- Japan

- /

- Entertainment

- /

- TSE:9766

Does Konami (TSE:9766) Boosting Dividends Reflect Strong Cash Flow or Fewer Growth Investments?

Reviewed by Sasha Jovanovic

- Konami Group Corporation recently announced it will increase its second quarter-end dividend for the fiscal year ending March 31, 2026, to ¥83.00 per share, up from ¥66.00 per share a year earlier, with payments beginning November 20, 2025.

- This higher interim dividend suggests the company is emphasizing shareholder returns and signals management’s confidence in ongoing cash generation.

- Let’s explore how this notable dividend hike contributes to Konami Group’s investment narrative, particularly through its commitment to enhanced shareholder value.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Konami Group's Investment Narrative?

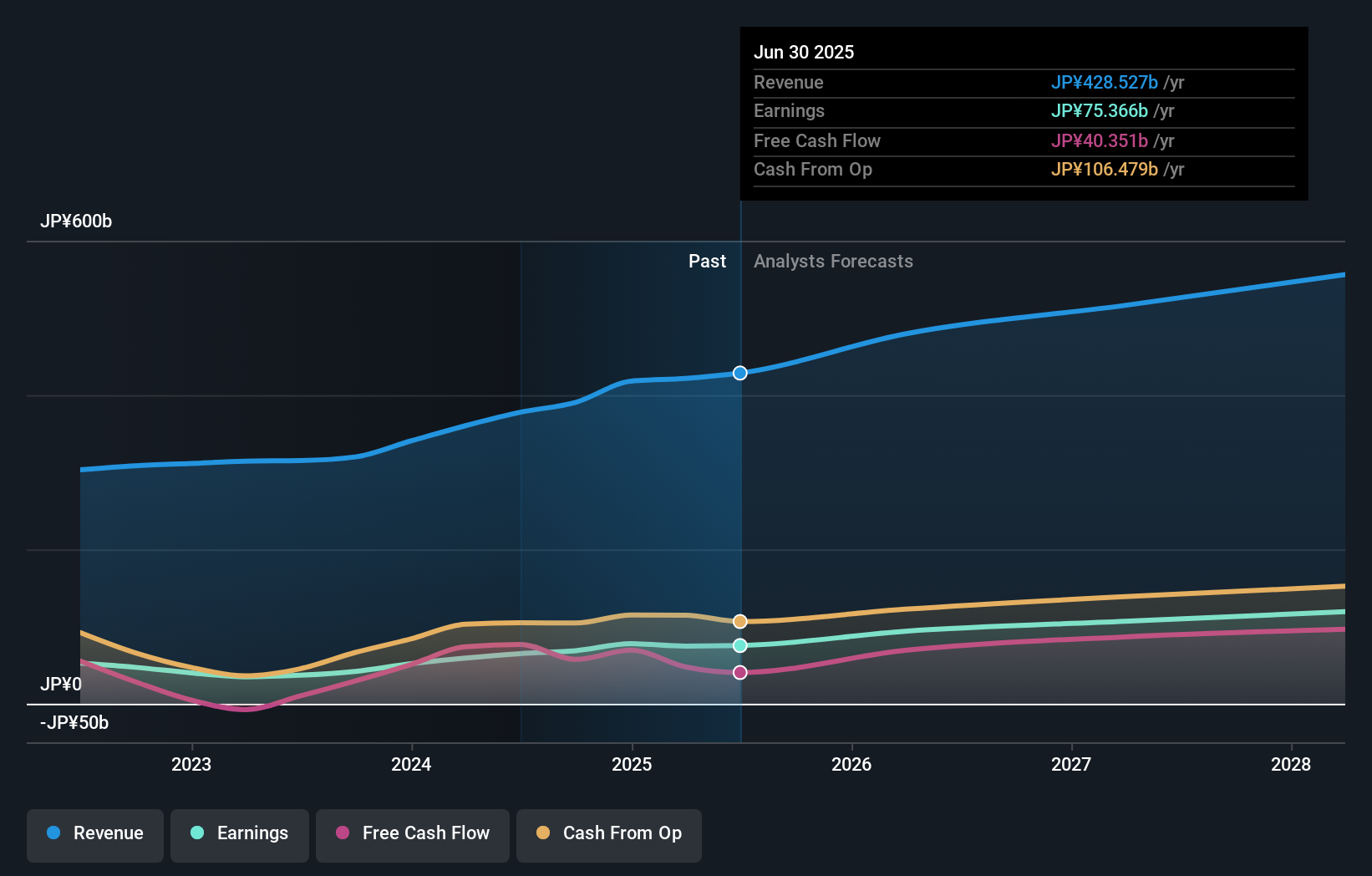

For investors considering Konami Group, the essential belief is in the company’s ability to maintain strong cash generation and steady growth, supported by shareholder-friendly policies such as consistent dividend increases. The latest announcement to boost the interim dividend to ¥83.00 per share not only underlines management’s ongoing confidence in financial stability, but could also serve to support shares in the short term by appealing to yield-focused participants. While this higher payout aligns well with recent profit growth and reinforces the company’s message around rewarding shareholders, it does not fundamentally alter the main short-term catalysts or chief risks: elevated valuation on a high price-to-earnings multiple and share price volatility remain key factors. Despite extra focus on shareholder returns, the dividend news doesn’t significantly change the broader investment thesis or major headwinds, leaving potential for both opportunity and caution.

However, investors should be mindful of ongoing volatility in the share price.

Exploring Other Perspectives

Explore 2 other fair value estimates on Konami Group - why the stock might be worth as much as ¥24616!

Build Your Own Konami Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Konami Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Konami Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Konami Group's overall financial health at a glance.

No Opportunity In Konami Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Konami Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9766

Konami Group

Primarily engages in the digital entertainment, amusement, gaming and systems, and sports businesses in Japan, Asia/Oceania countries, the United States, and Europe.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives