Fuji Media Holdings (TSE:4676): Assessing Valuation After Buyback Launch and Upgraded Earnings Outlook

Reviewed by Simply Wall St

Fuji Media Holdings (TSE:4676) has just unveiled a major share buyback plan totaling up to 9.5% of its outstanding shares, along with an upward revision to its full-year earnings outlook. The move demonstrates a clear focus on boosting both capital efficiency and shareholder returns.

See our latest analysis for Fuji Media Holdings.

Fuji Media Holdings’ timely buyback and improved earnings outlook follow a volatile stretch for Japanese media stocks. The company’s 102.75% year-to-date share price return has been particularly eye-catching, which suggests growing confidence among investors after a tough period that included executive board changes and a rebound in core TV ad revenues. Over the longer term, a 106.44% total shareholder return over the past 12 months and robust multi-year gains highlight Fuji Media’s momentum and potential for future upside as operational improvements continue.

If news like this has you thinking about what else is on the move, now is an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

Despite the strong rally and upward earnings revision, some metrics suggest Fuji Media Holdings may not be trading at a discount. Investors must consider whether this is still a buying opportunity or if the market has already anticipated the future growth.

Price-to-Sales of 1.4x: Is it justified?

Fuji Media Holdings’ current price-to-sales ratio stands at 1.4x, putting it almost on par with the peer group average but well below its estimated fair price-to-sales ratio. Despite a rally in share price, this measure suggests the market is still assigning a modest premium.

The price-to-sales ratio reflects how much investors are willing to pay for each yen of revenue generated by the company. For a media company like Fuji Media Holdings, this is especially relevant because it indicates whether the market expects future growth or operational improvements.

As of now, Fuji Media’s 1.4x price-to-sales multiple is slightly below the peer average (1.5x), suggesting reasonable value compared to similar companies in the sector. However, when contrasted with the JP Media industry average of 0.9x, the stock appears more expensive. The estimated fair price-to-sales ratio of 2.1x implies there is still headroom if the company’s improvements translate into sustainable growth and the market could move towards this fair ratio level.

Explore the SWS fair ratio for Fuji Media Holdings

Result: Price-to-Sales of 1.4x (ABOUT RIGHT)

However, risks remain, such as the company’s recent net loss and uncertain future ad revenue trends. These factors could challenge this growth narrative.

Find out about the key risks to this Fuji Media Holdings narrative.

Another View: What Does the SWS DCF Model Say?

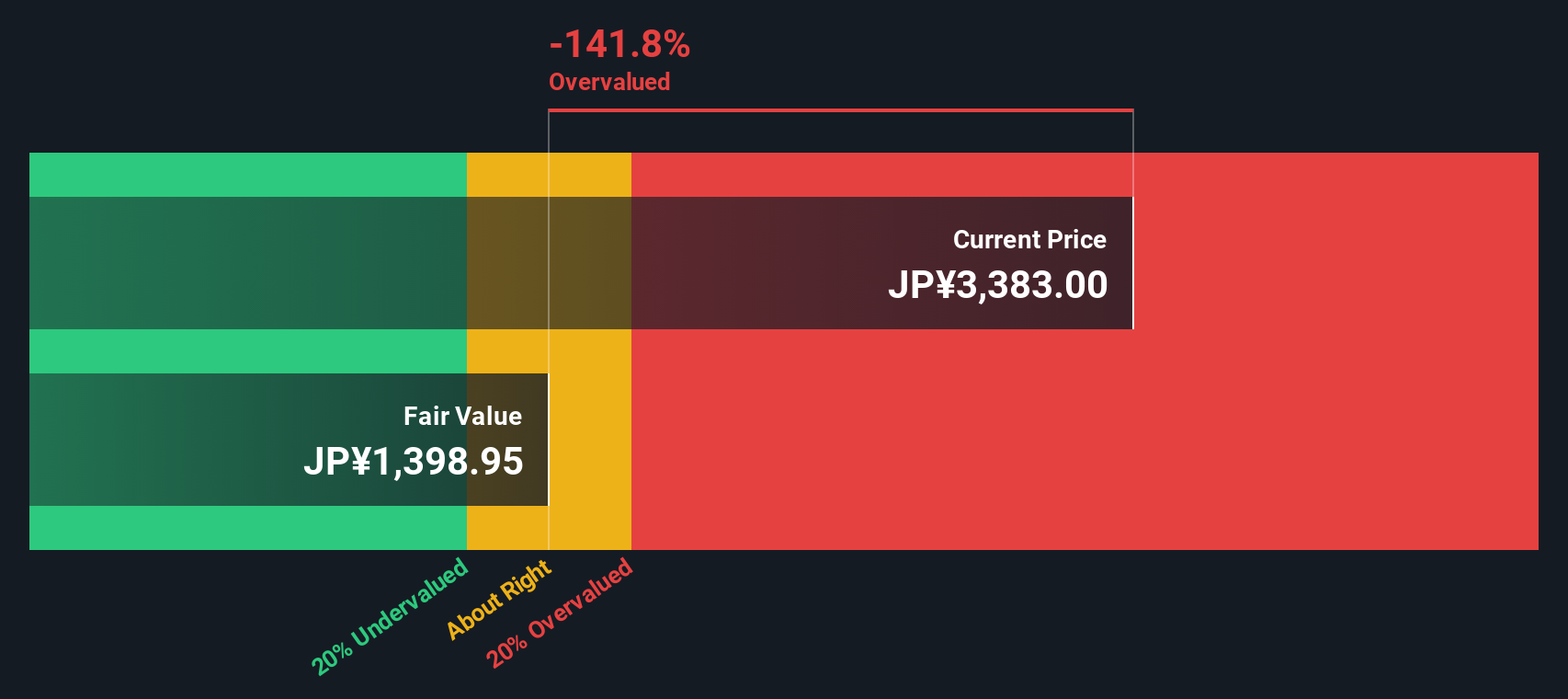

Looking at Fuji Media Holdings through the lens of our DCF model tells a more cautious story. The SWS DCF model estimates a fair value that is significantly below the current share price, suggesting the stock may be overvalued. This challenges the implications of the price-to-sales approach and highlights the potential downside risk if growth expectations are not met. Which method better captures the reality? What should investors watch for next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fuji Media Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fuji Media Holdings Narrative

If you have a different perspective on this or want to dig deeper into your own analysis, you can quickly craft your personal assessment in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Fuji Media Holdings.

Looking for More Investment Ideas?

Don’t just watch from the sidelines while new market opportunities unfold. Act now to uncover stocks that might transform your portfolio’s potential and future returns.

- Tap into the momentum of high-upside markets by checking out these 26 quantum computing stocks. Innovation is pushing boundaries in computing and beyond.

- Seize potential in healthcare’s transformation by reviewing these 30 healthcare AI stocks. Artificial intelligence is revolutionizing diagnostics, treatment, and patient care.

- Unlock stable, long-term cash flow possibilities with these 16 dividend stocks with yields > 3%. This focuses on businesses delivering consistent and attractive dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4676

Fuji Media Holdings

Through its subsidiaries, engages in the broadcasting activities in Japan.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives