As global markets navigate a landscape marked by fluctuating consumer sentiment and geopolitical shifts, Asian markets have shown resilience, with Chinese stocks gaining traction amid easing trade tensions. In this environment, dividend stocks offer a compelling opportunity for investors seeking stable income streams; these stocks can provide consistent returns even when broader market conditions are uncertain.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| NCD (TSE:4783) | 4.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.87% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.87% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.39% | ★★★★★★ |

Click here to see the full list of 1017 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Qingdao Hiron Commercial Cold Chain (SHSE:603187)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Hiron Commercial Cold Chain Co., Ltd. operates in the commercial refrigeration industry, specializing in the production and sale of cold chain equipment, with a market cap of approximately CN¥5.97 billion.

Operations: Qingdao Hiron Commercial Cold Chain Co., Ltd. generates revenue primarily from its Food Service Equipment segment, amounting to CN¥3.15 billion.

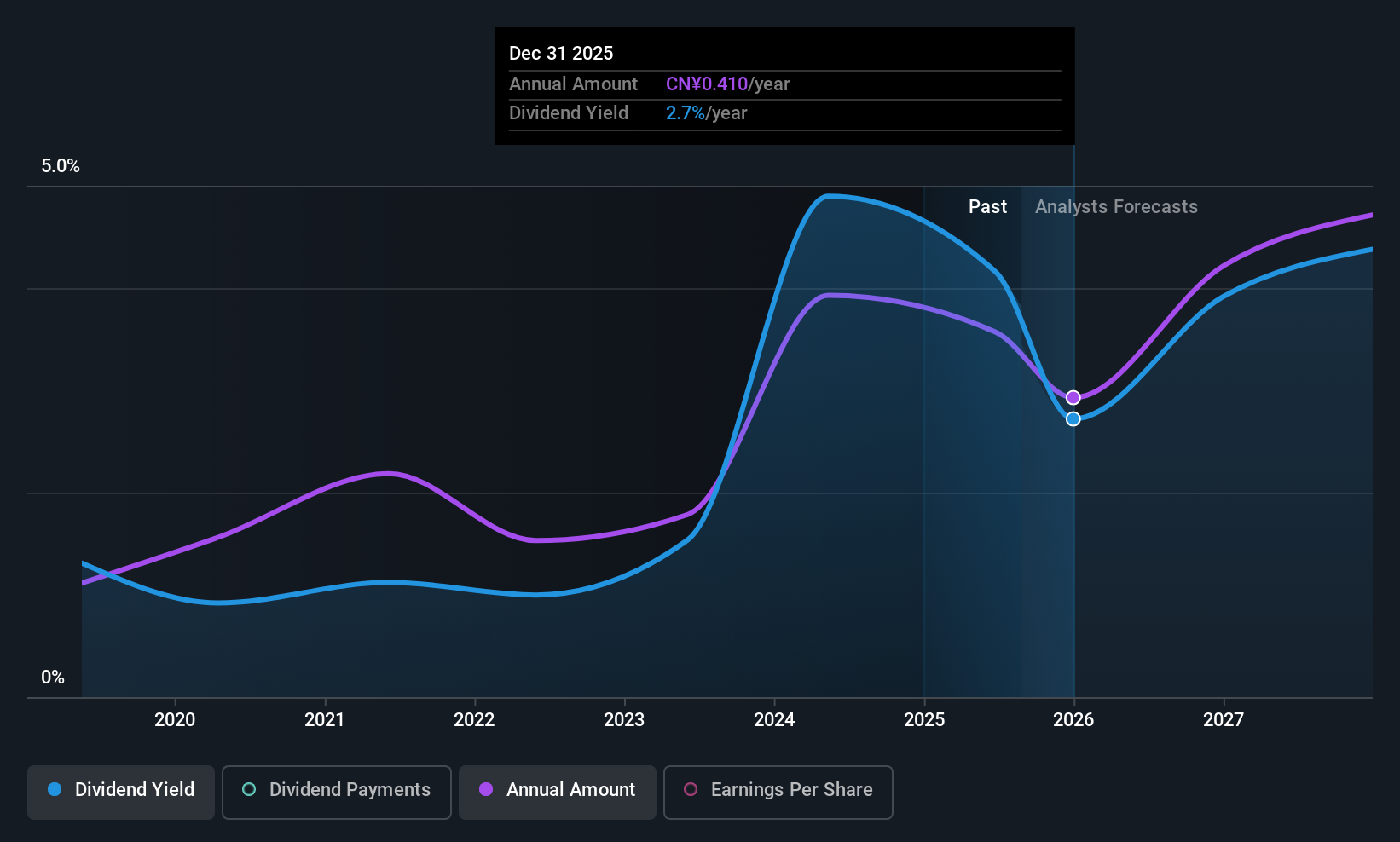

Dividend Yield: 3.2%

Qingdao Hiron Commercial Cold Chain offers a dividend yield of 3.24%, placing it in the top 25% of CN market payers. Despite its attractive payout ratio of 50%, indicating dividends are covered by earnings, its track record is unstable with less than a decade of payments and volatility over time. Recent financials show improved performance, with revenue rising to CNY 2.43 billion for the first nine months of 2025, suggesting potential for future growth if stability is achieved.

- Get an in-depth perspective on Qingdao Hiron Commercial Cold Chain's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Qingdao Hiron Commercial Cold Chain shares in the market.

Hokuriku Electric IndustryLtd (TSE:6989)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hokuriku Electric Industry Co., Ltd. develops, manufactures, and sells electronic components both in Japan and internationally, with a market cap of ¥19.81 billion.

Operations: Hokuriku Electric Industry Co., Ltd. generates its revenue through the development, manufacturing, and sale of electronic components across domestic and international markets.

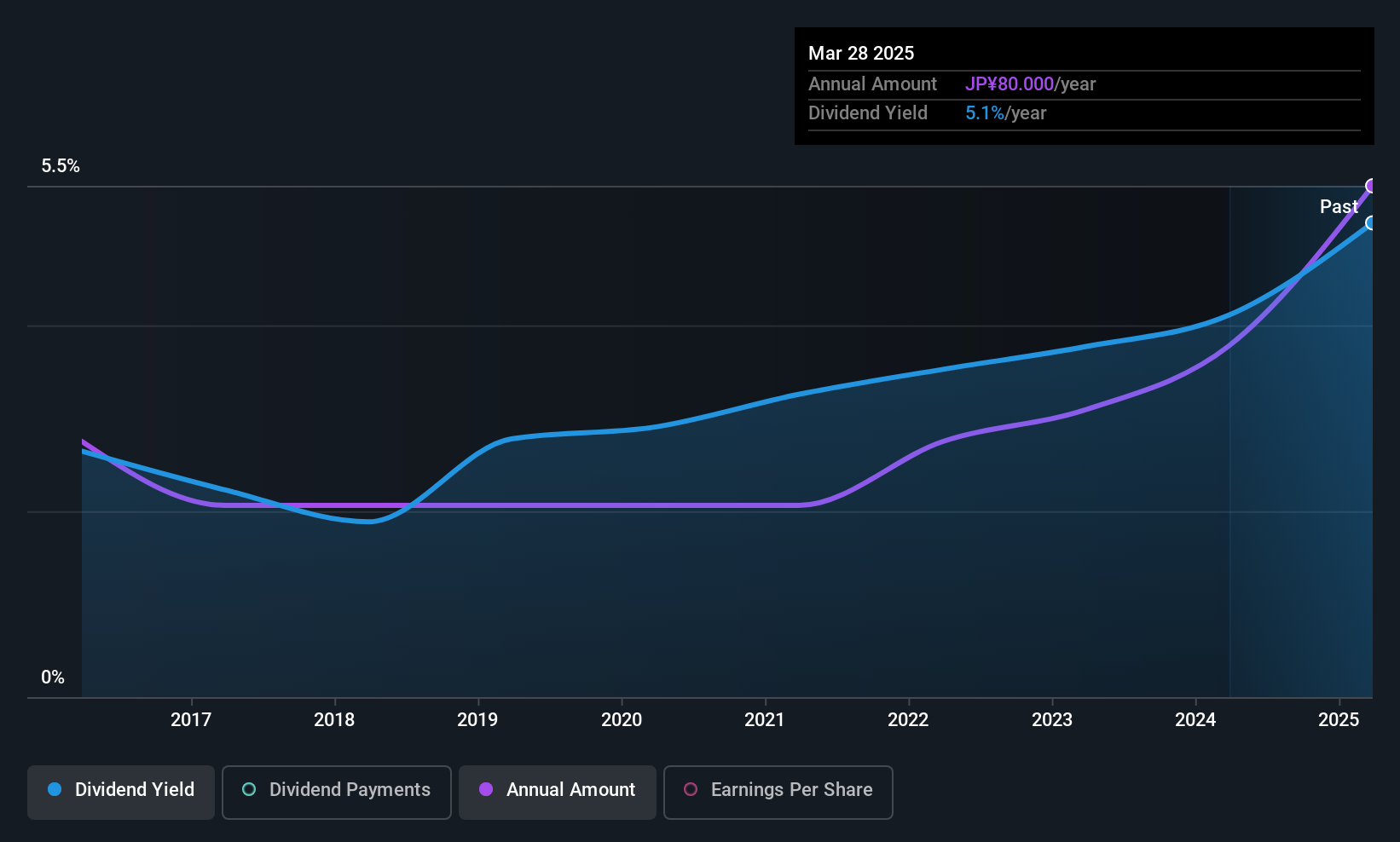

Dividend Yield: 3.6%

Hokuriku Electric Industry Ltd. trades at 63% below its estimated fair value, with a dividend yield of 3.56%, slightly under the top tier in Japan. Its dividends are well covered by earnings and cash flows, with payout ratios of 29% and 22.7%, respectively. However, the dividend has been volatile over the past decade despite recent growth in payments and earnings rising by 36.4% last year, indicating potential but unreliable stability.

- Delve into the full analysis dividend report here for a deeper understanding of Hokuriku Electric IndustryLtd.

- Our valuation report unveils the possibility Hokuriku Electric IndustryLtd's shares may be trading at a discount.

JSP (TSE:7942)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JSP Corporation manufactures and sells expanded polymers globally, with a market cap of ¥55.82 billion.

Operations: JSP Corporation's revenue segments include Bead Business at ¥74.56 billion and Extrusion Business at ¥38.42 billion.

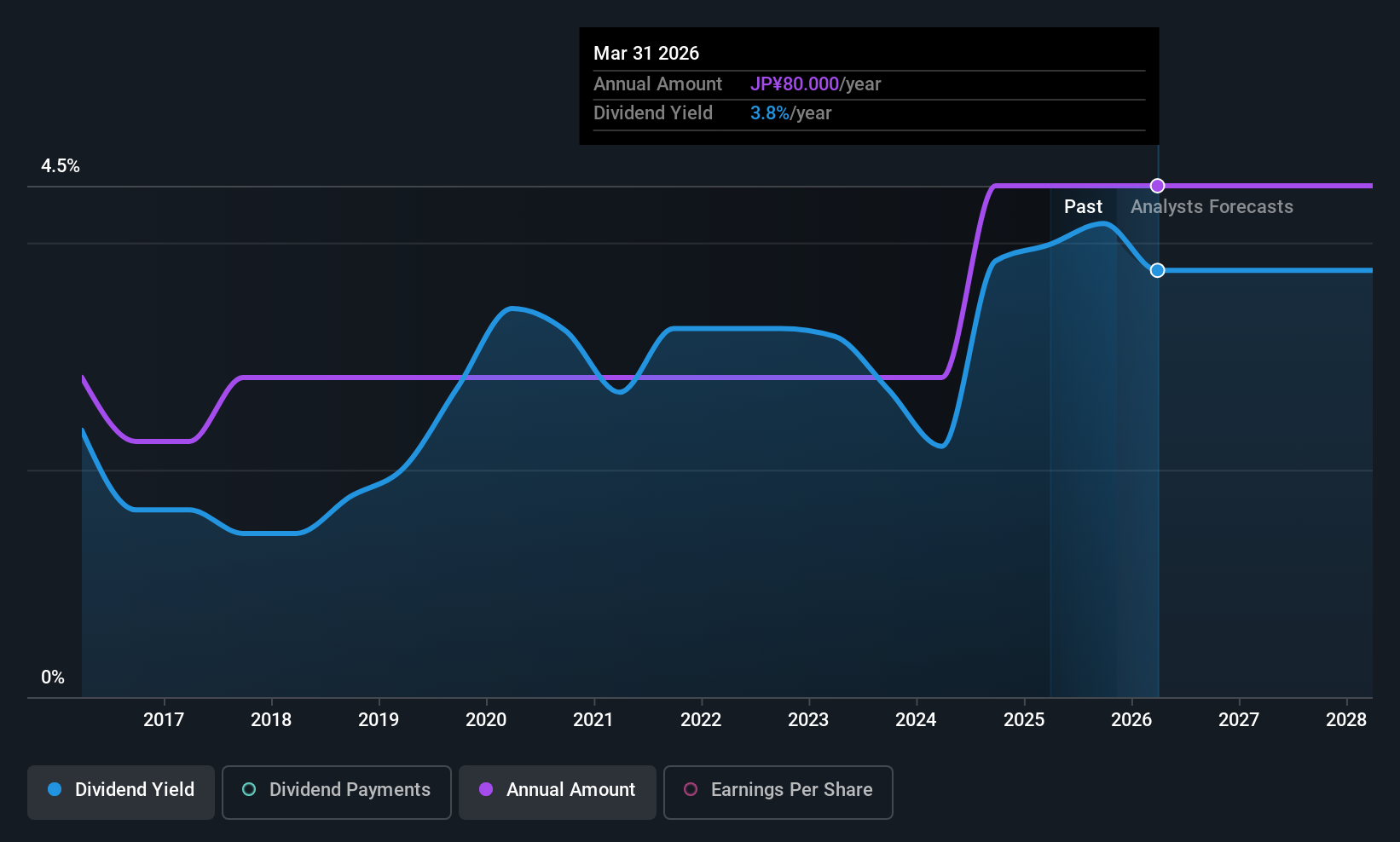

Dividend Yield: 3.8%

JSP Corporation's dividend yield of 3.76% ranks in the top 25% of Japanese dividend payers, yet its dividends are not well covered by free cash flows, with a high cash payout ratio of 192%. Despite a low earnings payout ratio of 19.6%, indicating coverage by earnings, the dividends have been volatile over the past decade. Recent guidance forecasts net sales of ¥142 billion and operating profit of ¥6 billion for FY2026, with a confirmed dividend payment scheduled for December 4, 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of JSP.

- Our expertly prepared valuation report JSP implies its share price may be lower than expected.

Next Steps

- Dive into all 1017 of the Top Asian Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Hiron Commercial Cold Chain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603187

Qingdao Hiron Commercial Cold Chain

Qingdao Hiron Commercial Cold Chain Co., Ltd.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives