Market Might Still Lack Some Conviction On PILLAR Corporation (TSE:6490) Even After 27% Share Price Boost

Those holding PILLAR Corporation (TSE:6490) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 42% in the last twelve months.

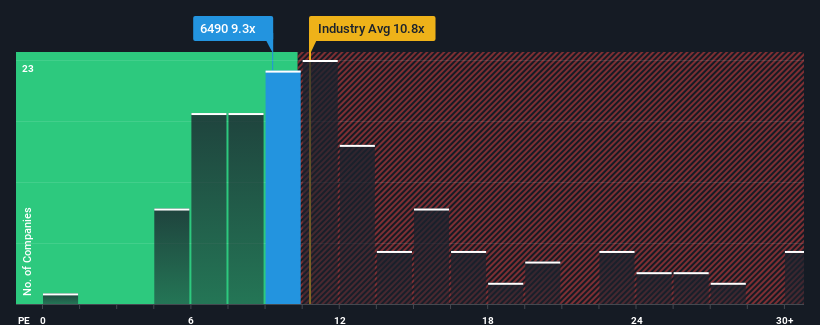

Although its price has surged higher, PILLAR may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.3x, since almost half of all companies in Japan have P/E ratios greater than 13x and even P/E's higher than 21x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

We've discovered 1 warning sign about PILLAR. View them for free.PILLAR could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for PILLAR

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as PILLAR's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 11% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 9.8% per annum, which is not materially different.

With this information, we find it odd that PILLAR is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

PILLAR's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of PILLAR's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for PILLAR that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6490

PILLAR

Designs, develops, manufactures, and sells various fluid control equipment in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives