Assessing SKY Perfect JSAT Holdings (TSE:9412) Valuation as Space Data Center Ambitions Drive Sector Spotlight

Reviewed by Simply Wall St

Momentum around building data centers in space is gaining traction, highlighted by NVIDIA’s upcoming launch of a GPU-powered satellite. This renewed focus on satellite and space infrastructure has brought SKY Perfect JSAT Holdings (TSE:9412) into the spotlight for investors.

See our latest analysis for SKY Perfect JSAT Holdings.

All this heightened excitement around space infrastructure seems to be fueling momentum for SKY Perfect JSAT Holdings as well. The company’s share price is up a stunning 63% so far this year, while its one-year total shareholder return clocks in at an impressive 72%. This is a clear sign that the market sees potential in both the company and the sector’s growth story.

If you’re intrigued by how shifting trends create new market leaders, it’s worth exploring fast growing stocks with high insider ownership as your next discovery opportunity.

But with SKY Perfect JSAT Holdings’ strong run, investors must now ask if shares are still trading at a discount or if the market has already factored in all the expected growth from the space data center boom.

Price-to-Earnings of 21.2x: Is it justified?

SKY Perfect JSAT Holdings trades with a price-to-earnings ratio of 21.2x, signaling the market values its earnings quite highly. For context, its closing share price was ¥1,464, reflecting optimism after a strong year.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each ¥1 of the company’s earnings. It is a critical yardstick for media sector firms, since profitability and forward growth are significant drivers of valuation. In this case, a 21.2x P/E suggests the market is expecting steady or improving profits from SKY Perfect JSAT Holdings.

Compared to peers, the company's P/E ratio of 21.2x is substantially lower than the peer group average of 61.4x, suggesting the stock looks attractively priced versus similarly sized companies. However, when measured against the broader Japanese media industry, the stock is somewhat more expensive than the industry average of 17.1x. Based on regression models, a fair price-to-earnings ratio for SKY Perfect JSAT Holdings would be around 26x, so there is potential for the market to re-rate the stock higher if expectations hold.

Explore the SWS fair ratio for SKY Perfect JSAT Holdings

Result: Price-to-Earnings of 21.2x (UNDERVALUED)

However, slower-than-expected revenue or net income growth could challenge the bullish thesis, particularly if the adoption of space data centers experiences delays.

Find out about the key risks to this SKY Perfect JSAT Holdings narrative.

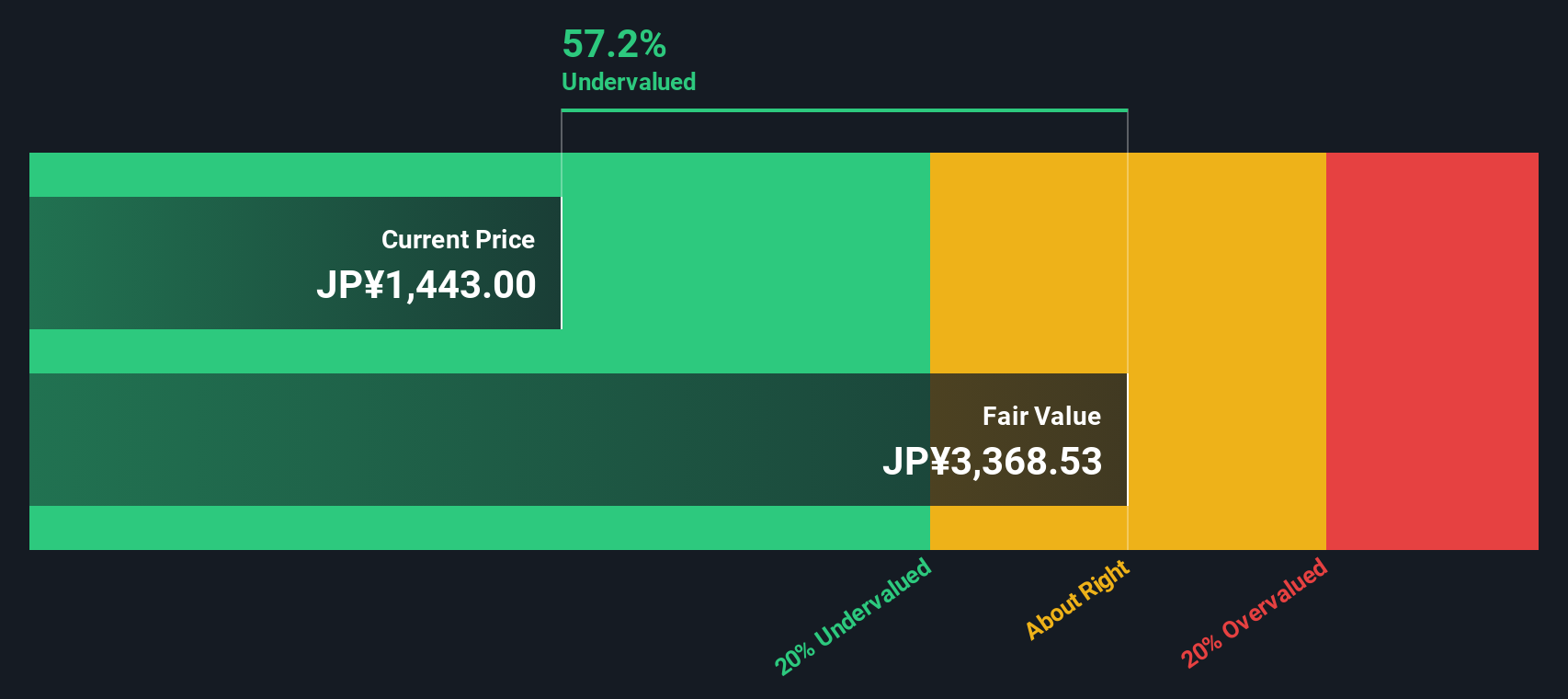

Another View: Our DCF Model Suggests Even Greater Upside

Looking at SKY Perfect JSAT Holdings through the lens of our SWS DCF model, the story appears even more compelling. The current share price of ¥1,464 trades at a steep 56.6% discount to our estimated fair value of ¥3,372.45. This raises the question of whether the market is underestimating the company’s true long-term potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SKY Perfect JSAT Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 854 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SKY Perfect JSAT Holdings Narrative

If you think the numbers tell a different story or want to dive deeper on your own, you can quickly craft your own analysis and unique narrative. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SKY Perfect JSAT Holdings.

Looking for more investment ideas?

Don’t settle for just one opportunity when you could be ahead of the curve on multiple trends. Level up your portfolio with these standout strategies:

- Pounce on high-potential winners with these 3579 penny stocks with strong financials that have impressive financial credentials and could be the next market success stories.

- Capitalize on game-changing breakthroughs using these 26 AI penny stocks packed with companies making waves in artificial intelligence and automation.

- Catch income opportunities with these 21 dividend stocks with yields > 3% to find solid businesses paying yields greater than 3%. This can be a useful approach if you want reliable returns alongside growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9412

SKY Perfect JSAT Holdings

Provides satellite-based multichannel pay TV and satellite communications services primarily in Asia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives