- Japan

- /

- Metals and Mining

- /

- TSE:5727

Bearish: Analysts Just Cut Their Toho Titanium Company, Limited (TSE:5727) Revenue and EPS estimates

One thing we could say about the analysts on Toho Titanium Company, Limited (TSE:5727) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

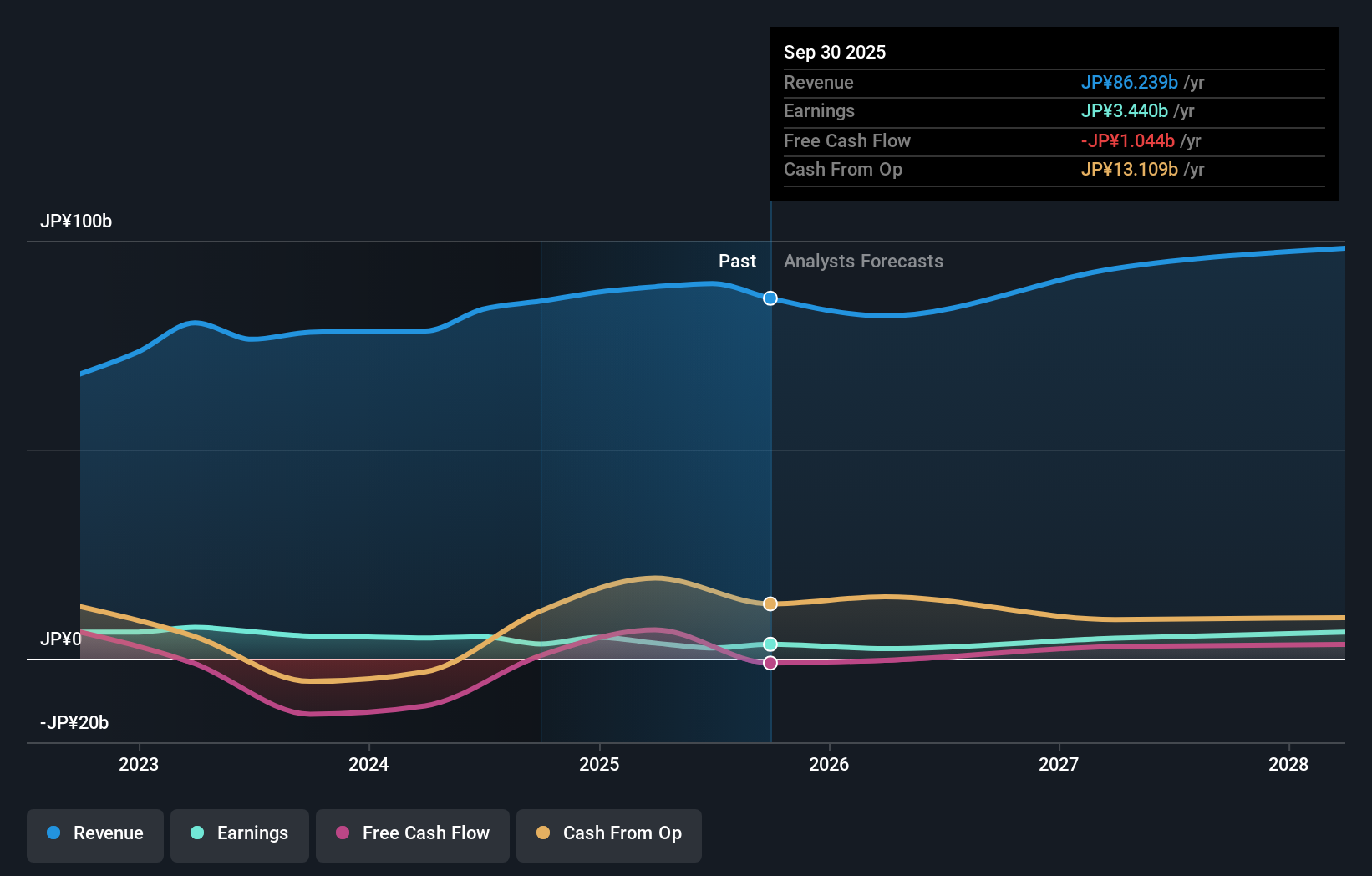

After the downgrade, the consensus from Toho Titanium Company's three analysts is for revenues of JP¥82b in 2026, which would reflect a perceptible 4.9% decline in sales compared to the last year of performance. Statutory earnings per share are anticipated to tumble 30% to JP¥33.70 in the same period. Before this latest update, the analysts had been forecasting revenues of JP¥94b and earnings per share (EPS) of JP¥48.63 in 2026. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a pretty serious decline to earnings per share numbers as well.

View our latest analysis for Toho Titanium Company

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 9.6% annualised revenue decline to the end of 2026. That is a notable change from historical growth of 17% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 2.8% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Toho Titanium Company is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Toho Titanium Company. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Toho Titanium Company's revenues are expected to grow slower than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on Toho Titanium Company, and their negativity could be grounds for caution.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

You can also see our analysis of Toho Titanium Company's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

Valuation is complex, but we're here to simplify it.

Discover if Toho Titanium Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5727

Toho Titanium Company

Engages in the manufacture and sale of titanium metals, catalysts for propylene polymerization, and electronic materials in Japan.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives