VALUE GOLF Inc.'s (TSE:3931) 27% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, VALUE GOLF Inc. (TSE:3931) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 60%.

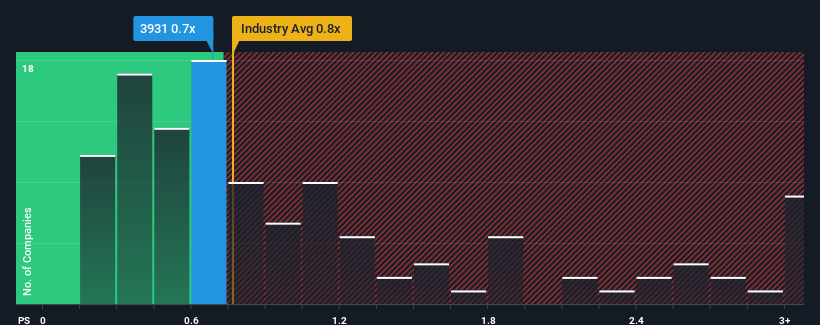

Even after such a large jump in price, there still wouldn't be many who think VALUE GOLF's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Japan's Media industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for VALUE GOLF

What Does VALUE GOLF's P/S Mean For Shareholders?

The revenue growth achieved at VALUE GOLF over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on VALUE GOLF will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for VALUE GOLF, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is VALUE GOLF's Revenue Growth Trending?

In order to justify its P/S ratio, VALUE GOLF would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. However, this wasn't enough as the latest three year period has seen an unpleasant 3.6% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 60% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that VALUE GOLF's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What We Can Learn From VALUE GOLF's P/S?

Its shares have lifted substantially and now VALUE GOLF's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at VALUE GOLF revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

There are also other vital risk factors to consider and we've discovered 5 warning signs for VALUE GOLF (2 are significant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3931

VALUE GOLF

Operates golf, travel, and advertising media production business in Japan.

Adequate balance sheet slight.

Market Insights

Community Narratives