- Japan

- /

- Metals and Mining

- /

- TSE:5713

Sumitomo Metal Mining (TSE:5713) Raises Guidance and Dividend: Taking a Fresh Look at Its Valuation

Reviewed by Simply Wall St

Sumitomo Metal Mining (TSE:5713) delivered two key updates: a sizable increase to its full-year profit guidance and a jump in its interim dividend payment. Both moves help paint a picture of renewed operating strength.

See our latest analysis for Sumitomo Metal Mining.

Following the news, Sumitomo Metal Mining’s momentum has accelerated, with a 44.5% share price return year to date and a 44.7% total shareholder return over the past year. This reflects renewed confidence as recent profit guidance upgrades and a boosted interim dividend signal positive shifts in fundamentals.

If Sumitomo’s uptick has you rethinking your watchlist, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With expectations running high and the stock’s rally already underway, the key question is whether Sumitomo Metal Mining still offers value or if the market is already factoring in all of its renewed growth prospects.

Price-to-Earnings of 58.9x: Is it justified?

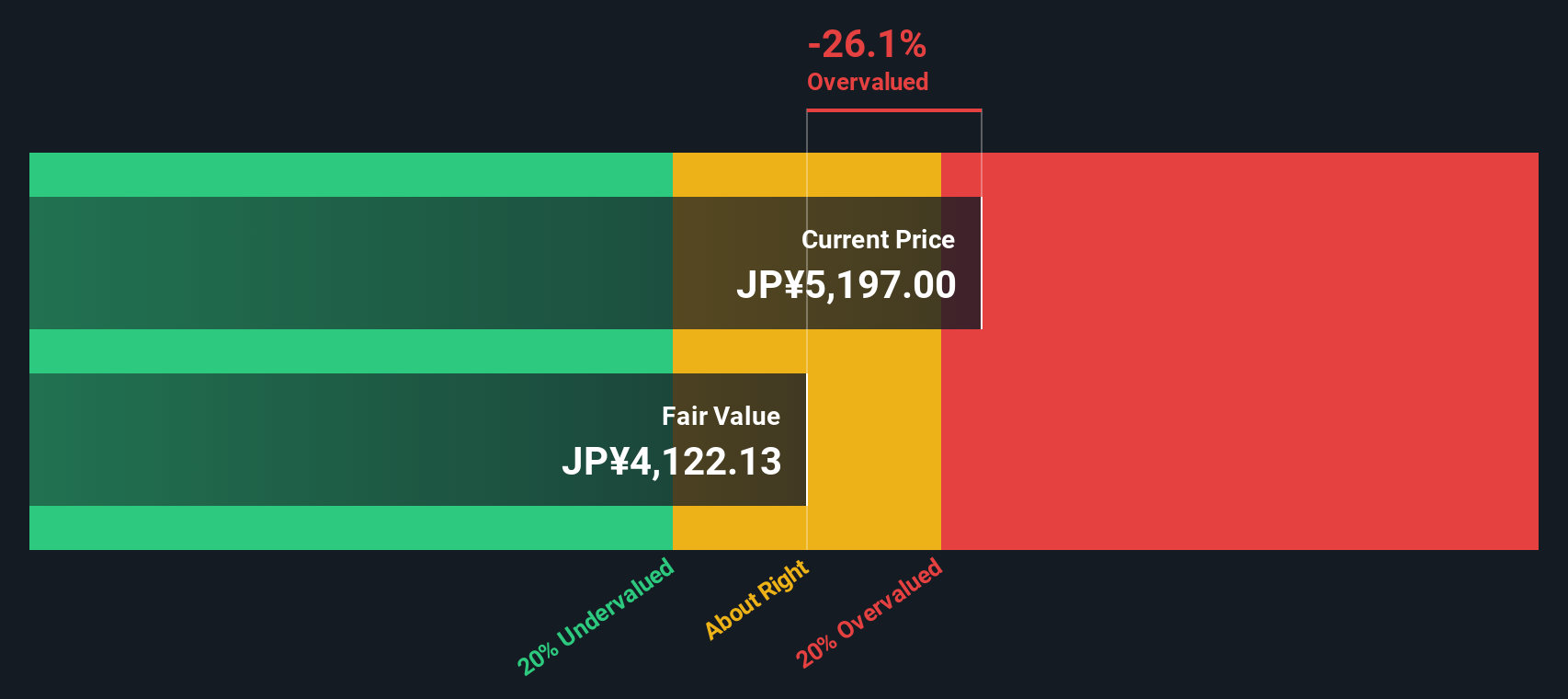

Sumitomo Metal Mining’s last closing price implies a hefty price-to-earnings (P/E) ratio of 58.9x, making it look meaningfully more expensive than both its industry peers and its own fair value estimate.

The price-to-earnings ratio measures how much investors are willing to pay for each unit of current earnings. A higher multiple can suggest optimism about future profit growth, or that the current earnings are temporarily depressed. In Sumitomo Metal Mining's case, the P/E of 58.9x stands well above the Japanese Metals and Mining industry average of 12.4x, as well as the peer average (22.8x).

This sizable premium suggests investors are pricing in a substantial turnaround in the company’s profitability or are betting on strong earnings growth that may not be fully reflected yet in financial results. However, compared to an estimated fair P/E ratio of just 22.5x, this market enthusiasm appears stretched and could be vulnerable if the company fails to meet elevated growth expectations.

Explore the SWS fair ratio for Sumitomo Metal Mining

Result: Price-to-Earnings of 58.9x (OVERVALUED)

However, weaker-than-expected earnings growth or a pullback from recent highs could quickly challenge the bullish sentiment that is currently driving Sumitomo Metal Mining’s valuation.

Find out about the key risks to this Sumitomo Metal Mining narrative.

Another View: What Does Our DCF Model Say?

In contrast to the high price-to-earnings ratio, the SWS DCF model estimates that Sumitomo Metal Mining is currently overvalued, with shares trading above the calculated fair value. This challenges the idea that forward growth fully justifies today’s pricing. Could the market have gone too far?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sumitomo Metal Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sumitomo Metal Mining Narrative

If you have a different perspective or want to shape your own view, you can explore the numbers and build your narrative in just a few minutes. Do it your way

A great starting point for your Sumitomo Metal Mining research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock more opportunities by checking out handpicked stocks that match your interests. Don’t let others get ahead; smart investing starts with the right screener.

- Seize the momentum in cutting-edge medical innovation by searching through these 32 healthcare AI stocks to find companies shaping tomorrow’s healthcare breakthroughs.

- Get ahead of the next market surge by uncovering these 882 undervalued stocks based on cash flows that offer strong cash flow potential and possible value opportunities.

- Position yourself early in digital transformation. Analyze these 82 cryptocurrency and blockchain stocks to spot rising stars in crypto and blockchain technology before crowds catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5713

Sumitomo Metal Mining

Engages in mining, smelting, and refining non-ferrous metals in Japan and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives