Kyowa Kirin (TSE:4151): A Fresh Look at Valuation After New Survival Data for Rare Lymphoma

Reviewed by Simply Wall St

Kyowa Kirin (TSE:4151) recently shared new insights from the PROCLIPI Study showing its drug mogamulizumab helps patients with mycosis fungoides and Sézary syndrome live longer. The results provide a fresh perspective on future treatment approaches.

See our latest analysis for Kyowa Kirin.

Kyowa Kirin’s encouraging PROCLIPI Study update landed as the stock continues to regroup from a challenging year. Its 1-year total shareholder return stands at -6.8%, and the three-year figure is even weaker, hinting that momentum has yet to fully turn. Even so, recent scientific milestones and steady newsflow could help shift sentiment if investor confidence returns.

If new progress in rare disease treatments has you watching the sector, now’s a great moment to check out promising peers with our See the full list for free.

With shares still down this year but trading at a notable discount to analyst targets, is Kyowa Kirin an undervalued opportunity for long-term investors, or is the market already pricing in future growth prospects?

Price-to-Earnings of 31.4x: Is it justified?

At a closing share price of ¥2,303.5, Kyowa Kirin currently trades at a price-to-earnings ratio of 31.4x. This places it at a notable premium to both its peers and broader industry benchmarks.

The price-to-earnings (P/E) ratio measures how much investors are paying for each yen of the company’s earnings. For pharmaceutical companies, it offers a snapshot of how the market is valuing their growth prospects and profitability compared to competitors.

Kyowa Kirin’s P/E is substantially higher than both the peer average of 23.1x and the broader Japanese pharmaceuticals industry at 15.3x. This suggests the market is pricing in above-average growth or quality, even with flat share performance and only moderate earnings expectations. When compared to the estimated fair P/E ratio of 23.3x, the stock appears overvalued, which could imply a potential adjustment toward more reasonable levels if current trends continue.

Explore the SWS fair ratio for Kyowa Kirin

Result: Price-to-Earnings of 31.4x (OVERVALUED)

However, weak recent returns and flat revenue growth could limit near-term upside, especially if investor sentiment does not improve soon.

Find out about the key risks to this Kyowa Kirin narrative.

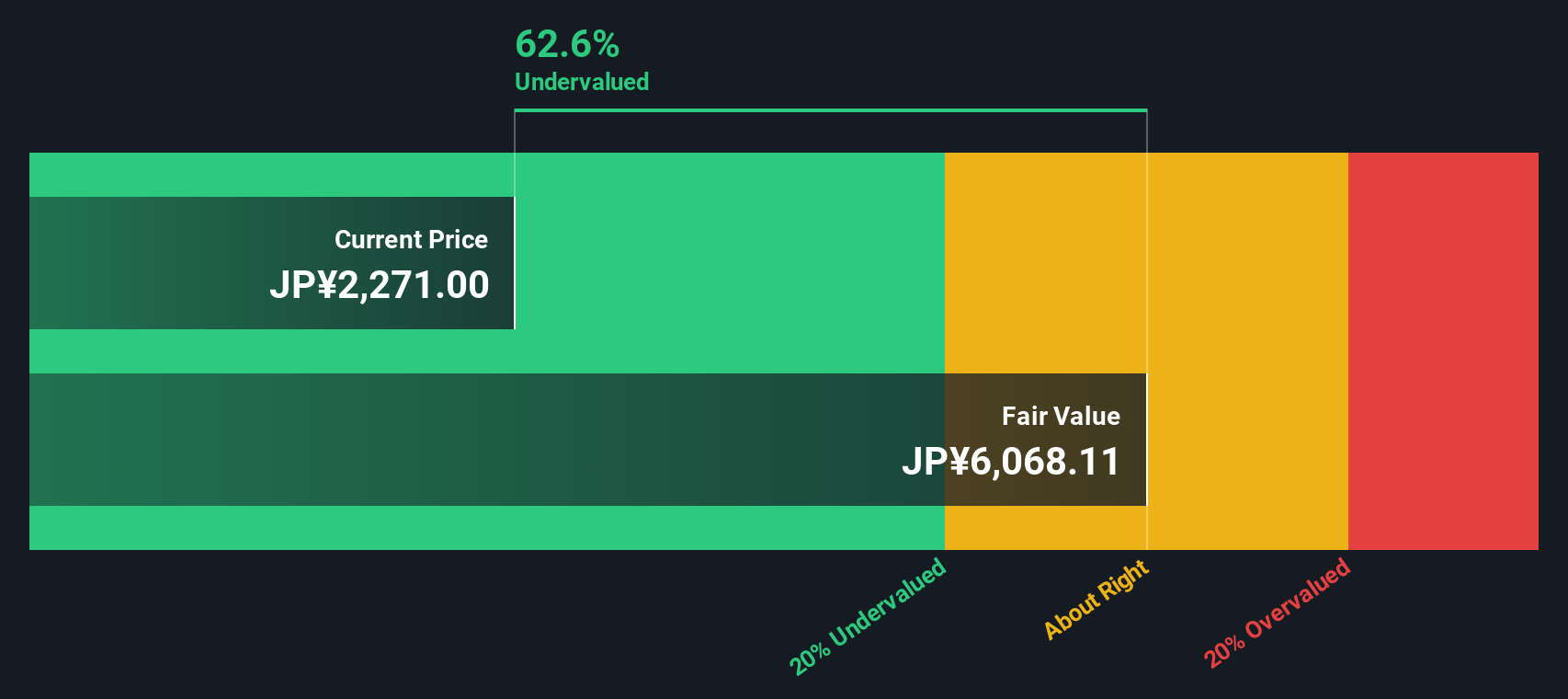

Another Perspective: SWS DCF Model Suggests Deep Undervaluation

While the price-to-earnings ratio makes Kyowa Kirin look expensive, our SWS DCF model presents a sharply contrasting picture. The DCF points to an estimated fair value of ¥6,068.11, which is over 2.5 times the current share price. This suggests the market may be overlooking longer-term cash flow potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyowa Kirin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyowa Kirin Narrative

If you want to dig deeper or have your own perspective on Kyowa Kirin, it takes just a few minutes to build a narrative that fits your view. Do it your way.

A great starting point for your Kyowa Kirin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Even More Investment Opportunities?

Don’t let great stocks pass you by while you focus on just one company. The market is full of overlooked gems and fresh trends. Seize your edge now.

- Tap into future tech breakthroughs by tracking these 27 AI penny stocks leading the charge with game-changing innovations in artificial intelligence.

- Start earning while you invest by checking out these 17 dividend stocks with yields > 3% that reward you with steady income and strong fundamentals.

- Catch the next big wave in finance as you check out these 80 cryptocurrency and blockchain stocks transforming how value moves across the globe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyowa Kirin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4151

Kyowa Kirin

Engages in the research, development, manufacture, import/export, and market of pharmaceuticals products worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives