In recent weeks, global markets have been marked by geopolitical tensions and concerns over consumer spending, leading to fluctuations in major indices like the S&P 500 and Dow Jones Industrial Average. As investors navigate these uncertain times, dividend stocks can offer a measure of stability and potential income through regular payouts. A good dividend stock typically combines a solid yield with the resilience to withstand market volatility, making it an attractive option for those looking to balance growth with income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.23% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2010 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

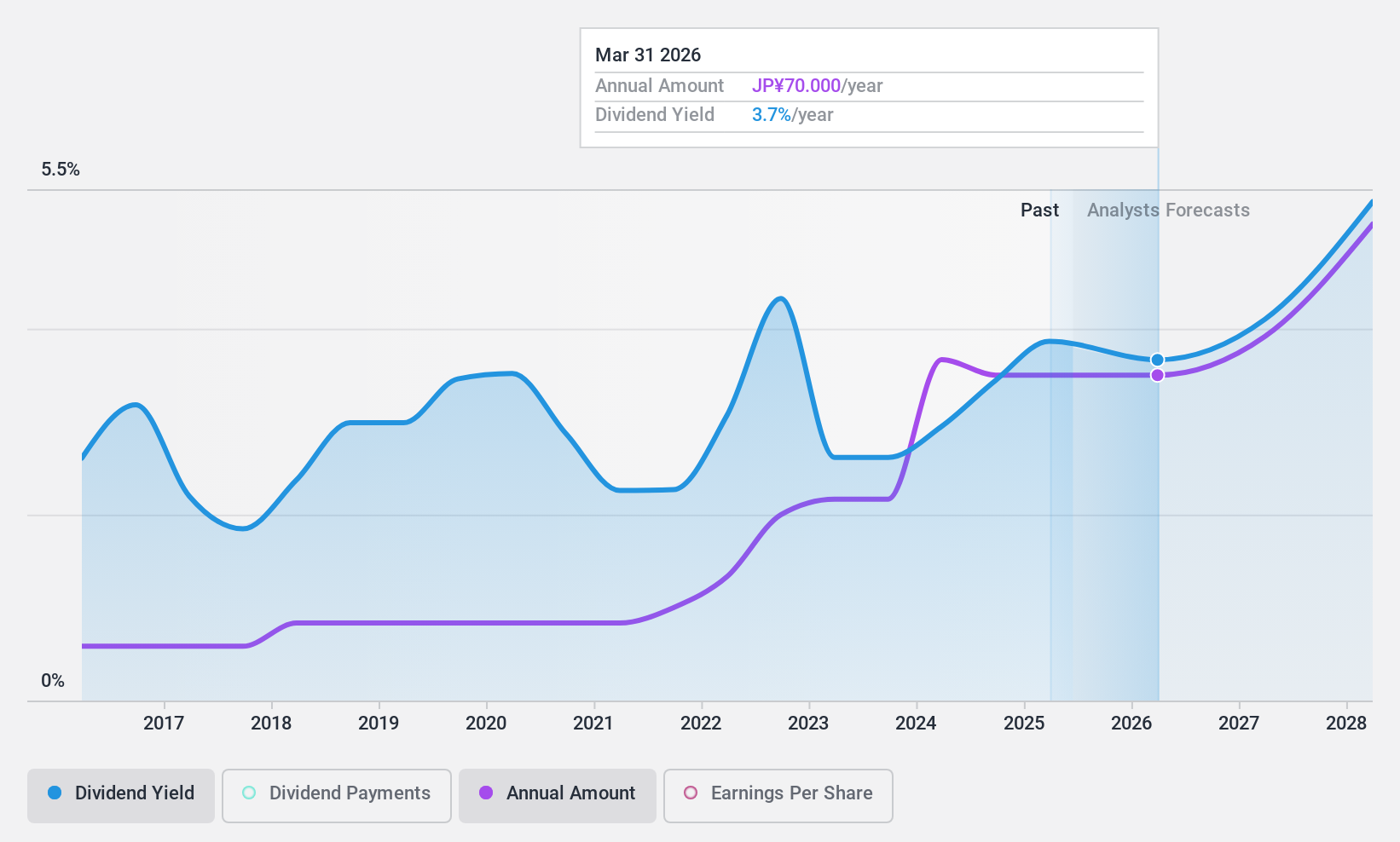

Macnica Holdings (TSE:3132)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macnica Holdings, Inc. is involved in the import, sale, and export of electronic components in Japan with a market capitalization of approximately ¥333.28 billion.

Operations: Macnica Holdings generates revenue primarily from its Integrated Circuits, Electronic Devices and Other Businesses segment, which accounts for ¥863.36 billion, followed by the Network Business segment at ¥146.85 billion.

Dividend Yield: 3.7%

Macnica Holdings' dividend payments, while increasing over the past decade, have been volatile and unreliable. The company's dividends are well-covered by earnings with a payout ratio of 38% and a cash payout ratio of 73.6%. Despite trading at 64.3% below its estimated fair value, its dividend yield is slightly lower than the top tier in Japan's market. Recent buybacks and potential acquisitions suggest strategic moves to bolster growth amidst industry pressures.

- Click here to discover the nuances of Macnica Holdings with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Macnica Holdings is priced lower than what may be justified by its financials.

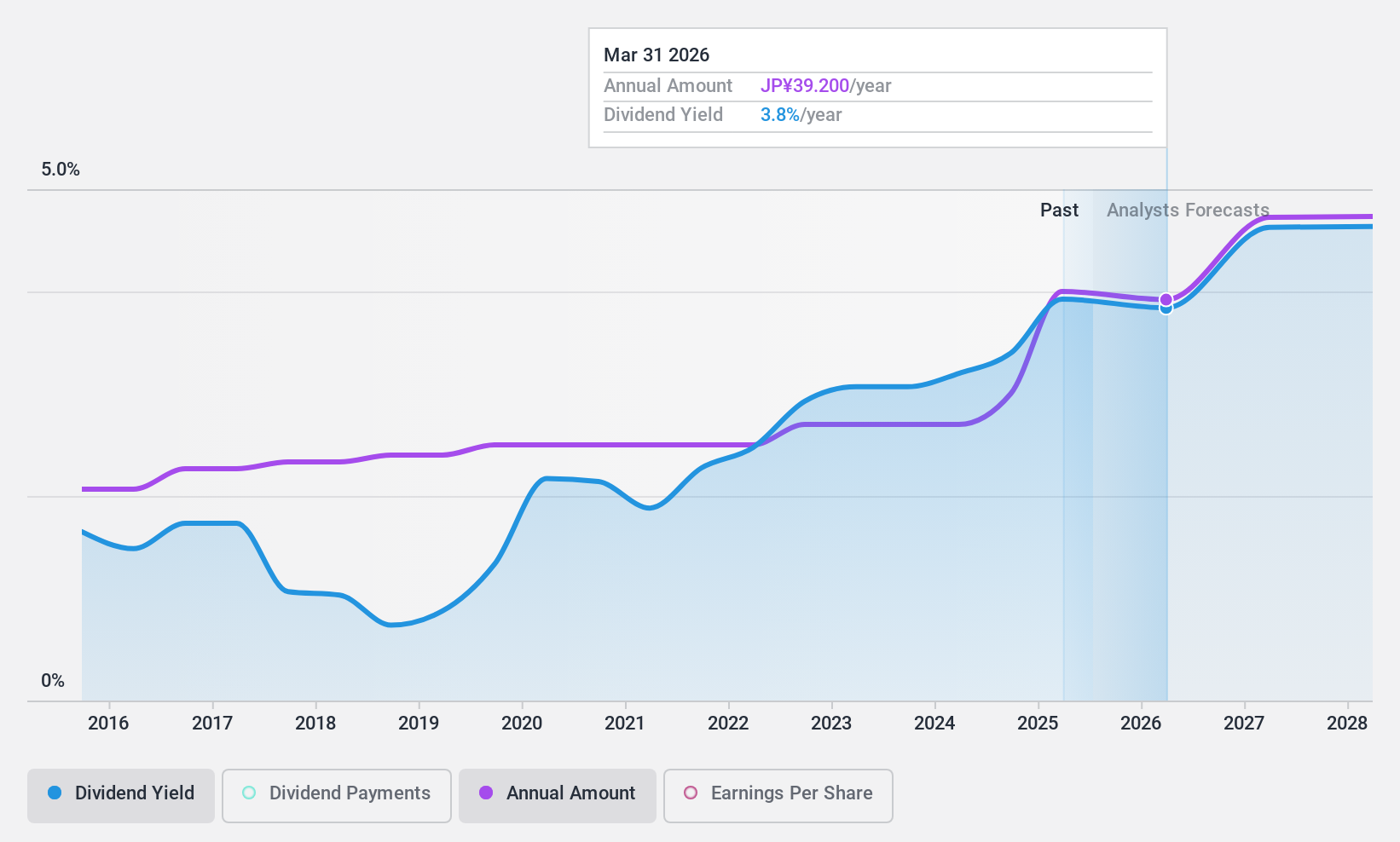

Zenrin (TSE:9474)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Zenrin Co., Ltd. specializes in the collection and management of geospatial information globally, with a market cap of ¥52.84 billion.

Operations: Zenrin Co., Ltd. generates revenue primarily from its Location Information Service Related Business, amounting to ¥63.68 billion.

Dividend Yield: 4%

Zenrin's dividend payments, recently increased to JPY 20 per share for the fiscal year ending March 31, 2025, are well-covered by earnings with a payout ratio of 45.9% and cash flows at an 83.4% cash payout ratio. The company maintains stable dividends with a reliable history over the past decade and offers an attractive yield of 4.04%, placing it in the top tier among Japanese dividend payers. Recent executive changes may influence future strategic directions.

- Dive into the specifics of Zenrin here with our thorough dividend report.

- Our valuation report here indicates Zenrin may be undervalued.

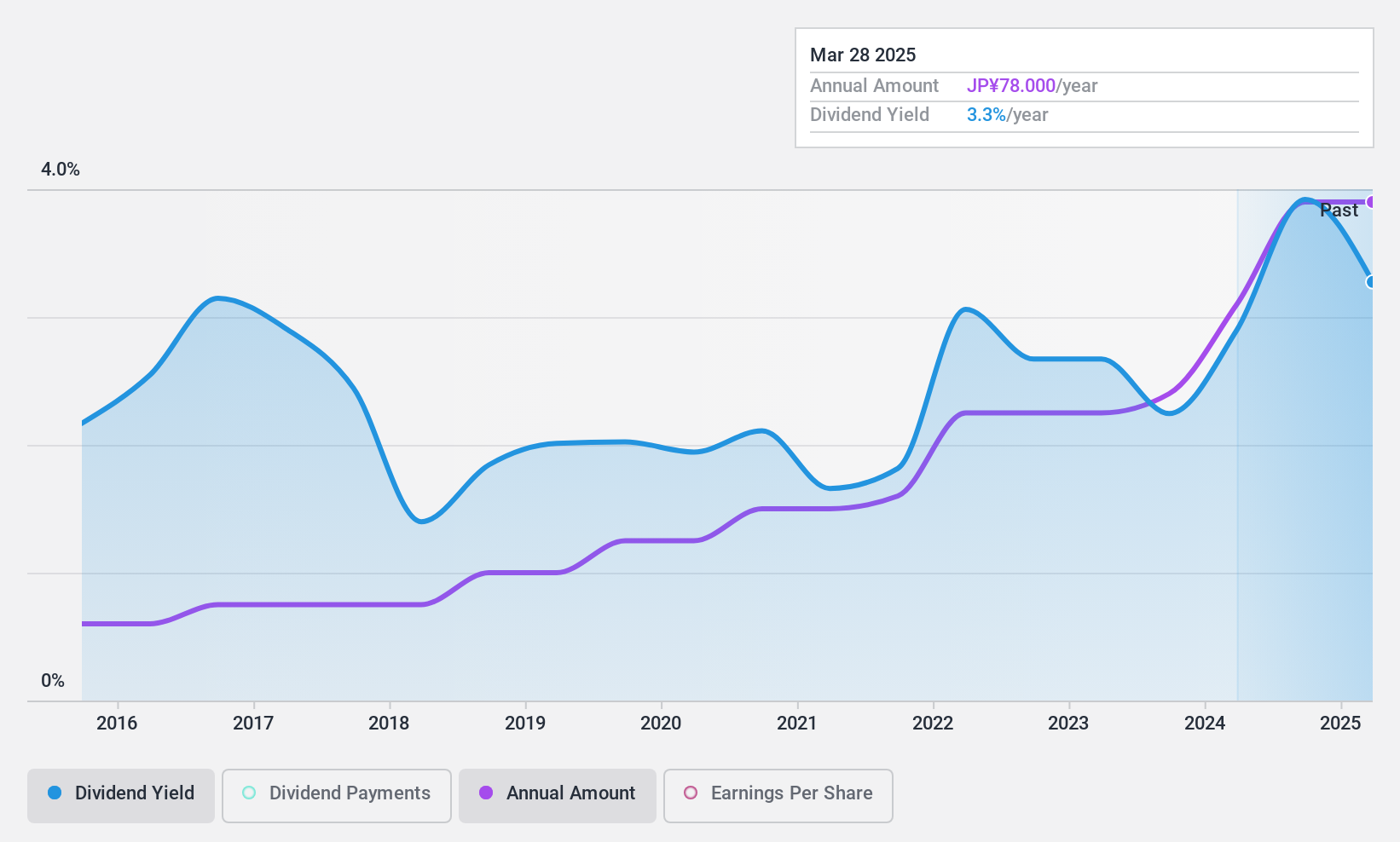

Business Brain Showa-Ota (TSE:9658)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Business Brain Showa-Ota Inc. offers consulting and system development solutions in Japan, with a market cap of ¥29.82 billion.

Operations: Business Brain Showa-Ota Inc. generates revenue through two main segments: Management Services (BPO) at ¥11.19 billion and Consulting and System Development at ¥26.61 billion.

Dividend Yield: 3%

Business Brain Showa-Ota's dividend yield of 3.04% is below the top quartile in Japan but remains reliable and stable over the past decade, with recent increases to ¥41 per share for fiscal year 2025. The dividend is well-covered by earnings and cash flows, with payout ratios of 33.4% and 37%, respectively. Recent share repurchase initiatives aim to enhance capital efficiency, potentially benefiting shareholders through improved capital allocation strategies amidst revised upward earnings guidance.

- Get an in-depth perspective on Business Brain Showa-Ota's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Business Brain Showa-Ota's current price could be quite moderate.

Taking Advantage

- Explore the 2010 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zenrin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9474

Zenrin

Engages in the collection and management of a range of geospatial information worldwide.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives