- Japan

- /

- Entertainment

- /

- TSE:2432

There's Reason For Concern Over DeNA Co., Ltd.'s (TSE:2432) Massive 38% Price Jump

Despite an already strong run, DeNA Co., Ltd. (TSE:2432) shares have been powering on, with a gain of 38% in the last thirty days. The last 30 days bring the annual gain to a very sharp 65%.

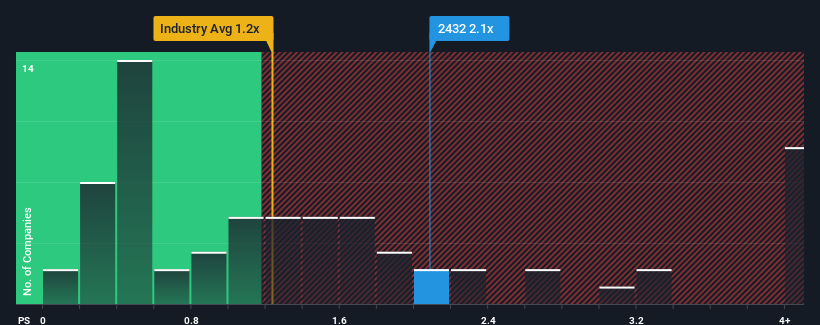

After such a large jump in price, when almost half of the companies in Japan's Entertainment industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider DeNA as a stock probably not worth researching with its 2.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for DeNA

What Does DeNA's P/S Mean For Shareholders?

There hasn't been much to differentiate DeNA's and the industry's retreating revenue lately. One possibility is that the P/S ratio is high because investors think the company can turn things around and break free from the broader downward trend in revenue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on DeNA will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For DeNA?

In order to justify its P/S ratio, DeNA would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.0%. As a result, revenue from three years ago have also fallen 3.2% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 2.9% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% each year, which is noticeably more attractive.

With this information, we find it concerning that DeNA is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On DeNA's P/S

DeNA shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see DeNA trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about this 1 warning sign we've spotted with DeNA.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2432

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives