- Japan

- /

- Interactive Media and Services

- /

- TSE:6184

What You Can Learn From Kamakura Shinsho, Ltd.'s (TSE:6184) P/EAfter Its 25% Share Price Crash

Kamakura Shinsho, Ltd. (TSE:6184) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

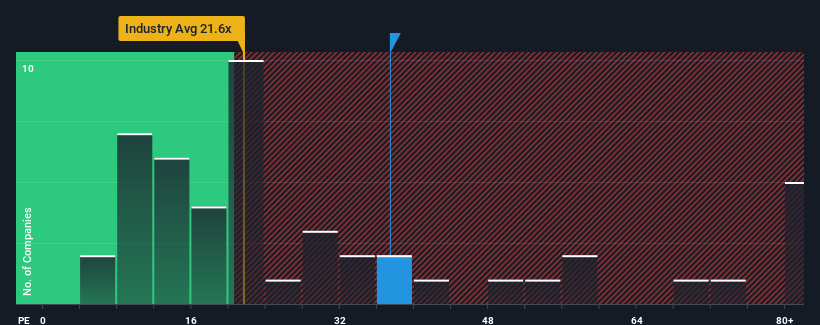

Although its price has dipped substantially, Kamakura Shinsho may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 37.4x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Earnings have risen firmly for Kamakura Shinsho recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Kamakura Shinsho

Is There Enough Growth For Kamakura Shinsho?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Kamakura Shinsho's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. The strong recent performance means it was also able to grow EPS by 207% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Kamakura Shinsho's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Kamakura Shinsho's P/E

Even after such a strong price drop, Kamakura Shinsho's P/E still exceeds the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Kamakura Shinsho revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Kamakura Shinsho you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kamakura Shinsho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6184

Kamakura Shinsho

Operates a portal site that provides information services related to end of life in Japan.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives