- Japan

- /

- Interactive Media and Services

- /

- TSE:2371

What Kakaku.com (TSE:2371)'s Move Into en Inc.'s Engage Business Means For Shareholders

Reviewed by Sasha Jovanovic

- On December 17, 2025, Kakaku.com’s board approved entering into a basic agreement concerning the “engage” business operated by en Inc., marking a potential shift in its service portfolio.

- This move suggests Kakaku.com is exploring deeper exposure to employment-related digital services, which could influence how investors view its growth mix and risk profile.

- We’ll now examine how Kakaku.com’s basic agreement around en Inc.’s engage business could reshape the company’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kakaku.com Investment Narrative Recap

To own Kakaku.com, you need to believe its core comparison and restaurant platforms can keep monetizing strong user bases while newer services eventually add diversification rather than drag on margins. The basic agreement around en Inc.’s engage business does not yet change the key near term catalyst, which remains execution in Kyujin Box, or the biggest risk, that sustained losses in newer job related services could further compress profitability.

The most relevant recent announcement here is management’s guidance for FY ending March 31, 2026, targeting revenue of ¥92,000 million and operating profit of ¥28,000 million. Those numbers implicitly assume the core businesses continue to fund investment in areas like Kyujin Box and potential new employment related services, which makes any incremental commitment to engage important when you think about how much earnings pressure the group can comfortably absorb before sentiment weakens.

Yet, investors should also be aware that continued losses in newer job related services could...

Read the full narrative on Kakaku.com (it's free!)

Kakaku.com's narrative projects ¥123.8 billion revenue and ¥28.9 billion earnings by 2028. This requires 14.4% yearly revenue growth and about a ¥8.7 billion earnings increase from ¥20.2 billion today.

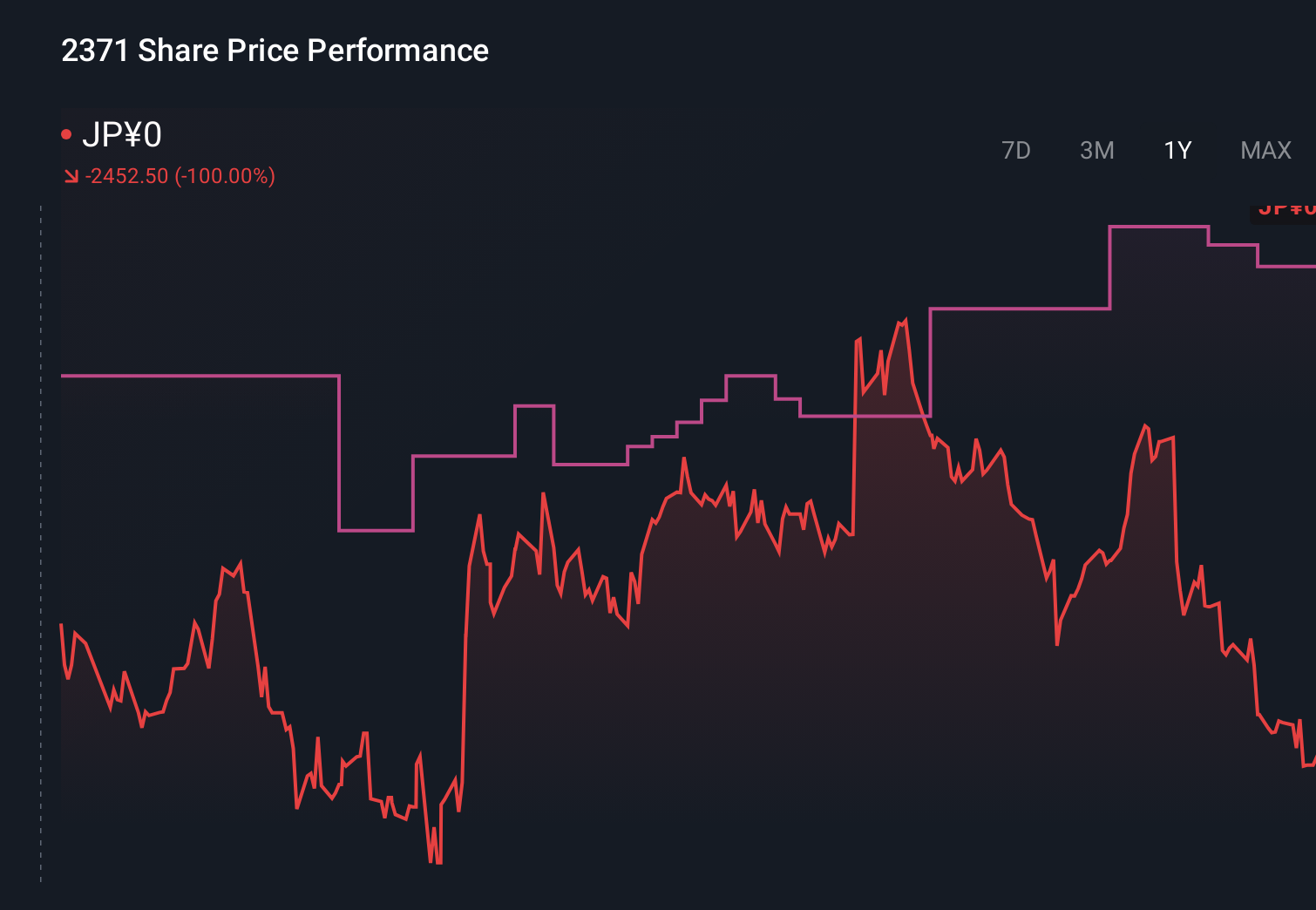

Uncover how Kakaku.com's forecasts yield a ¥3035 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently see Kakaku.com’s fair value between ¥2,650 and ¥3,149 per share, well above the recent market price. You can set those views against concerns that high spending on fast growing but loss making businesses may pressure margins and decide which risk and reward balance feels more realistic for you.

Explore 3 other fair value estimates on Kakaku.com - why the stock might be worth just ¥2650!

Build Your Own Kakaku.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kakaku.com research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kakaku.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kakaku.com's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kakaku.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2371

Kakaku.com

Provides purchase support, restaurant review, and other services in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion