-positive gastric cancers. This recent regulatory win reinforces access and revenue potential for VYLOY, highlighting how pipeline setbacks like GLEAM are balanced by commercial progress in other areas. In contrast, investors should keep a close eye on upcoming exclusivity expirations that could change the earnings mix more quickly than expected...

Read the full narrative on Astellas Pharma (it's free!)

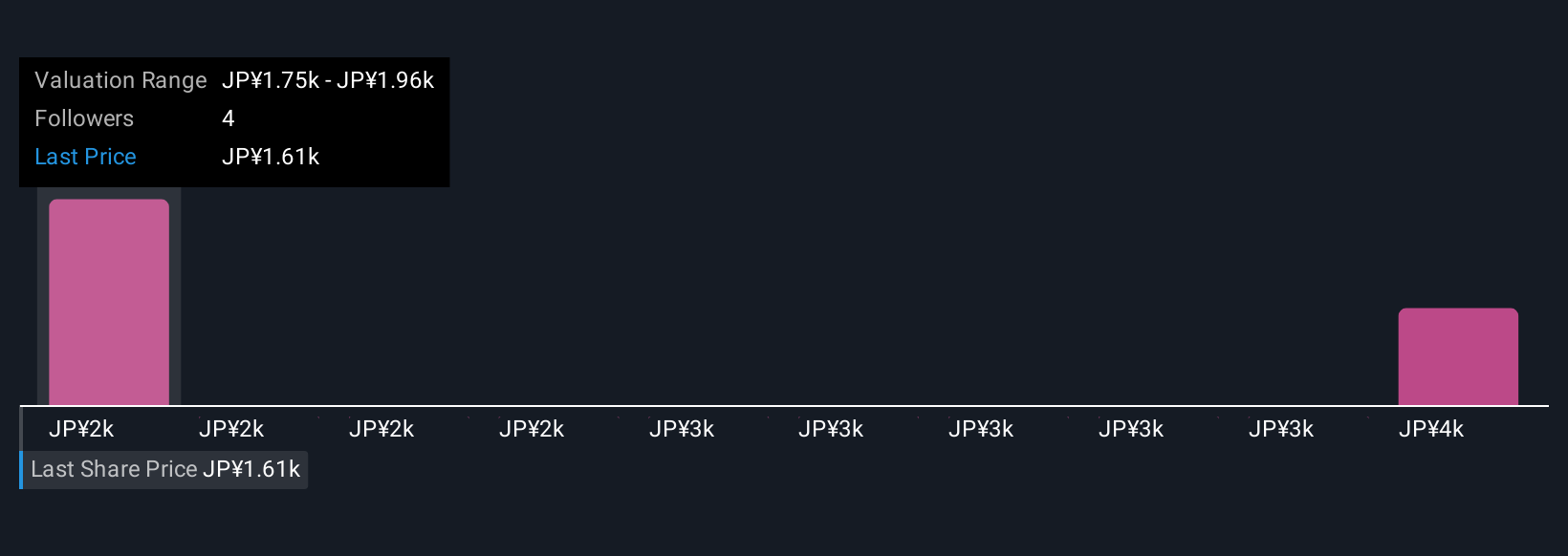

Astellas Pharma's outlook anticipates ¥1,868.3 billion in revenue and ¥184.0 billion in earnings by 2028. This implies a -1.3% annual revenue decline and a ¥102.4 billion increase in earnings from ¥81.6 billion currently.

Uncover how Astellas Pharma's forecasts yield a ¥1749 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Recent fair value estimates from the Simply Wall St Community span a wide range, from ¥1,749 to ¥3,854, showing how much investor opinions can differ. The looming risk of generic competition, highlighted by analysts, underlines the importance of understanding both upside and downside scenarios when forming your view on Astellas Pharma.

Explore 2 other fair value estimates on Astellas Pharma - why the stock might be worth just ¥1749!

Build Your Own Astellas Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astellas Pharma research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Astellas Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astellas Pharma's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4503

Astellas Pharma

Manufactures, markets, and imports and exports pharmaceuticals in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives