- Japan

- /

- Professional Services

- /

- TSE:4194

Top Japanese Growth Stocks With High Insider Ownership August 2024

Reviewed by Simply Wall St

Japan’s stock markets have experienced sharp weekly losses, with the Nikkei 225 Index falling 6.0% and the broader TOPIX Index down 5.6%. Despite this downturn, growth companies with high insider ownership continue to attract investor interest due to their potential for long-term value creation and alignment of interests between company executives and shareholders. In such volatile market conditions, stocks that exhibit strong growth potential coupled with significant insider ownership can be particularly appealing as they often indicate confidence in the company's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| Money Forward (TSE:3994) | 21.4% | 66.8% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| freee K.K (TSE:4478) | 32.8% | 72.9% |

We'll examine a selection from our screener results.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥312.30 billion.

Operations: Visional generates revenue through its human resources platform solutions in Japan.

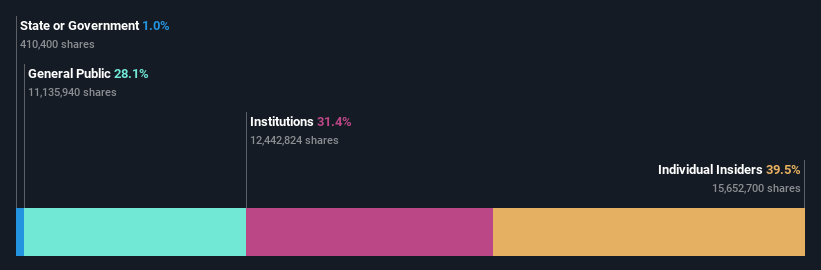

Insider Ownership: 39.5%

Visional has seen significant earnings growth of 74.3% over the past year and is expected to continue growing at 11.18% annually, outpacing the JP market's forecasted growth of 8.9%. Trading at 47.6% below its fair value estimate, Visional presents a potentially undervalued opportunity despite its highly volatile share price in recent months. The company's Return on Equity is projected to reach a robust 25.4% in three years, indicating strong profitability prospects ahead.

- Delve into the full analysis future growth report here for a deeper understanding of Visional.

- The analysis detailed in our Visional valuation report hints at an deflated share price compared to its estimated value.

PeptiDream (TSE:4587)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market cap of ¥359.40 billion.

Operations: The company generates revenue from the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

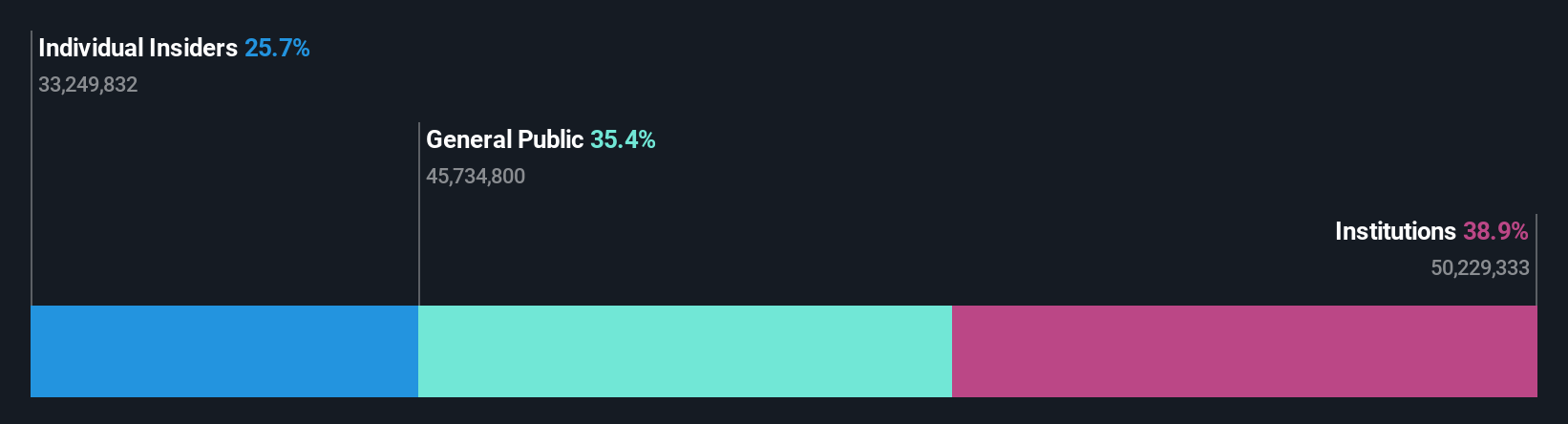

Insider Ownership: 26.1%

PeptiDream's earnings are forecast to grow significantly at 22.6% per year, well above the JP market's 8.9%. Despite a volatile share price, it trades at 37.9% below its fair value estimate. Recent product-related announcements include a promising first-in-human imaging study for clear cell renal cell carcinoma, potentially accelerating clinical development. The company raised its consolidated earnings guidance for FY2024, reflecting strong expected operating profit and revenue growth compared to previous estimates.

- Unlock comprehensive insights into our analysis of PeptiDream stock in this growth report.

- Our valuation report unveils the possibility PeptiDream's shares may be trading at a premium.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a company that plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally with a market cap of ¥1.34 trillion.

Operations: Capcom's revenue segments include Digital Content at ¥103.38 billion, Amusement Equipment at ¥10.34 billion, and Amusement Facilities at ¥20.09 billion.

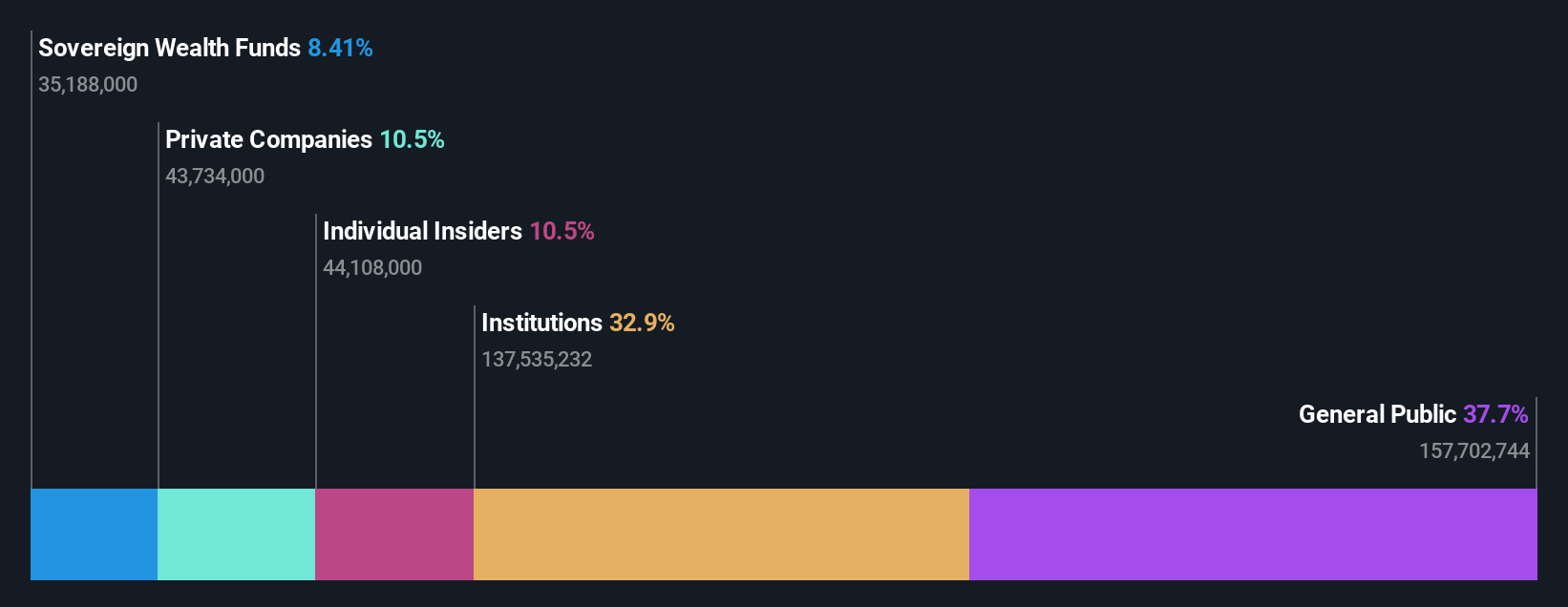

Insider Ownership: 11.5%

Capcom's earnings are forecast to grow at 14.3% per year, outpacing the JP market's 8.9%. Revenue is expected to increase by 9.5% annually, also above the market average of 4.3%. The company's Return on Equity is projected to reach a robust 20.4% in three years. Recent events include an upcoming Q1 2025 earnings report on July 29, indicating transparency and active communication with shareholders, though no significant insider trading activity has been reported recently.

- Take a closer look at Capcom's potential here in our earnings growth report.

- According our valuation report, there's an indication that Capcom's share price might be on the expensive side.

Make It Happen

- Navigate through the entire inventory of 100 Fast Growing Japanese Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4194

Outstanding track record with reasonable growth potential.