INTAGE HOLDINGS (TSE:4326): One-Off Gain Drives Profit Surge, Raising Questions on Earnings Quality

Reviewed by Simply Wall St

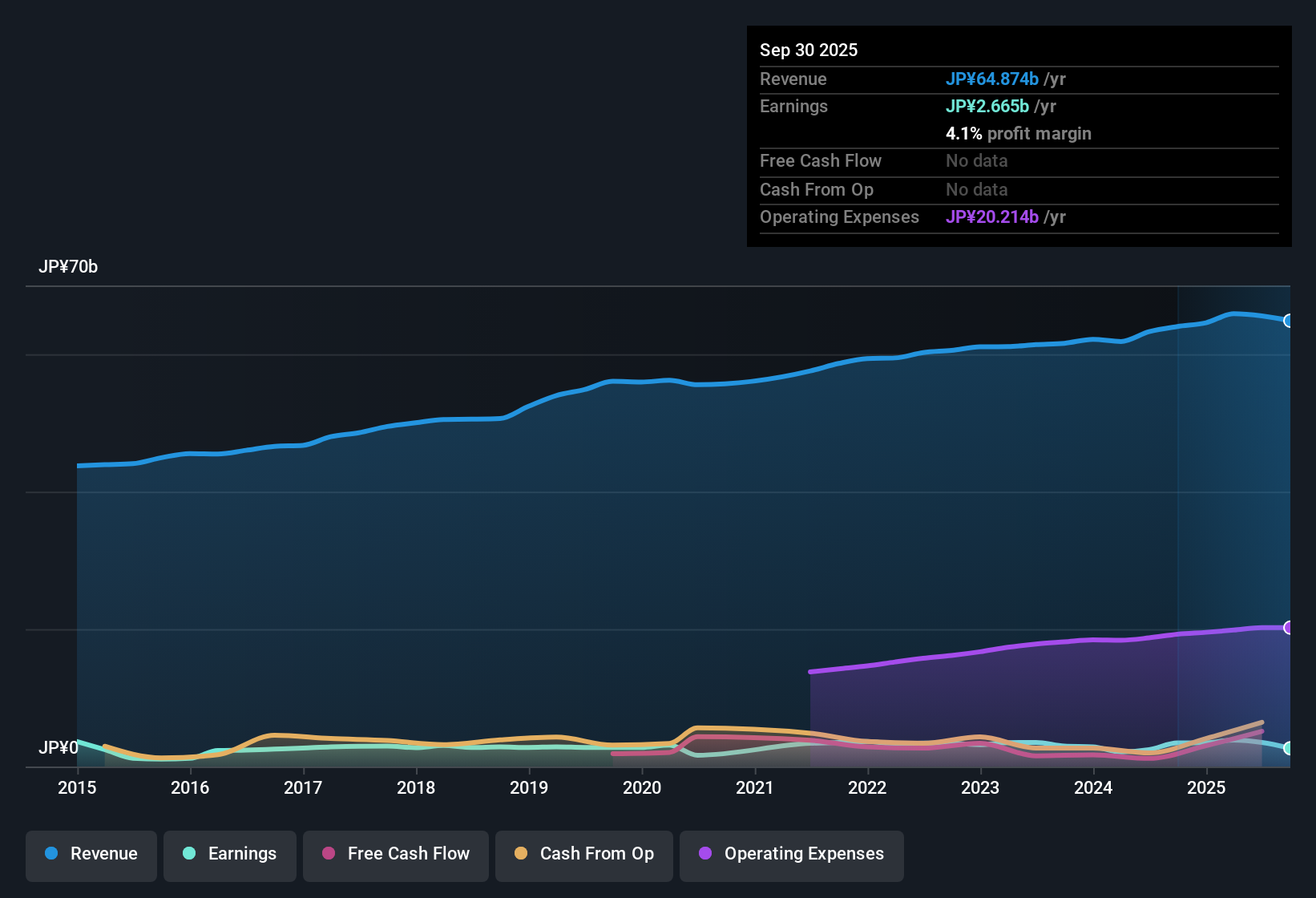

INTAGE HOLDINGS (TSE:4326) posted a net profit margin of 5.3% for the past year, an improvement from 3.9% previously. Year-over-year, earnings jumped 42.7%, reversing the company’s five-year average annual decline of 1.7%. However, results were boosted by a notable one-off gain of ¥1.1 billion, which means the headline growth figure should be viewed with caution.

See our full analysis for INTAGE HOLDINGS.Next, we’ll see how these key numbers compare to market narratives. A few perceptions could be reinforced, while others might not hold up under the latest financials.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Lifts Reported Profits

- The net profit margin improved to 5.3% from 3.9% last year. However, ¥1.1 billion of profit this period came from a one-off gain, meaning a significant portion of the reported increase is not recurring operating income.

- Recent figures highlight that reported earnings surged by 42.7% year-over-year, directly boosting profitability. Prevailing market analysis notes that this headline jump contrasts with the company's five-year track record, which shows profits declining at an average of 1.7% annually.

- This situation suggests that bullish narratives relying solely on this year's increase may be overlooking the outsized impact of non-recurring items on profit growth quality.

- Investors should weigh the headline jump against the longer-term trend, as relying too much on one-off boosts could leave growth expectations vulnerable next year.

Valuation at a Discount vs Peers, but Above Sector

- INTAGE HOLDINGS trades on a Price-To-Earnings (P/E) ratio of 18.4x, below its direct peer average of 25.4x, but still slightly higher than the broader Japanese Media industry’s 17.1x level.

- The market's prevailing view is that INTAGE appears attractively priced compared to similar companies, which supports its appeal for value-minded investors. However, the firm is not the cheapest option in the entire sector.

- The data-driven narrative points to a fair-value gap, as the company’s current share price of ¥1,685 is well below the calculated DCF fair value of ¥3,618.73.

- This discount suggests potential upside if profitability remains steady, but the relatively higher P/E compared to the broader industry may reflect ongoing concerns around sustainable earnings momentum.

Five-Year Profit Slide Counters Headline Growth

- Despite dramatic improvement in the most recent year, profits across the past five years have declined at an average annual rate of 1.7%. This trend contrasts with this year's surge and raises questions about the repeatability of such growth.

- Prevailing market analysis points out that while this rebound is encouraging, investors should remain aware of the multi-year downtrend.

- The prominence of the one-off gain this year puts added pressure on the company to deliver genuine improvements in future results rather than rely on non-recurring income.

- For long-term holdings, a turnaround in this five-year trend will be important for shifting skeptical or sideline sentiment into sustained support.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on INTAGE HOLDINGS's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

INTAGE HOLDINGS’ recent profit surge is largely due to a one-off gain. Over the longer term, earnings have trended downward and growth remains inconsistent.

For those who value companies with reliable earnings progression, check out stable growth stocks screener (2080 results) to discover businesses with proven track records of steady growth and fewer surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4326

INTAGE HOLDINGS

Operates as a marketing research company in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives