- Japan

- /

- Interactive Media and Services

- /

- TSE:3491

Exploring High Growth Tech Stocks In February 2025

Reviewed by Simply Wall St

In February 2025, global markets are navigating a complex landscape marked by U.S. tariff uncertainties and mixed economic indicators, with key indices like the S&P 500 experiencing slight declines amid robust earnings reports. As investors assess these dynamics, identifying high-growth tech stocks requires a focus on companies that can demonstrate resilience and adaptability in the face of evolving trade policies and economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Banijay Group (ENXTAM:BNJ)

Simply Wall St Growth Rating: ★★★★★☆

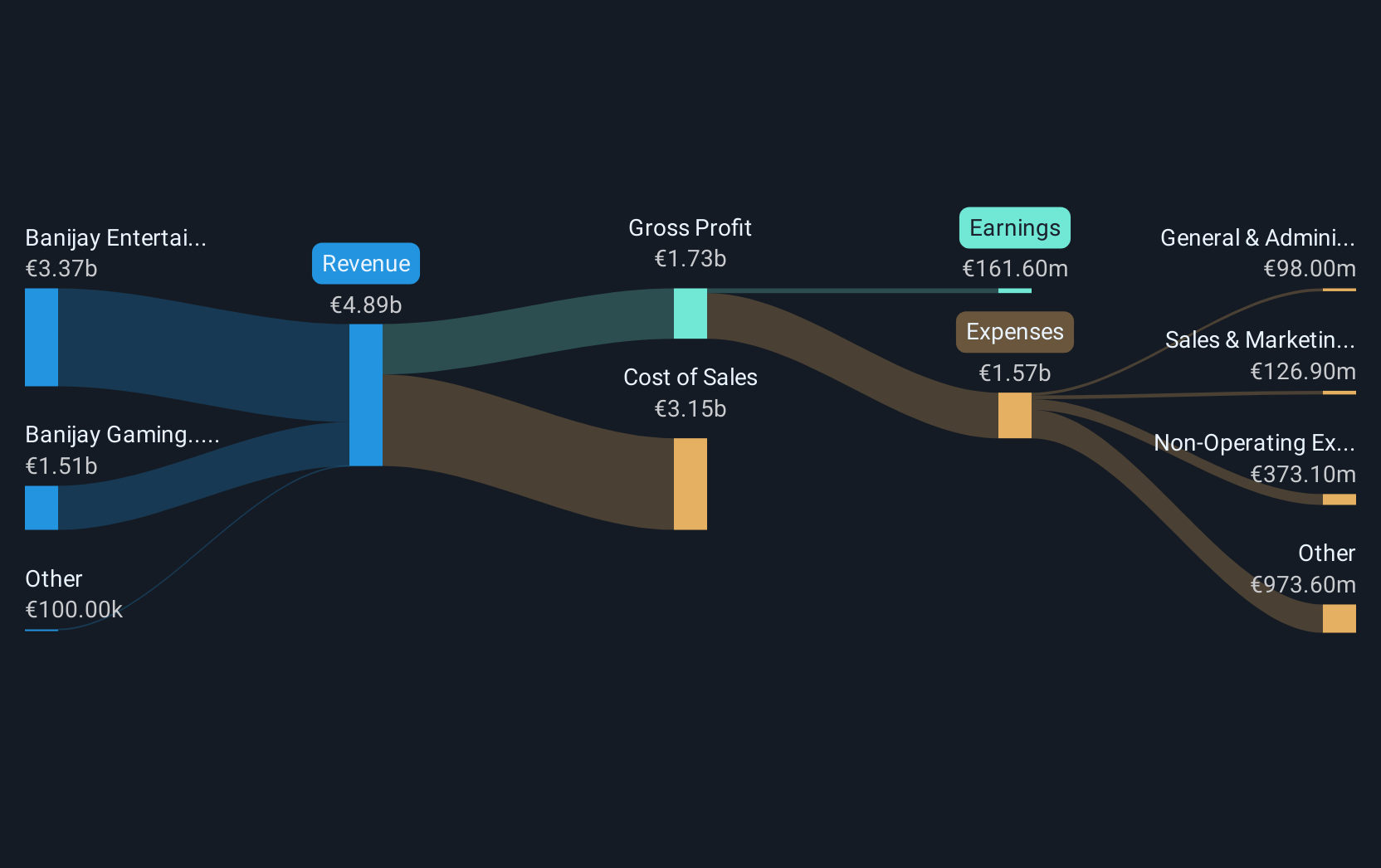

Overview: Banijay Group N.V. operates in content production, distribution, online sports betting, and gaming across the USA, Europe, and internationally with a market cap of €3.36 billion.

Operations: The company generates revenue primarily from two segments: Banijay Entertainment & Banijay Live, which contributes €3.26 billion, and Banijay Gaming, contributing €1.32 billion.

Banijay Group N.V., with its impressive earnings growth of 38.1% per year, is outpacing the Dutch market's average of 13.3%. This surge is underpinned by a staggering past year earnings increase of 931.6%, significantly ahead of the entertainment industry's growth rate of 21.6%. Despite challenges like a substantial one-off loss of €65 million affecting last year's financials, Banijay’s strategic focus on innovative content production continues to pay dividends, as evidenced by their robust forecast return on equity at an anticipated 78.9% in three years. Their commitment to R&D and adaptation in a dynamic media landscape ensures they remain competitive, even though their revenue growth at 8.9% per year slightly lags behind high-growth benchmarks but still exceeds the broader Dutch market projection of 7.9%.

GA technologies (TSE:3491)

Simply Wall St Growth Rating: ★★★★★☆

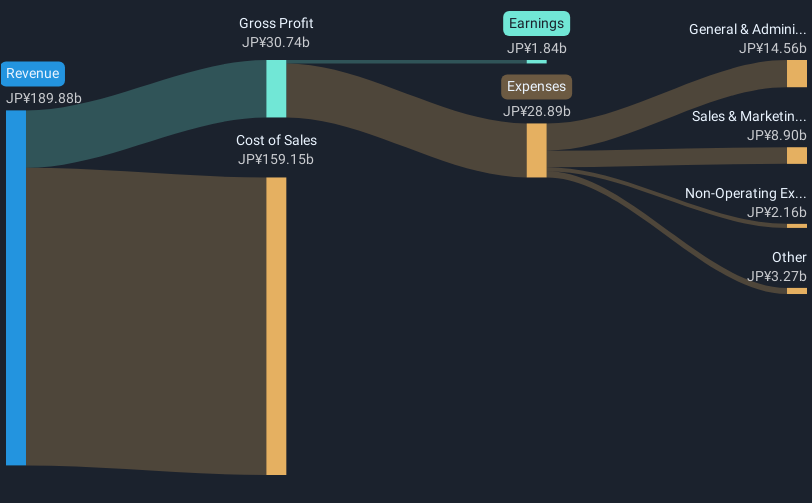

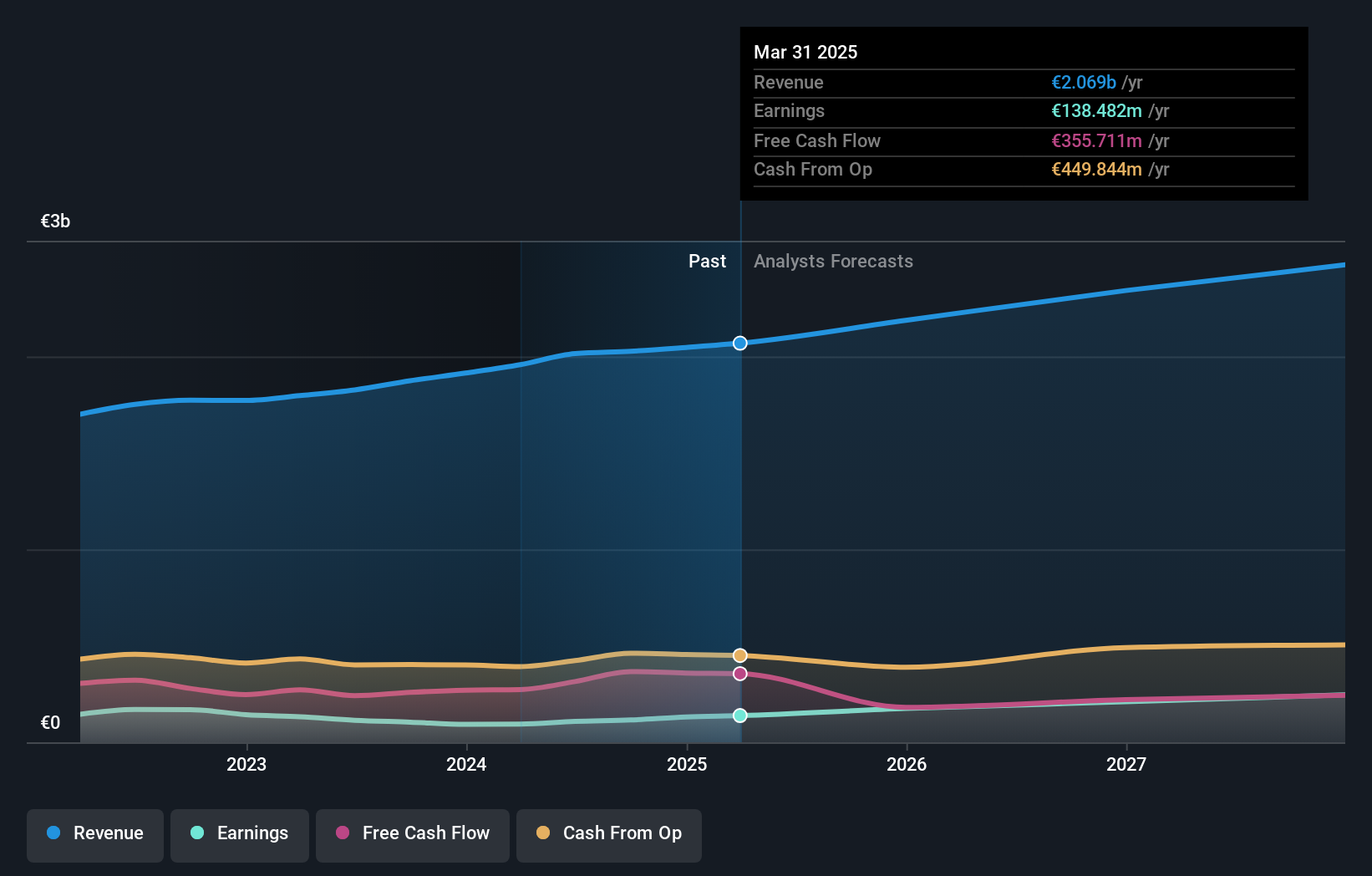

Overview: GA technologies Co., Ltd. operates a real estate brokerage platform and has a market cap of ¥45.77 billion.

Operations: The company generates revenue primarily through its real estate brokerage platform. It focuses on facilitating property transactions, offering related services that contribute to its revenue streams.

GA Technologies is distinguishing itself in the tech-driven real estate sector with its RENOSY platform, which has recently expanded into the U.S. market, signaling robust growth prospects. This strategic move complements its impressive annual revenue growth of 25.3% and earnings surge of 54.4%, outpacing the broader Japanese market significantly. The company's commitment to innovation is evident in its R&D spending trends, which have consistently aligned with expanding service offerings like RENOSY's new cross-border investment opportunities. These developments not only enhance GA Technologies' service portfolio but also position it well for sustained growth in a competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of GA technologies.

Gain insights into GA technologies' historical performance by reviewing our past performance report.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA is a company that offers out-of-home media and online advertising solutions both in Germany and internationally, with a market capitalization of approximately €3.14 billion.

Operations: Ströer SE & Co. KGaA generates revenue primarily from its Out-Of-Home Media segment (€942 million) and Digital & Dialog Media segment (€867 million), supplemented by Daas & E-Commerce (€352 million).

Ströer SE & Co. KGaA, navigating the dynamic media landscape, is poised for significant growth with a forecasted earnings increase of 27.2% annually, outstripping Germany's market average of 19.3%. This growth trajectory is supported by a robust revenue uptick at 6.4% per year, also ahead of the national curve. The company's strategic pivot includes potential divestiture discussions for its advertising and digital content divisions, reflecting a proactive approach in optimizing its asset portfolio amidst evolving industry demands. With R&D expenses marking substantial investment to fuel innovation and competitiveness, Ströer demonstrates a clear commitment to maintaining its market relevance and driving future profitability.

- Click to explore a detailed breakdown of our findings in Ströer SE KGaA's health report.

Examine Ströer SE KGaA's past performance report to understand how it has performed in the past.

Summing It All Up

- Delve into our full catalog of 1212 High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3491

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives