Dentsu Group (TSE:4324): Assessing Valuation Following Launch of Sports & Entertainment Division in India

Reviewed by Simply Wall St

Dentsu Group (TSE:4324) has unveiled its new Sports & Entertainment division in India, in line with its global expansion strategy. This move combines fresh leadership and local expertise, with a focus on reaching younger, digitally savvy audiences through cultural engagement.

See our latest analysis for Dentsu Group.

Dentsu Group’s recent launch of its Sports & Entertainment division in India comes amid a year marked by shifting sentiment, with the share price showing a 3.5% gain over the last 90 days, yet a steep 16.7% decline year-to-date. However, the bigger picture is even more telling: a five-year total shareholder return of 15.3% contrasts sharply with a one-year total return of -32.8%. This suggests momentum still has some catching up to do, even as the company invests heavily for future growth.

If this kind of bold repositioning sparks your curiosity, now is a great moment to see what else is possible and discover fast growing stocks with high insider ownership

With the stock down sharply this year despite bold international moves, investors must ask whether Dentsu’s current valuation underestimates future growth or if the market has already considered all the upside potential.

Most Popular Narrative: Fairly Valued

The narrative-driven fair value for Dentsu Group aligns almost exactly with the last close price, suggesting analysts see recent moves largely reflected in current levels. The stage is set for bold shifts as the company transforms its business model and global footprint. But what’s fueling that forecasted recovery?

“Dentsu's stepped-up internal investment in data, technology, and AI-driven platforms is expected to strengthen its offering in high-growth digital advertising and data-driven marketing, expanding its addressable market and supporting long-term revenue growth and client retention. The company's continued expansion into sports, entertainment, and content-driven services (such as Dentsu Anime Solutions) targets fast-growing consumer and brand verticals, potentially providing new, higher-margin revenue streams and earnings growth beyond traditional advertising.”

What’s the one number behind this fair value? Most investors are betting on a turnaround built on ambitious profit margin expansion and future earnings growth. The full narrative exposes the key quantitative drivers analysts are aiming for. Find out what’s powering the recalibration and why it matters right now.

Result: Fair Value of ¥3,070 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Dentsu's international divisions and ongoing industry disruption could quickly unravel even the most carefully constructed recovery narrative.

Find out about the key risks to this Dentsu Group narrative.

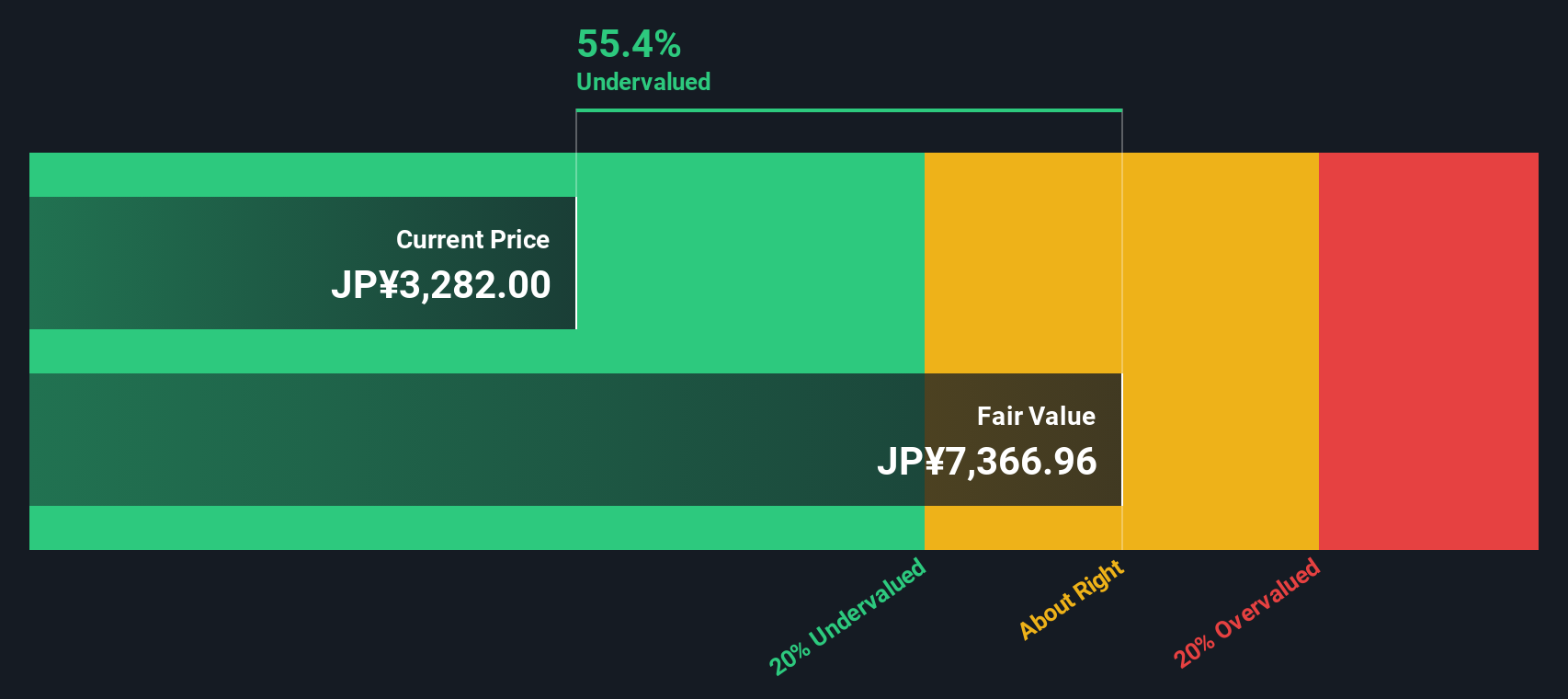

Another View: Discounted Cash Flow Signals Undervaluation

While most analysts peg Dentsu as fairly valued based on current market multiples, our SWS DCF model paints a very different picture. It suggests Dentsu shares could be trading at 57% below fair value, which may indicate a significant discount. Can the company’s future earnings really bridge such a gap, or is the market identifying real risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dentsu Group Narrative

If you see the story differently or want to dig into the numbers firsthand, you can craft your own narrative in just minutes with Do it your way

A great starting point for your Dentsu Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to seize the next big opportunity? The right screener can point you to stocks with hidden upside that others overlook. Explore these hand-picked strategies and unlock fresh possibilities before the crowd catches on:

- Boost your portfolio's income by targeting quality companies among these 17 dividend stocks with yields > 3%, returning over 3% yields right now.

- Find tomorrow’s breakthroughs and shape your growth strategy with these 27 quantum computing stocks, paving the way in quantum computing technology.

- Ride the AI momentum and position yourself ahead of trends by selecting from these 24 AI penny stocks, making major moves in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4324

Dentsu Group

Operates in the advertising business in Japan, the Americas, Europe, the Middle East and Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives