- Japan

- /

- Interactive Media and Services

- /

- TSE:2120

LIFULL Co.,Ltd.'s (TSE:2120) 25% Dip In Price Shows Sentiment Is Matching Revenues

LIFULL Co.,Ltd. (TSE:2120) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

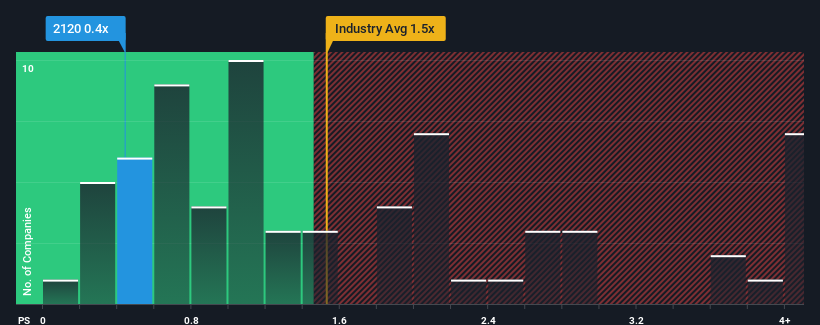

After such a large drop in price, given about half the companies operating in Japan's Interactive Media and Services industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider LIFULLLtd as an attractive investment with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for LIFULLLtd

How Has LIFULLLtd Performed Recently?

LIFULLLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think LIFULLLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For LIFULLLtd?

The only time you'd be truly comfortable seeing a P/S as low as LIFULLLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 6.1% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 1.6% over the next year. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

With this in consideration, its clear as to why LIFULLLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

LIFULLLtd's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of LIFULLLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for LIFULLLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2120

LIFULLLtd

Provides real estate information services in Japan and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives