Top Dividend Stocks On The Japanese Exchange In October 2024

Reviewed by Simply Wall St

In October 2024, Japan's stock markets have experienced notable gains, with the Nikkei 225 Index rising by 2.45% and the broader TOPIX Index up by 0.45%, bolstered by yen weakness which has improved profit outlooks for exporters. Amidst these favorable conditions, dividend stocks on the Japanese exchange present an attractive opportunity for investors seeking stable income streams in a dynamic market environment.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.24% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.95% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.29% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.76% | ★★★★★★ |

| Innotech (TSE:9880) | 4.83% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.58% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

Click here to see the full list of 447 stocks from our Top Japanese Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

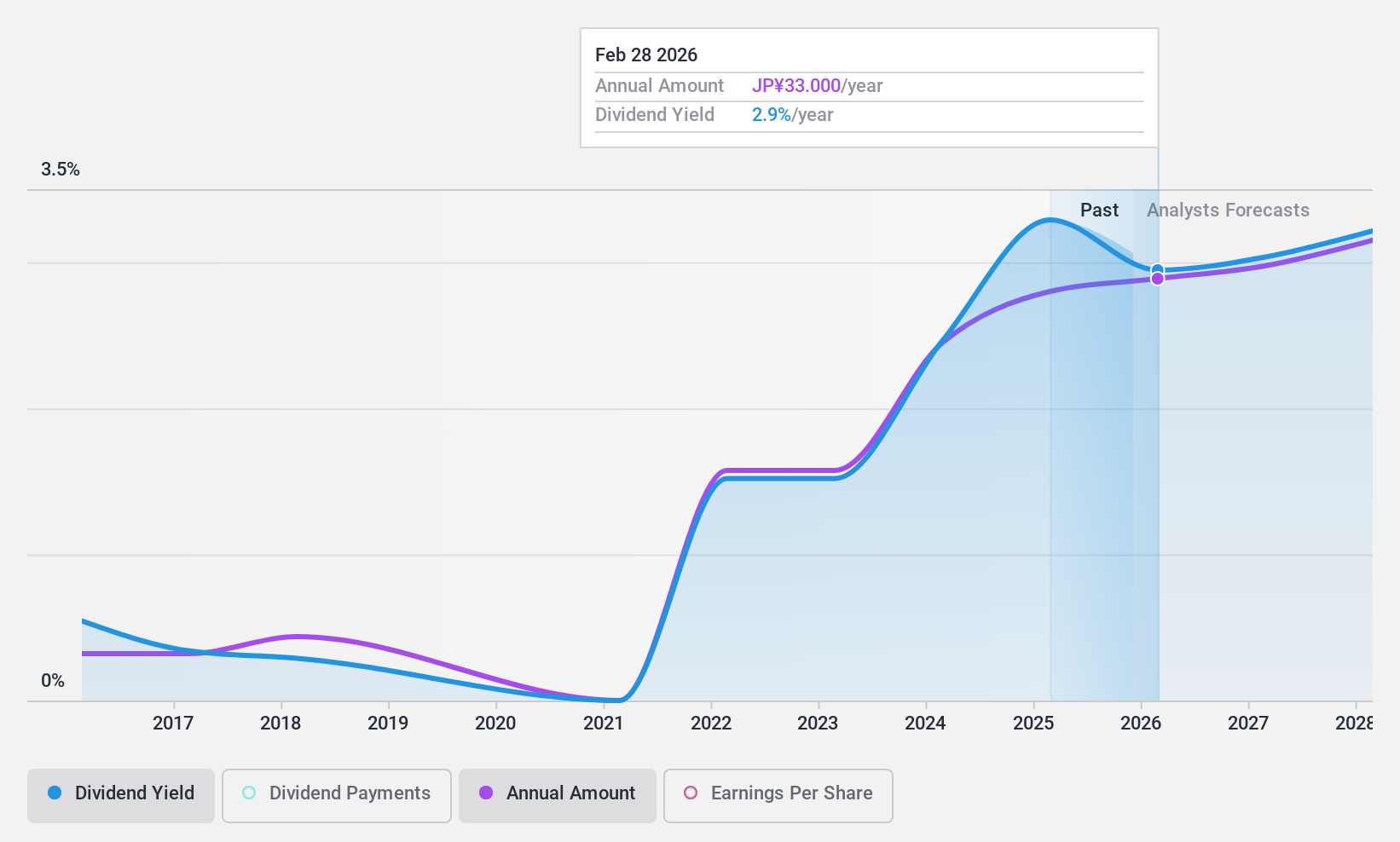

Vector (TSE:6058)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vector Inc. operates in public relations, advertising, press release and video distribution, direct marketing, media, investment, and human resources sectors across Japan, China, and internationally with a market cap of ¥45.68 billion.

Operations: Vector Inc.'s revenue is primarily derived from its operations in public relations, advertising, press and video distribution, direct marketing, media, investment, and human resources across various regions.

Dividend Yield: 3.2%

Vector Inc. recently revised its dividend policy, increasing the year-end dividend forecast to JPY 32 per share from JPY 31, reflecting a commitment to shareholder returns despite a lowered earnings forecast. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 30.6% and 41%, respectively. However, its dividend yield is below top-tier levels in Japan, and past payments have been volatile. Vector trades at a good value relative to peers.

- Take a closer look at Vector's potential here in our dividend report.

- Upon reviewing our latest valuation report, Vector's share price might be too pessimistic.

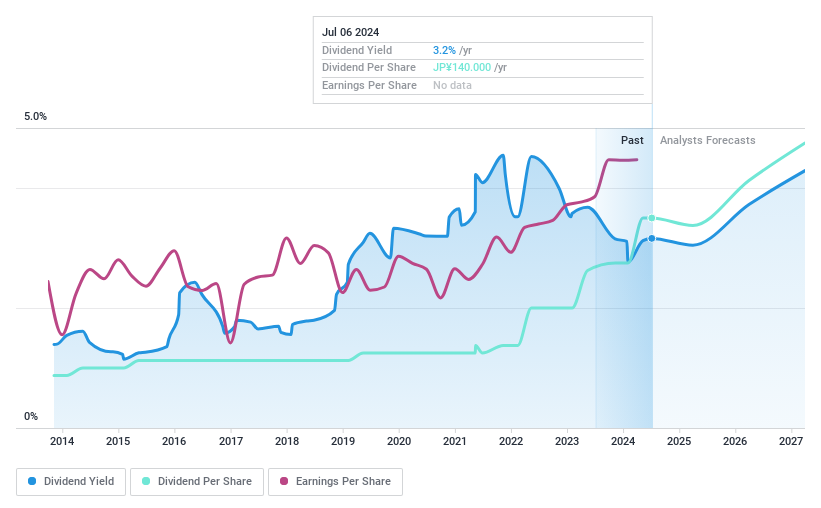

77 Bank (TSE:8341)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd., along with its subsidiaries, offers banking products and services to both corporate and individual customers in Japan, with a market cap of ¥308.79 billion.

Operations: The 77 Bank, Ltd. generates revenue through its banking products and services provided to corporate and individual clients in Japan.

Dividend Yield: 3.4%

77 Bank's dividends are well-covered by earnings, with a low payout ratio of 27.8%, and have been stable and reliable over the past decade. Despite a dividend yield of 3.36% being below Japan's top tier, recent increases reflect strong shareholder commitment. Earnings grew by 27.2% last year, though high bad loans (1010.4%) pose risks. The bank trades at a significant discount to its estimated fair value, suggesting potential investment appeal despite challenges in loan management.

- Navigate through the intricacies of 77 Bank with our comprehensive dividend report here.

- The analysis detailed in our 77 Bank valuation report hints at an deflated share price compared to its estimated value.

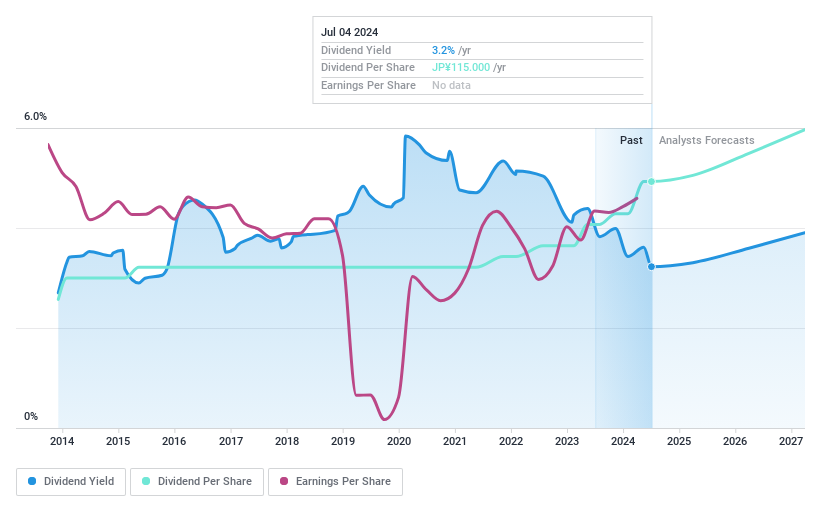

Mizuho Financial Group (TSE:8411)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mizuho Financial Group, Inc. operates in banking, trust, securities, and other financial services across Japan and internationally with a market cap of ¥8.04 trillion.

Operations: Mizuho Financial Group's revenue segments include ¥0.51 billion from The Global Markets Company, ¥0.58 billion from Corporate & Institutional Company, ¥0.76 billion from Retail & Business Banking Company, ¥0.06 billion from The Asset Management Company, and ¥0.69 billion from The Global Corporate & Investment Banking Company.

Dividend Yield: 3.6%

Mizuho Financial Group offers a stable dividend profile with a 3.62% yield, supported by a low payout ratio of 36.8%, indicating dividends are well-covered by earnings. The company's dividends have been reliable and stable over the past decade, though slightly below Japan's top tier. Recent earnings growth and trading at nearly half its estimated fair value highlight potential appeal for investors seeking undervalued opportunities despite recent market volatility and ongoing M&A discussions in India.

- Delve into the full analysis dividend report here for a deeper understanding of Mizuho Financial Group.

- Insights from our recent valuation report point to the potential undervaluation of Mizuho Financial Group shares in the market.

Where To Now?

- Delve into our full catalog of 447 Top Japanese Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6058

Vector

Engages in the public relations (PR) and advertising, press release distribution, video release distribution, direct marketing, media, investment, and human resources businesses in Japan, China, and internationally.

Flawless balance sheet, undervalued and pays a dividend.