Three Days Left To Buy GMO AD Partners Inc. (TYO:4784) Before The Ex-Dividend Date

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that GMO AD Partners Inc. (TYO:4784) is about to go ex-dividend in just three days. If you purchase the stock on or after the 29th of December, you won't be eligible to receive this dividend, when it is paid on the 25th of March.

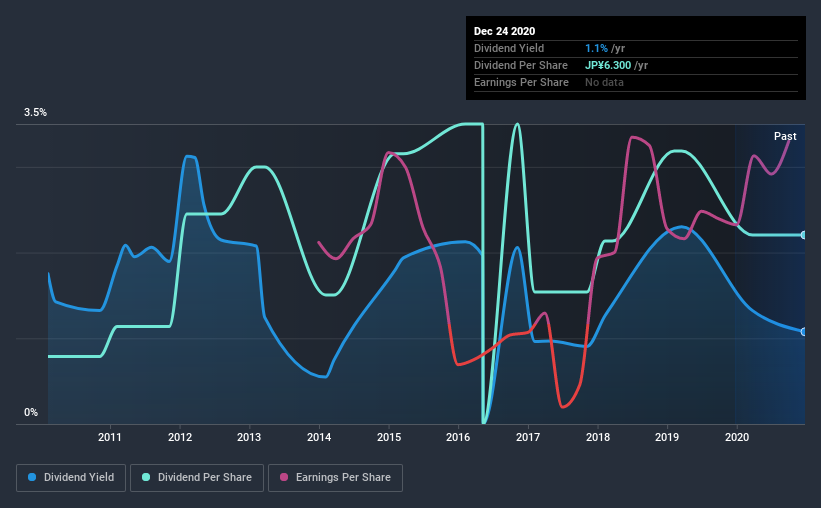

GMO AD Partners's next dividend payment will be JP¥12.80 per share, which looks like a nice increase on last year, when the company distributed a total of JP¥6.30 to shareholders. If you buy this business for its dividend, you should have an idea of whether GMO AD Partners's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for GMO AD Partners

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately GMO AD Partners's payout ratio is modest, at just 27% of profit. A useful secondary check can be to evaluate whether GMO AD Partners generated enough free cash flow to afford its dividend. The company paid out 107% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want look more closely here.

GMO AD Partners does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

GMO AD Partners paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were GMO AD Partners to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit GMO AD Partners paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That explains why we're not overly excited about GMO AD Partners's flat earnings over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share. Earnings have been growing somewhat, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. GMO AD Partners has delivered 11% dividend growth per year on average over the past 10 years.

The Bottom Line

Is GMO AD Partners worth buying for its dividend? Earnings per share have barely grown in this time, and although GMO AD Partners is paying out a low percentage of its profit, its dividend was not well covered by free cash flow. It's not common to see a company paying out a limited amount of its profits yet a substantially higher percentage of its cash flow, so we'd flag this as a concern. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

So if you want to do more digging on GMO AD Partners, you'll find it worthwhile knowing the risks that this stock faces. For example - GMO AD Partners has 3 warning signs we think you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading GMO AD Partners or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:4784

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026