As global markets continue to react to U.S. inflation data and the prospect of a Federal Reserve rate cut, small-cap stocks have been leading gains, with the Russell 2000 Index outperforming larger indices like the S&P 500. In this context of economic optimism and market volatility, identifying high growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and adapt swiftly to changing economic conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Huace Navigation Technology | 25.38% | 24.34% | ★★★★★★ |

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Fositek | 33.62% | 43.76% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| KebNi | 21.77% | 66.81% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 24.93% | 24.09% | ★★★★★★ |

| CD Projekt | 33.65% | 39.46% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Presight AI Holding (ADX:PRESIGHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Presight AI Holding PLC is a big data analytics company leveraging generative artificial intelligence to serve clients in the United Arab Emirates and globally, with a market capitalization of AED20.30 billion.

Operations: Presight AI Holding PLC generates revenue primarily through its artificial intelligence, machine learning, data analytics, and hosting services, totaling AED2.70 billion.

Presight AI Holding has demonstrated robust growth with a 21.2% annual increase in revenue, outpacing the AE market's 7.3% expansion. Despite a challenging year with earnings dipping by 9.4%, the company's strategic initiatives, including a recent MoU with Dow Jones Factiva to develop AI-native risk solutions, underscore its commitment to innovation and sector leadership. This collaboration aims to enhance financial regulatory frameworks using AI, positioning Presight as a pivotal player in tech-driven regulatory evolution, crucial for future-proofing global financial systems.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG develops, produces, sells, and services sensor systems, modules, and components across various regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF1.18 billion.

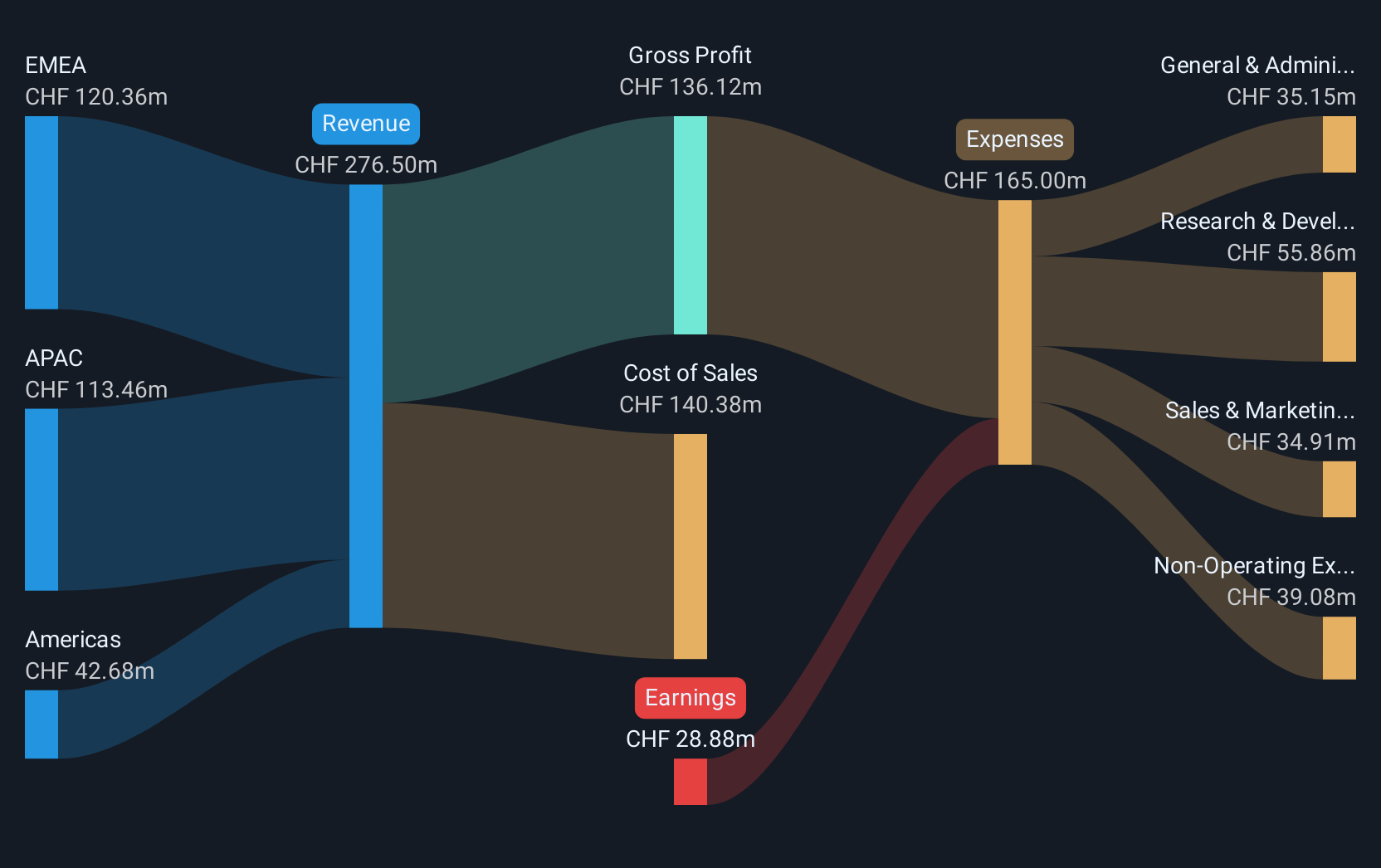

Operations: Sensirion Holding AG generates revenue primarily from its sensor systems, modules, and components segment, amounting to CHF276.50 million. The company operates across diverse regions such as the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Sensirion Holding AG is navigating the competitive tech landscape with a forward-looking approach, underscored by its recent product launches and strategic partnerships. With an impressive 69.42% forecasted annual earnings growth and a transition to profitability expected within three years, Sensirion is aligning its operations with industry demands for high-accuracy environmental sensors. The collaboration with Sintropy.ai highlights Sensirion's commitment to innovation, leveraging their R&D prowess (spending trends not specified) to enhance AI-driven automation solutions across various sectors. This synergy not only broadens their market reach but also reinforces their role in advancing smart technology integrations, crucial for sustained growth in the evolving tech ecosystem.

- Click here and access our complete health analysis report to understand the dynamics of Sensirion Holding.

Understand Sensirion Holding's track record by examining our Past report.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

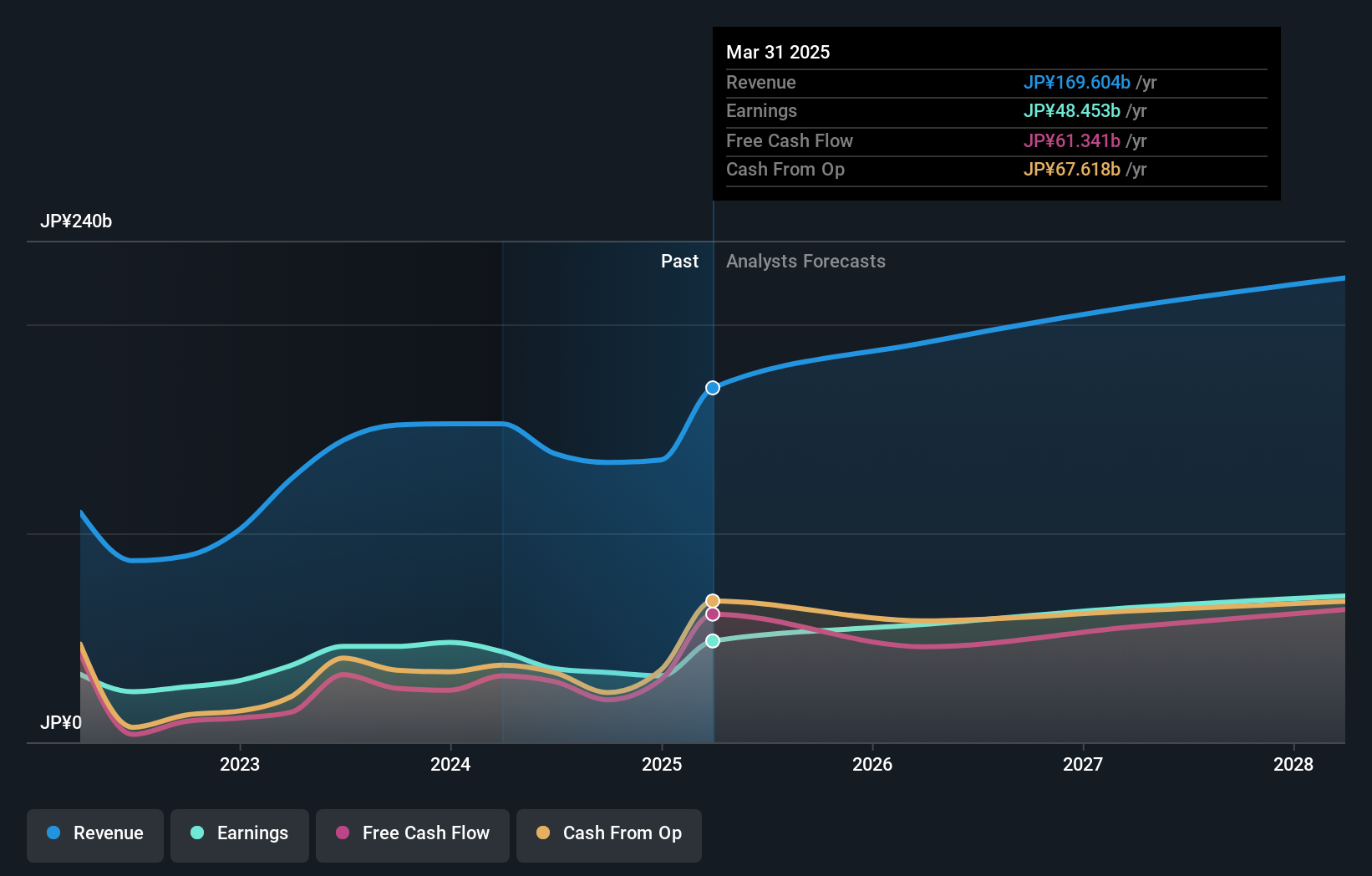

Overview: Capcom Co., Ltd. is a Japanese company involved in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games globally with a market cap of ¥1.71 trillion.

Operations: The primary revenue stream for Capcom Co., Ltd. is its Digital Content segment, generating ¥133.57 billion, followed by Arcade Operations at ¥23.49 billion and Amusement Equipment at ¥21.20 billion.

Capcom is setting a strong pace in the gaming industry with its innovative approach to new and existing franchises. The recent announcement of Resident Evil Requiem, scheduled for release in February 2026, showcases Capcom's commitment to leveraging its proprietary RE ENGINE for enhanced graphical fidelity and immersive gameplay. This strategic focus is supported by a robust financial performance, with revenue growth forecast at 7% per year, outpacing the Japanese market's 4.3%. Moreover, Capcom's earnings have surged by 58.3% over the past year, significantly exceeding the entertainment industry's growth rate of 12.2%. These developments underscore Capcom’s potential to maintain its competitive edge and appeal to a global audience eager for high-quality gaming experiences.

- Get an in-depth perspective on Capcom's performance by reading our health report here.

Explore historical data to track Capcom's performance over time in our Past section.

Where To Now?

- Get an in-depth perspective on all 240 Global High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives