Nitto Denko (TSE:6988): Assessing Valuation After Upgraded Earnings Outlook and Dividend Increase

Reviewed by Simply Wall St

Nitto Denko (TSE:6988) caught investors’ attention after the company boosted its full-year earnings outlook and announced a dividend increase for the upcoming quarter. These moves indicate stronger profit expectations and a commitment to rewarding shareholders.

See our latest analysis for Nitto Denko.

Nitto Denko's upbeat earnings outlook and higher dividend have helped fuel strong momentum in its shares, with a 15.6% 1-month share price return and an eye-catching 70.2% total return over the past year. After such a rapid rise, both short-term and long-term performance highlight growing enthusiasm from investors.

If Nitto Denko’s surge has you on the lookout for more exciting moves, now is an ideal time to broaden your horizons and discover fast growing stocks with high insider ownership

With such strong momentum and upgraded guidance, is Nitto Denko’s elevated share price justified by fundamentals? Or has the market already accounted for all future growth, leaving limited upside for new investors?

Price-to-Earnings of 20.7: Is it justified?

Nitto Denko is currently valued with a price-to-earnings (P/E) ratio of 20.7, marginally higher than both its direct peers and the wider sector. With the last close price at ¥4068, the stock trades at a notable premium to industry norms and its own historical valuation multiples.

The price-to-earnings ratio measures how much investors are willing to pay today for a company’s current and future earnings. For a diversified chemical business like Nitto Denko, it represents what the market expects for future growth and profitability.

Right now, the company's P/E of 20.7 exceeds the Japanese Chemicals industry average of 13.5 and even comes in just above its peer group average of 20.3. This suggests expectations for stronger or more durable earnings growth. When compared to the estimated Fair P/E Ratio of 19.9, the market appears to be pricing in optimism that could fade if forecasts disappoint. If sentiment shifts, the share price could be pulled toward this fair level, which is now seen as a reasonable anchor for valuation.

Explore the SWS fair ratio for Nitto Denko

Result: Price-to-Earnings of 20.7 (OVERVALUED)

However, any slowdown in revenue or earnings growth, or a reversal in recent momentum, could quickly challenge the company's elevated market expectations.

Find out about the key risks to this Nitto Denko narrative.

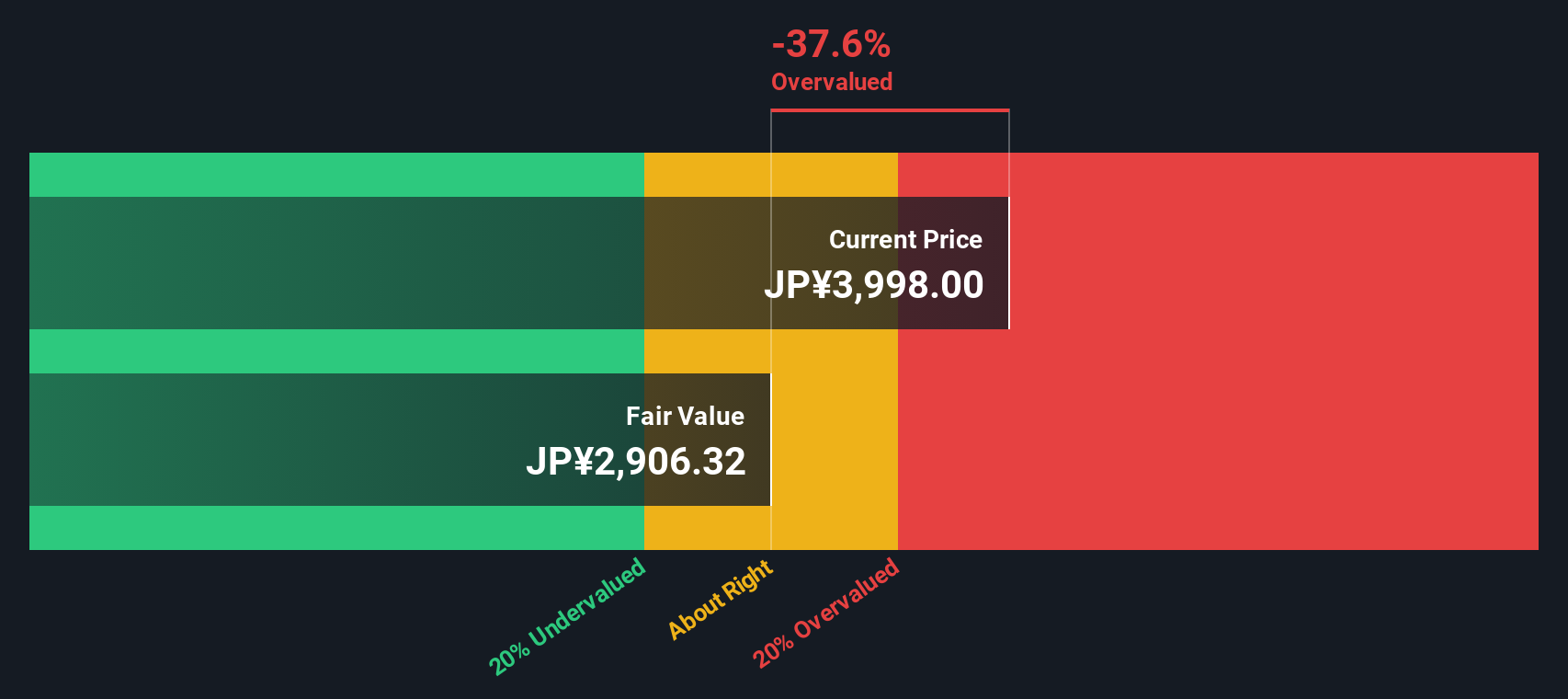

Another View: Discounted Cash Flow Tells a Different Story

While the current share price looks high based on traditional market multiples, our DCF model offers a more conservative perspective. It suggests Nitto Denko could be overvalued, with shares trading notably above the estimated fair value of ¥2,906. This casts doubt on how much future growth is already priced in. Could the market be too optimistic, or has the opportunity been fully realized?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nitto Denko for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nitto Denko Narrative

If you see the numbers differently or want to draw your own conclusions, you can build a Nitto Denko narrative in just a few minutes and shape your own insights. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nitto Denko.

Looking for more investment ideas?

Don’t let opportunity pass you by. Expand your horizons with investment picks perfectly matched to today’s trends, all easily filtered with Simply Wall Street.

- Tap into tomorrow’s market leaders with these 27 AI penny stocks, where AI innovation meets real growth momentum.

- Lock in reliable passive income by starting with these 19 dividend stocks with yields > 3%, offering attractive yields and proven stability.

- Access remarkable value opportunities through these 874 undervalued stocks based on cash flows that the market hasn’t fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Denko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6988

Nitto Denko

Primarily engages in the adhesive tapes business in Japan, the Americas, Europe, Asia, and Oceania.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives