3-D Matrix's (TYO:7777) Shareholders Are Down 68% On Their Shares

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term 3-D Matrix, Ltd. (TYO:7777) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 68% in that time. The more recent news is of little comfort, with the share price down 28% in a year. Furthermore, it's down 16% in about a quarter. That's not much fun for holders.

See our latest analysis for 3-D Matrix

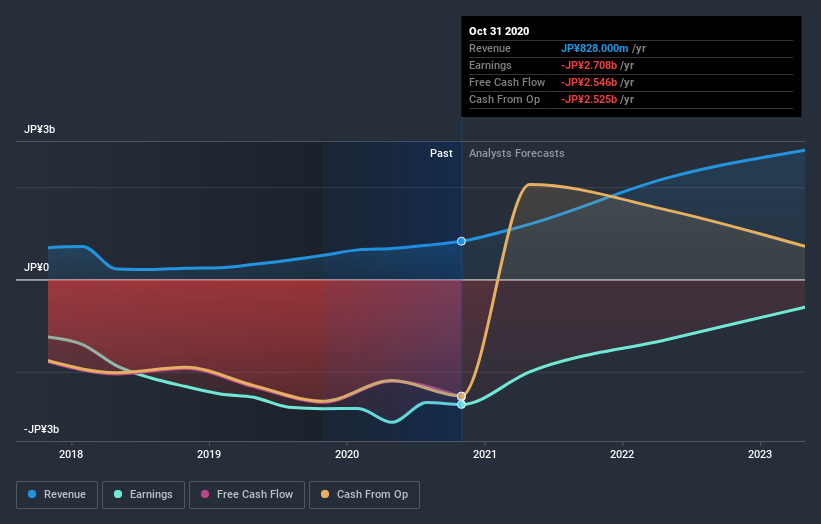

Given that 3-D Matrix didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, 3-D Matrix saw its revenue grow by 21% per year, compound. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 19% over that time, a bad result. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

3-D Matrix shareholders are down 28% for the year, but the market itself is up 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for 3-D Matrix that you should be aware of.

Of course 3-D Matrix may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you decide to trade 3-D Matrix, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if 3-D Matrix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:7777

3-D Matrix

3-D Matrix, Ltd. developing, manufacturing, and selling self-assembling peptide technology in Japan and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives