GNI Group Ltd. Just Missed Earnings - But Analysts Have Updated Their Models

GNI Group Ltd. (TSE:2160) missed earnings with its latest annual results, disappointing overly-optimistic forecasters. GNI Group delivered a grave earnings miss, with both revenues (JP¥24b) and statutory earnings per share (JP¥19.55) falling badly short of analyst expectations. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on GNI Group after the latest results.

View our latest analysis for GNI Group

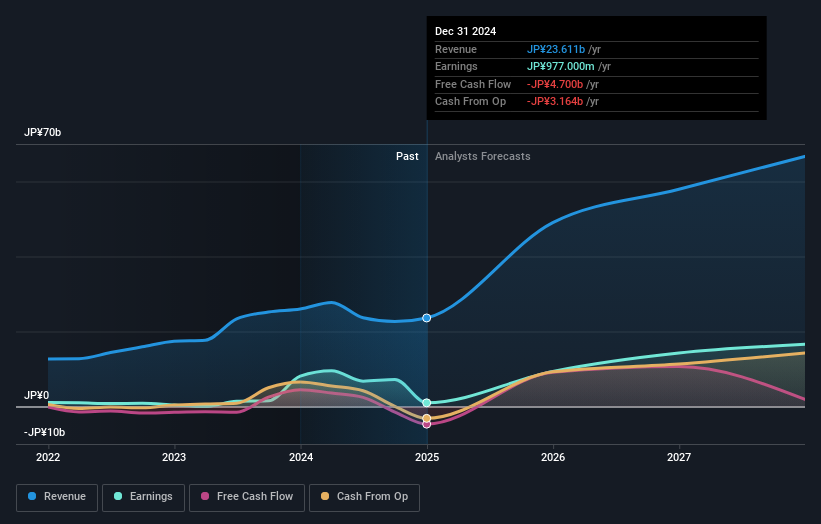

Following the latest results, GNI Group's four analysts are now forecasting revenues of JP¥49.0b in 2025. This would be a major 108% improvement in revenue compared to the last 12 months. Per-share earnings are expected to bounce 899% to JP¥195. Yet prior to the latest earnings, the analysts had been anticipated revenues of JP¥49.0b and earnings per share (EPS) of JP¥258 in 2025. So there's definitely been a decline in sentiment after the latest results, noting the pretty serious reduction to new EPS forecasts.

It might be a surprise to learn that the consensus price target fell 6.1% to JP¥3,850, with the analysts clearly linking lower forecast earnings to the performance of the stock price. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on GNI Group, with the most bullish analyst valuing it at JP¥4,000 and the most bearish at JP¥3,700 per share. This is a very narrow spread of estimates, implying either that GNI Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting GNI Group's growth to accelerate, with the forecast 108% annualised growth to the end of 2025 ranking favourably alongside historical growth of 25% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 17% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect GNI Group to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for GNI Group. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of GNI Group's future valuation.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple GNI Group analysts - going out to 2027, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with GNI Group (at least 2 which make us uncomfortable) , and understanding these should be part of your investment process.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2160

GNI Group

Engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion