- Japan

- /

- Entertainment

- /

- TSE:3635

Koei Tecmo (TSE:3635): Assessing Valuation After Major Earnings Guidance Upgrade for FY2026

Reviewed by Simply Wall St

Koei Tecmo Holdings (TSE:3635) just issued a substantial increase to its earnings guidance for the fiscal year ending March 2026, raising projections for net sales, operating profit, and profit attributable to owners. This update is likely to draw fresh attention from investors.

See our latest analysis for Koei Tecmo Holdings.

Koei Tecmo Holdings has caught fresh momentum this year after the sharp upgrade to its earnings guidance, pushing its latest share price to ¥2,080.5. While the 1-year total shareholder return stands at a standout 35.9%, recent short-term share price gains suggest investor optimism is building on improved profit expectations, even though there has been more modest performance over the past three years.

If Koei Tecmo’s surge piqued your interest, this is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Koei Tecmo's shares rallying on upgraded guidance and optimism running high, investors now face the crucial question: Is the current price reflecting all this good news, or does an undervalued opportunity remain for future growth?

Price-to-Earnings of 19.8x: Is it justified?

Koei Tecmo Holdings currently trades at a price-to-earnings (P/E) ratio of 19.8x, which is lower than both its industry peers and fair value benchmarks. With the last close at ¥2,080.5, this signals potential undervaluation relative to comparable entertainment companies in Japan.

The price-to-earnings ratio measures how much investors are willing to pay now for every ¥1 of earnings the company generates. This metric is especially relevant for entertainment sector stocks, where future profit visibility can fluctuate and often commands a premium.

The company’s 19.8x P/E is below the Japanese Entertainment industry average of 21.6x as well as the peer average of 26.9x. Compared to the estimated fair P/E ratio of 25.2x, Koei Tecmo shares could be attractively priced should the market re-rate its future profits upwards.

Explore the SWS fair ratio for Koei Tecmo Holdings

Result: Price-to-Earnings of 19.8x (UNDERVALUED)

However, slower-than-expected revenue growth or unexpected market volatility could pose challenges to the current optimism and affect Koei Tecmo’s valuation in the future.

Find out about the key risks to this Koei Tecmo Holdings narrative.

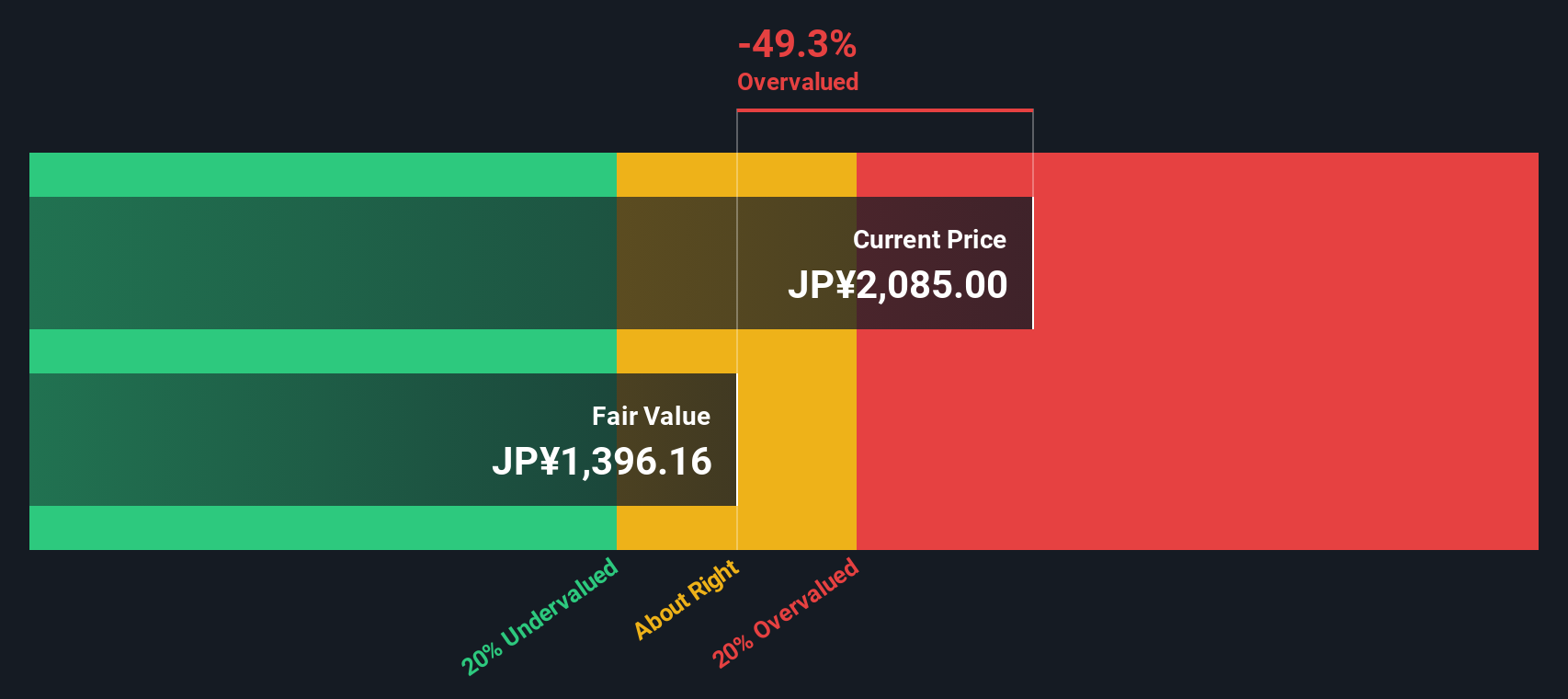

Another View: Discounted Cash Flow Gives a Different Signal

While the current price-to-earnings ratio presents Koei Tecmo Holdings as undervalued when compared to peers and industry norms, our DCF model provides a different perspective. According to this cash flow-based valuation, the shares are trading well above their estimated fair value of ¥1,412.23, which raises questions about future upside potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koei Tecmo Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koei Tecmo Holdings Narrative

If you see things differently or prefer to explore the numbers yourself, you can craft your own analysis in just a few minutes: Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Koei Tecmo Holdings.

Ready to Expand Your Portfolio?

Go beyond Koei Tecmo Holdings and tap into new opportunities using our powerful screener. The market moves fast, so don’t let the next winning idea pass you by!

- Uncover income potential by tapping into these 22 dividend stocks with yields > 3%, which offer yields above 3% and reliable payout histories.

- Catch the AI trend early by checking out these 26 AI penny stocks, companies poised to shape industries with advances in machine learning and automation.

- Capitalize on future breakthroughs by seeking out these 28 quantum computing stocks, those pushing the boundaries of quantum computing and technological innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koei Tecmo Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3635

Koei Tecmo Holdings

Operates as an entertainment company in Japan, North America, Europe, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives