- Japan

- /

- Interactive Media and Services

- /

- TSE:2148

ITmedia (TSE:2148) Margin Decline Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

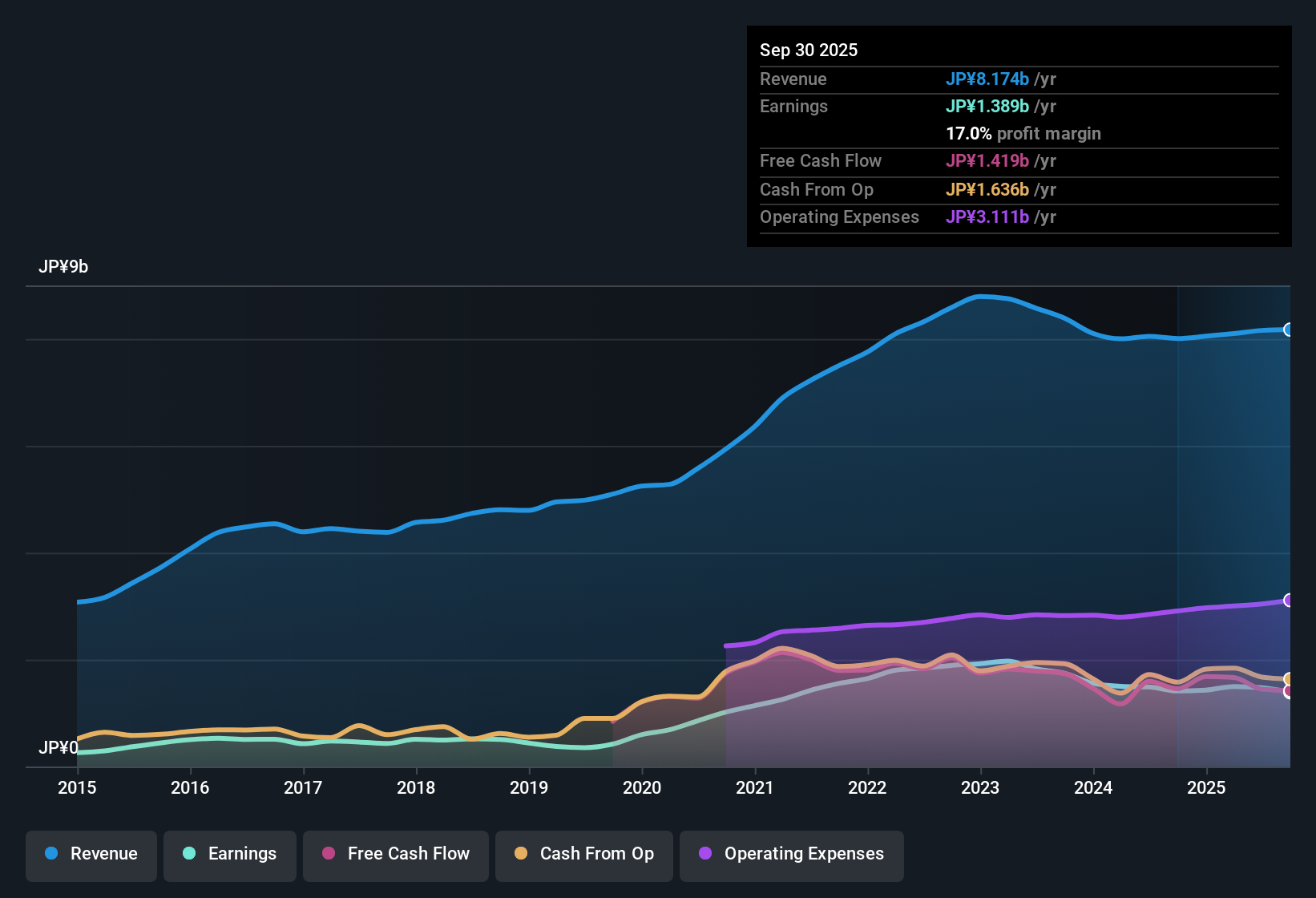

ITmedia (TSE:2148) posted a mixed set of earnings, with net profit margins slipping from 17.6% to 17%. The latest year showed negative earnings growth, even as earnings grew at an average rate of 1.5% per year over the past five years. Looking forward, revenue is projected to grow at 8% per annum and earnings are expected to rise by 12.1% each year. Both figures are anticipated to outpace the Japanese market, though investors may view the dip in margins with caution.

See our full analysis for ITmedia.Now that the headline numbers are out, let's see how the results measure up against the stories and expectations that drive sentiment around ITmedia.

Curious how numbers become stories that shape markets? Explore Community Narratives

Growth Projections Outpace Market Norms

- ITmedia is forecasting revenue growth of 8% per year and earnings growth of 12.1% annually. Both figures are well ahead of the Japanese market’s projected 4.5% and 7.8% rates.

- The prevailing market view sees the company’s upbeat forecasts as a strong draw for growth-focused investors, yet emphasizes two points for balance:

- Sustained forecasted growth indicates ITmedia is positioned as a sector outperformer, particularly since broader market expectations are more modest.

- However, negative earnings growth in the most recent period highlights that not all momentum is translating into current period results. This underlines the need to watch future execution.

Premium Valuation Versus Industry and Peers

- Shares trade at a price-to-earnings ratio of 22.4, compared to the interactive media and services industry average of 21.5 and peer average of 20.1. The current share price (¥1,604) is 40% above the company’s DCF fair value estimate (¥1,141.36).

- The prevailing market view highlights tension for value-oriented investors and points to these factors:

- The sizeable premium to DCF fair value suggests much of the anticipated growth is already reflected in today’s price, increasing the risk if forecasts stumble.

- While robust industry-wide digital transformation bolsters sector optimism, valuation metrics indicate less margin of safety compared to sector and peer averages.

Profit Margins Stay Solid, Yet Slip Modestly

- Net profit margins have edged down from 17.6% to 17%, reflecting a minor contraction rather than a sharp drop in profitability.

- The prevailing market view focuses on how ITmedia’s margins, while still healthy, could shape future sentiment:

- High profit margins support the assessment of “quality earnings,” providing some reassurance for those prioritizing stability, even as recent earnings dipped.

- Any sustained declines would be closely watched, especially since current investor optimism depends in part on continued margin strength.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ITmedia's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite robust forecasts and premium valuations, ITmedia posted negative earnings growth this year. There is caution over whether its high expectations are already priced in.

If you’re looking for companies with more attractive entry points and less valuation risk, target solid opportunities in these 831 undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2148

ITmedia

Engages in the development and operation of Internet-only media providing information on various topics in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives