- Japan

- /

- Entertainment

- /

- TSE:3659

Taking Stock of NEXON (TSE:3659): Examining Valuation After Recent Momentum

Reviewed by Simply Wall St

It is not every day that a stock like NEXON (TSE:3659) draws attention without a headline-grabbing event, but sometimes these quiet periods are the best moments to take stock, so to speak. While there may not be a dramatic trigger, the recent movement in NEXON’s share price is still raising eyebrows and prompting investors to revisit its fundamentals. When a company moves this much without a clear news catalyst, it can be a good opportunity to pause and ask whether the current valuation tells the real story, or if the market is simply in a holding pattern, waiting for the next spark of news.

Zooming out, NEXON’s shares have actually shown steady momentum over the past year, with a 27% gain that tracks above Japan’s broader markets. Short-term action has been even more lively, up 13% over the past month and nearly 29% in the past 3 months, a pace outpacing many of its peers. A look at the annual and three-year figures reveals NEXON has quietly outperformed more volatile stocks while keeping revenue and net income growth steady. With numbers like these, it is no surprise that investors are pondering the stock’s next move and whether its recent gains signal the market is warming up to its growth prospects.

But with the year’s jump in share price, investors now have to decide: is NEXON still undervalued, or are today’s prices already building in all of the future growth?

Most Popular Narrative: 11.1% Overvalued

According to the most widely followed narrative, NEXON is considered overvalued at current prices, despite consensus that the business itself may be set for moderate improvement in the coming years.

"Intense investment in live-service games, frequent content updates, and global marketing are currently boosting user engagement and revenues, but also driving up recurring expenses (royalties, platform fees, creator payments, and marketing), which could pressure net margins as incremental returns diminish."

Curious what’s really driving NEXON’s lofty valuation? Analysts are banking on a future financial mix that most companies can only dream of: strong growth from both old and new titles, but with margins tightening as expansion meets new challenges. Want to know whose forecasts shape this price target? The underlying growth assumptions might surprise you.

Result: Fair Value of ¥3,066.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if NEXON’s global expansion delivers stronger-than-expected engagement or if core franchises see a revival, the overvaluation argument could quickly unwind.

Find out about the key risks to this NEXON narrative.Another View: The DCF Model Tells a Different Story

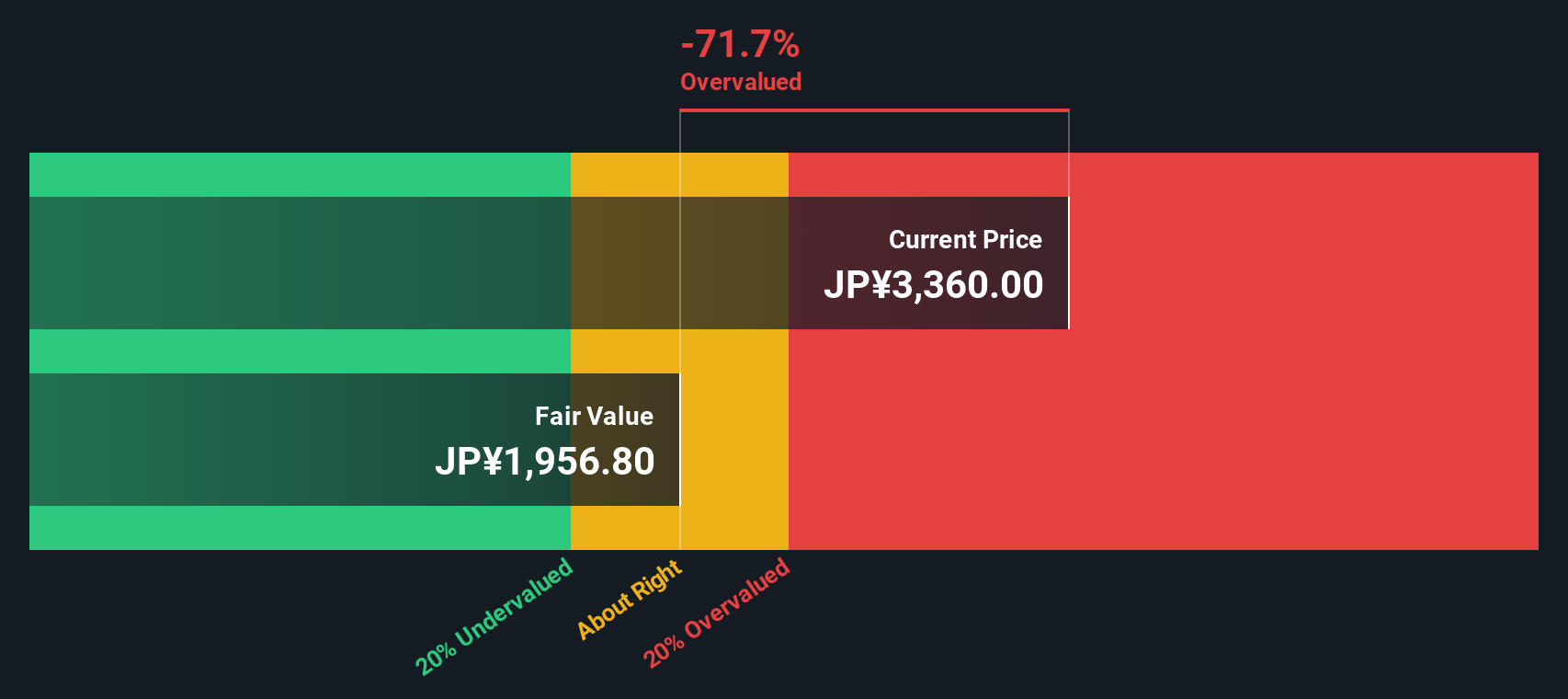

Looking through the lens of our SWS DCF model, NEXON's valuation appears even less attractive and suggests the shares may be above what fundamentals alone would justify. Is the market pricing in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NEXON Narrative

If you see things differently or want to put your own view to the test, it only takes a few minutes to build your own perspective on NEXON’s outlook. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NEXON.

Looking for More Smart Investment Opportunities?

Make your next investing move count by using the screener to spot high-potential stocks that others might miss. With so many paths to wealth, you do not want to sit this one out.

- Uncover companies using artificial intelligence to shape tomorrow’s industries by checking out AI penny stocks.

- Capture growth potential by targeting quality businesses trading below cash-flow value in undervalued stocks based on cash flows.

- Zero in on stocks offering reliable income and attractive yields with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:3659

NEXON

Produces, develops, distributes, and services PC online and mobile games in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives