- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A336370

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

Amid global trade tensions and the recent imposition of higher-than-expected tariffs by the U.S., Asian markets have been navigating a challenging landscape, with key indices experiencing notable declines. In this environment, identifying high-growth tech stocks in Asia requires a focus on companies that demonstrate resilience through innovation and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.15% | ★★★★★★ |

| Zhongji Innolight | 28.16% | 28.04% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 20.52% | 25.50% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Solus Advanced Materials (KOSE:A336370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Solus Advanced Materials Co., Ltd. is a company that offers materials and solutions across South Korea, Europe, and other international markets with a market capitalization of approximately ₩562.28 billion.

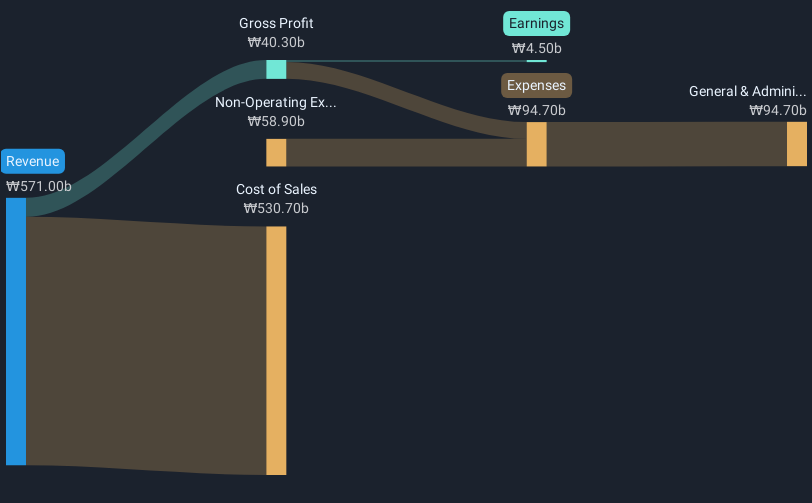

Operations: Solus Advanced Materials generates revenue primarily from its Copper Foil/Battery Foil Sector, contributing ₩444.57 billion, and the Advanced Materials Division, which adds ₩131.24 billion.

Solus Advanced Materials has shown promising growth, with revenue projected to increase by 18.3% annually, outpacing the Korean market's average of 7.3%. Despite its current unprofitability and a highly volatile share price over the past three months, earnings are expected to surge by approximately 74.67% per year. The company recently reported a significant turnaround in its financial results for the year ended December 31, 2024, with sales rising to KRW 571 billion from KRW 429.4 billion the previous year and net income improving dramatically to KRW 4.5 billion from a net loss of KRW 187.5 billion. These developments suggest robust internal improvements and potential for future profitability despite some challenges in debt coverage by operating cash flow.

- Unlock comprehensive insights into our analysis of Solus Advanced Materials stock in this health report.

Understand Solus Advanced Materials' track record by examining our Past report.

IG Port (TSE:3791)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IG Port, Inc. is an animation production company operating in Japan and internationally with a market capitalization of ¥37.09 billion.

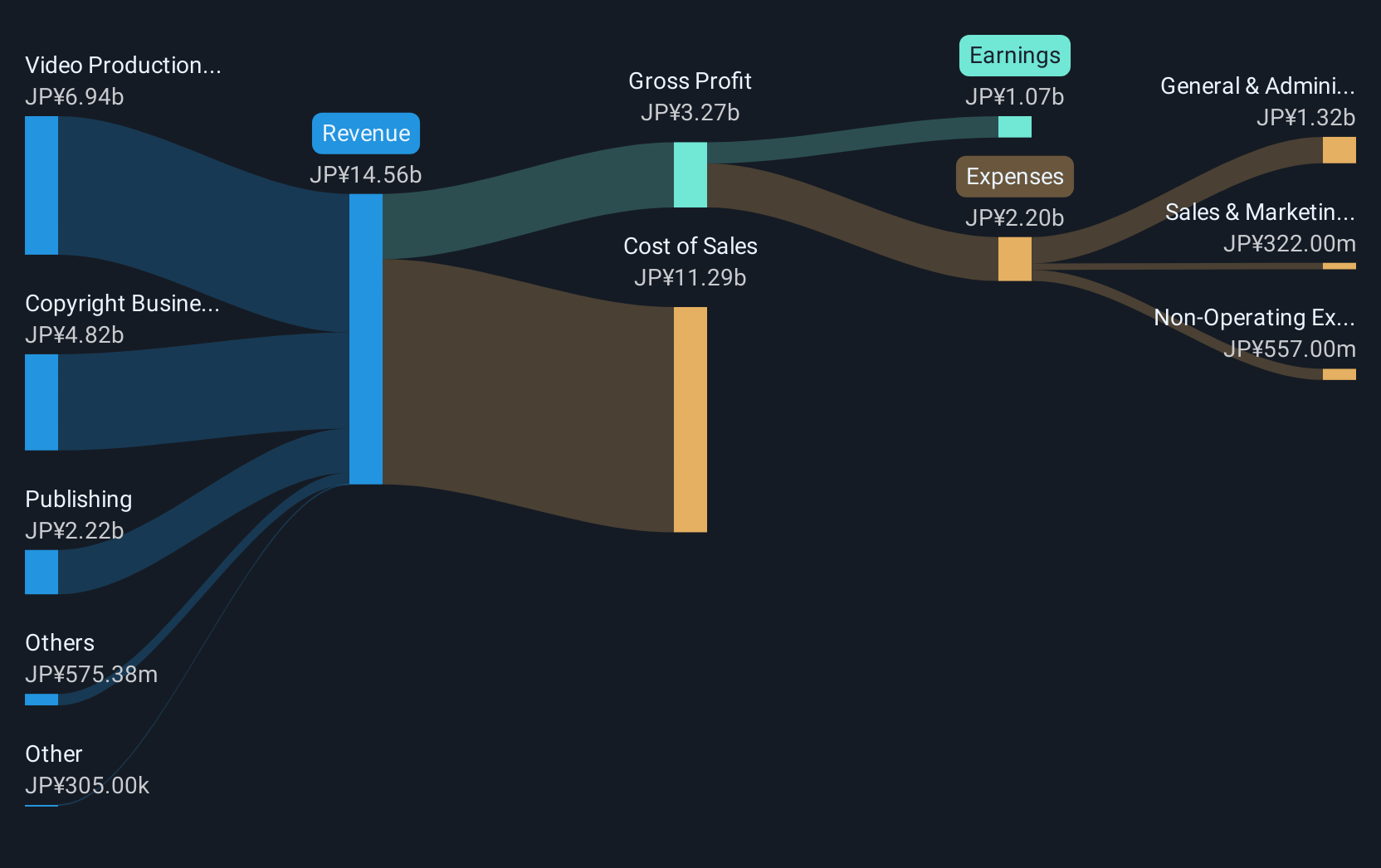

Operations: The company generates revenue primarily from video production, publishing, and copyright business, with video production contributing the largest share at ¥6.72 billion. The publishing segment follows with ¥2.28 billion in revenue, while the copyright business adds ¥4.79 billion to the overall revenue stream.

IG Port stands out in the Asian tech landscape, with its earnings growth surpassing the Japanese market's average. The company's annual earnings are expected to increase by 24.6%, significantly higher than Japan's general market growth of 7.8%. This performance is bolstered by a robust revenue uptick at 6.4% annually, outpacing the national rate of 4.3%. Notably, IG Port has also demonstrated a commitment to innovation and future readiness through substantial investments in R&D, aligning expenditure closely with revenue increases to maintain competitive advantage and foster continuous improvement in its offerings. These strategic moves underscore IG Port’s potential for sustained growth amidst a rapidly evolving technological sector.

- Click here to discover the nuances of IG Port with our detailed analytical health report.

Assess IG Port's past performance with our detailed historical performance reports.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market capitalization of approximately ¥189.86 billion.

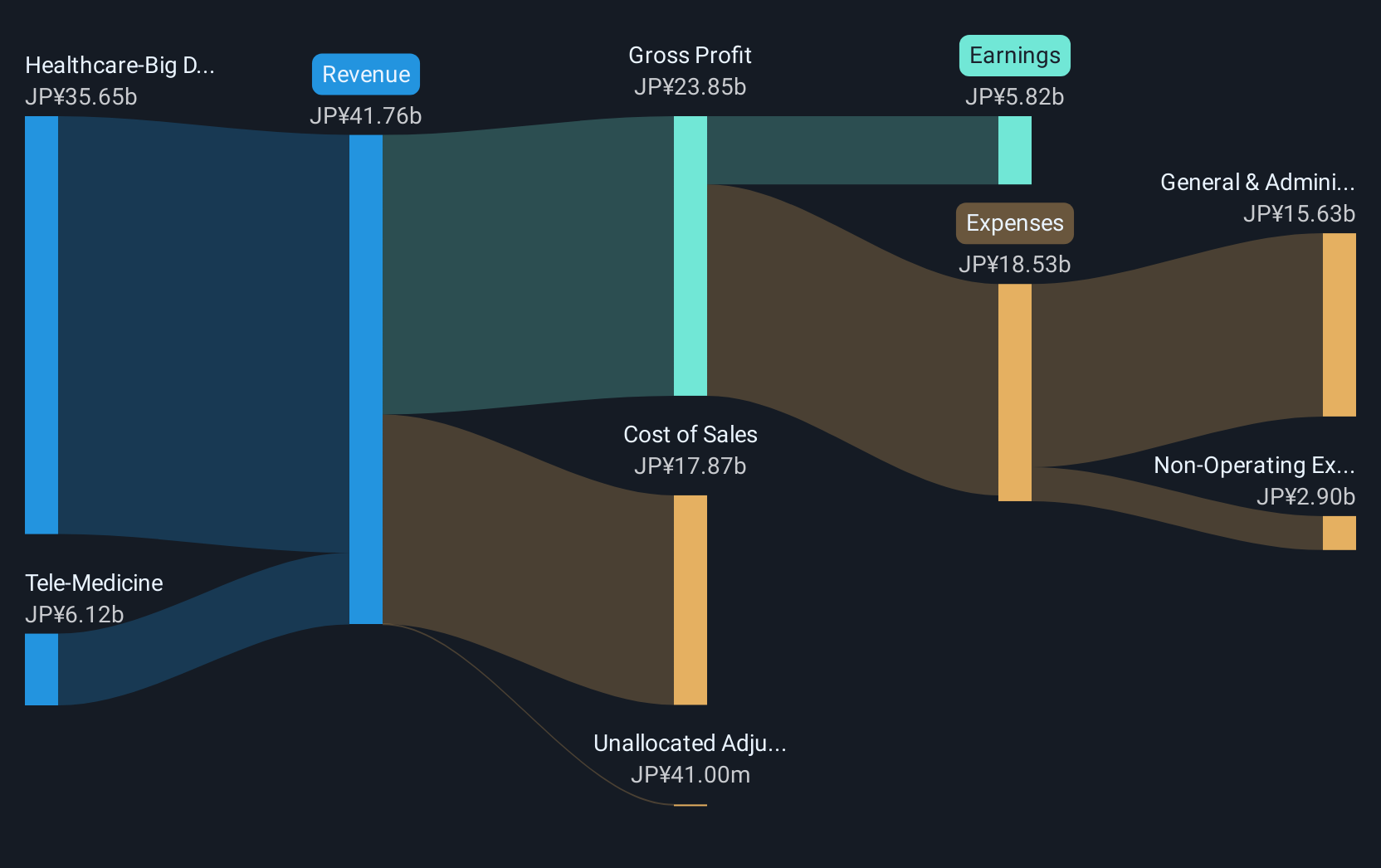

Operations: The company generates revenue primarily through its Healthcare-Big Data segment, which accounts for ¥33.44 billion, followed by Tele-Medicine at ¥6.04 billion and Pharmacy Support at ¥1.28 billion.

JMDC's trajectory in the high-growth tech sector in Asia is marked by its robust revenue and earnings growth forecasts, outstripping broader market averages with an anticipated annual revenue increase of 15.3% and earnings growth of 24.8%. Despite a challenging past year with earnings contraction of 19.6%, the company's focus on innovation is evident from its alignment of R&D expenditures, ensuring continued adaptation and competitiveness in dynamic markets. Moreover, JMDC's recent declaration of a ¥14.0 cash dividend underscores its commitment to shareholder returns amidst these expansive growth strategies. This blend of aggressive financial targets coupled with strategic reinvestments positions JMDC intriguingly for future prospects within the tech landscape.

- Take a closer look at JMDC's potential here in our health report.

Evaluate JMDC's historical performance by accessing our past performance report.

Summing It All Up

- Click this link to deep-dive into the 493 companies within our Asian High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A336370

Solus Advanced Materials

Provides materials and solutions in South Korea, Europe, and internationally.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives