- Japan

- /

- Interactive Media and Services

- /

- TSE:6037

RAKUMACHI,Inc.'s (TSE:6037) Business Is Yet to Catch Up With Its Share Price

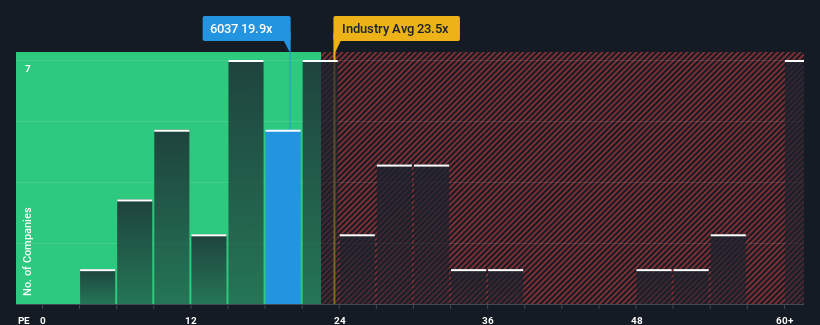

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider RAKUMACHI,Inc. (TSE:6037) as a stock to avoid entirely with its 19.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, RAKUMACHIInc's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for RAKUMACHIInc

Does Growth Match The High P/E?

In order to justify its P/E ratio, RAKUMACHIInc would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 31%. This means it has also seen a slide in earnings over the longer-term as EPS is down 15% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's an unpleasant look.

With this information, we find it concerning that RAKUMACHIInc is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that RAKUMACHIInc currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for RAKUMACHIInc with six simple checks on some of these key factors.

If you're unsure about the strength of RAKUMACHIInc's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6037

RAKUMACHIInc

Operates a real estate investment portal site under the Rakumachi name in Japan.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives