- Japan

- /

- Entertainment

- /

- TSE:5032

ANYCOLOR (TSE:5032) Updates Forecasts: What Does Stronger Growth Mean for Valuation?

Reviewed by Simply Wall St

ANYCOLOR (TSE:5032) just gave investors a reason to sit up and take notice, announcing a revision to its full-year financial forecasts after outperforming expectations in the first quarter. The company credits its success to thriving VTuber anniversary events, strong merchandise sales, and a series of well-received live experiences. With management now anticipating even greater growth for the rest of the year, this move signals a renewed confidence in their strategy and a clear message to markets about the strength of their digital entertainment business.

In the bigger picture, ANYCOLOR’s momentum stands out. Over the past year, the share price has delivered a return above 150%, and this has been paired with annual revenue and profit growth over 10%. In the shorter term, gains have accelerated in recent months as positive sentiment built on the back of both successful product launches and new strategic initiatives such as the NIJISANJI WORLD TOUR. The stock’s run-up over the past month suggests investors are becoming more comfortable with ANYCOLOR’s prospects and risk profile, reflecting a clear uptick in confidence.

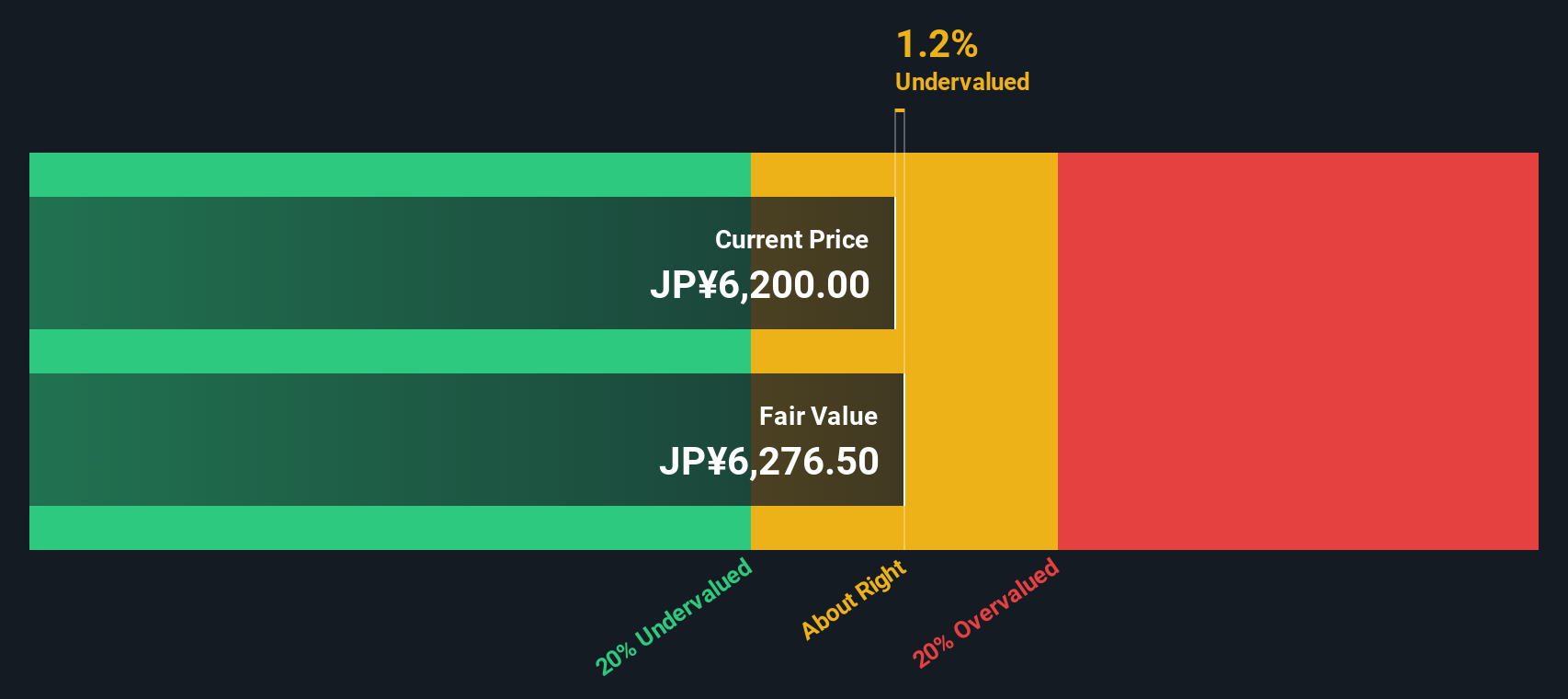

With such strong recent gains and upgraded forecasts, some may ask whether shares are still offering value at these levels, or if the market is now fully pricing in the company’s next wave of growth.

Price-to-Earnings of 26.3x: Is it justified?

ANYCOLOR is currently trading at a price-to-earnings (P/E) ratio of 26.3x, which is higher than the average P/E of 23x for the Japanese Entertainment industry. This suggests the market is assigning a premium to the company compared to its sector peers.

The P/E ratio reflects how much investors are willing to pay for each yen of earnings. It is one of the most widely used valuation measures for fast-growing, profitable entertainment businesses because it signals both current profitability and growth expectations.

With ANYCOLOR’s combination of rapid earnings expansion and upgraded forecasts, the elevated P/E may signal confidence in the company’s ability to keep outperforming its competitors and maintain strong momentum. However, it also indicates that some of the future growth is already priced in by the market.

Result: Fair Value of ¥6,157.72 (OVERVALUED)

See our latest analysis for ANYCOLOR.However, if growth momentum slows or competition intensifies in the digital entertainment sector, ANYCOLOR’s premium valuation could quickly come under pressure.

Find out about the key risks to this ANYCOLOR narrative.Another View: What Does the SWS DCF Model Say?

Looking at things from a different angle, our DCF model weighs in and points to a similar story, finding the shares to be overvalued. Does this second method raise fresh questions, or does it just confirm what the market thinks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ANYCOLOR Narrative

If you have a different take or want to dig deeper into the numbers yourself, you can easily craft your own perspective in just a few minutes. Do it your way.

A great starting point for your ANYCOLOR research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss out on opportunities beyond ANYCOLOR. Let Simply Wall Street’s screener point you toward stocks with real momentum, specialty niches, or untapped potential.

- Spot undervalued companies poised for a turnaround by checking the latest opportunities in undervalued stocks based on cash flows.

- Target growth in healthcare technology by browsing innovators in medical artificial intelligence through healthcare AI stocks.

- Unlock passive income possibilities with stocks offering robust yields in dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5032

ANYCOLOR

Operates as an entertainment company in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives