- Japan

- /

- Metals and Mining

- /

- TSE:5711

Mitsubishi Materials (TSE:5711) Valuation: Weighing the Recycling Pivot and Global Expansion Strategy

Reviewed by Simply Wall St

Mitsubishi Materials (TSE:5711) has announced a major shift in strategy, planning to reduce its primary copper smelting operations by up to 40% by 2035. The company is setting its sights on secondary smelting, drawing from electronic waste, and has outlined plans to develop new smelters in Europe and the United States. This move is motivated by the pursuit of higher profitability and a growing focus on recycling.

See our latest analysis for Mitsubishi Materials.

Momentum has picked up for Mitsubishi Materials, with the stock posting a 6.5% share price return over the past month and a strong 20.9% rally across the last 90 days. Looking further back, its total shareholder return reached an impressive 33% over the past year and almost 56% over three years. This may indicate that investors are showing increased interest in the company’s evolving strategy and perceived long-term potential.

If this shift toward recycling and international growth has you thinking about what else might be out there, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares already rallying and trading near recent highs, the key question for investors is whether Mitsubishi Materials is undervalued amid its transformation, or if the current price has fully reflected its future growth potential.

Price-to-Earnings of 27.1x: Is it justified?

At the current share price, Mitsubishi Materials is valued at a price-to-earnings (P/E) ratio of 27.1x, which is slightly below the peer average of 27.9x but significantly higher than the broader industry average of 12.1x. This means investors are paying a premium for each unit of earnings compared to many industry peers.

The P/E ratio measures how much investors are willing to pay today for a company's future earnings. Higher P/E values often reflect optimism about future profit growth or a premium for perceived quality or competitive advantages, particularly relevant in industries undergoing rapid change or transformation, such as metals and mining shifting towards recycling and sustainability.

While the current P/E is marginally lower than the peer average, it is well above the sector benchmark, suggesting that the market may be pricing in higher growth expectations or strong confidence in Mitsubishi Materials' strategic shift. However, it is also trading above the estimated fair P/E ratio of 20x, indicating that the stock could see downward pressure if results do not match optimistic forecasts.

Compared to the Japan Metals and Mining industry average of 12.1x, Mitsubishi Materials trades at a significantly richer valuation. This premium signals higher market expectations for future growth or returns. However, the gap with the fair P/E ratio highlights how quickly the outlook could shift if investor sentiment or financial results change.

Explore the SWS fair ratio for Mitsubishi Materials

Result: Price-to-Earnings of 27.1x (OVERVALUED)

However, shifts in investor sentiment or weaker than expected earnings growth could quickly challenge the market’s confidence in Mitsubishi Materials’ future trajectory.

Find out about the key risks to this Mitsubishi Materials narrative.

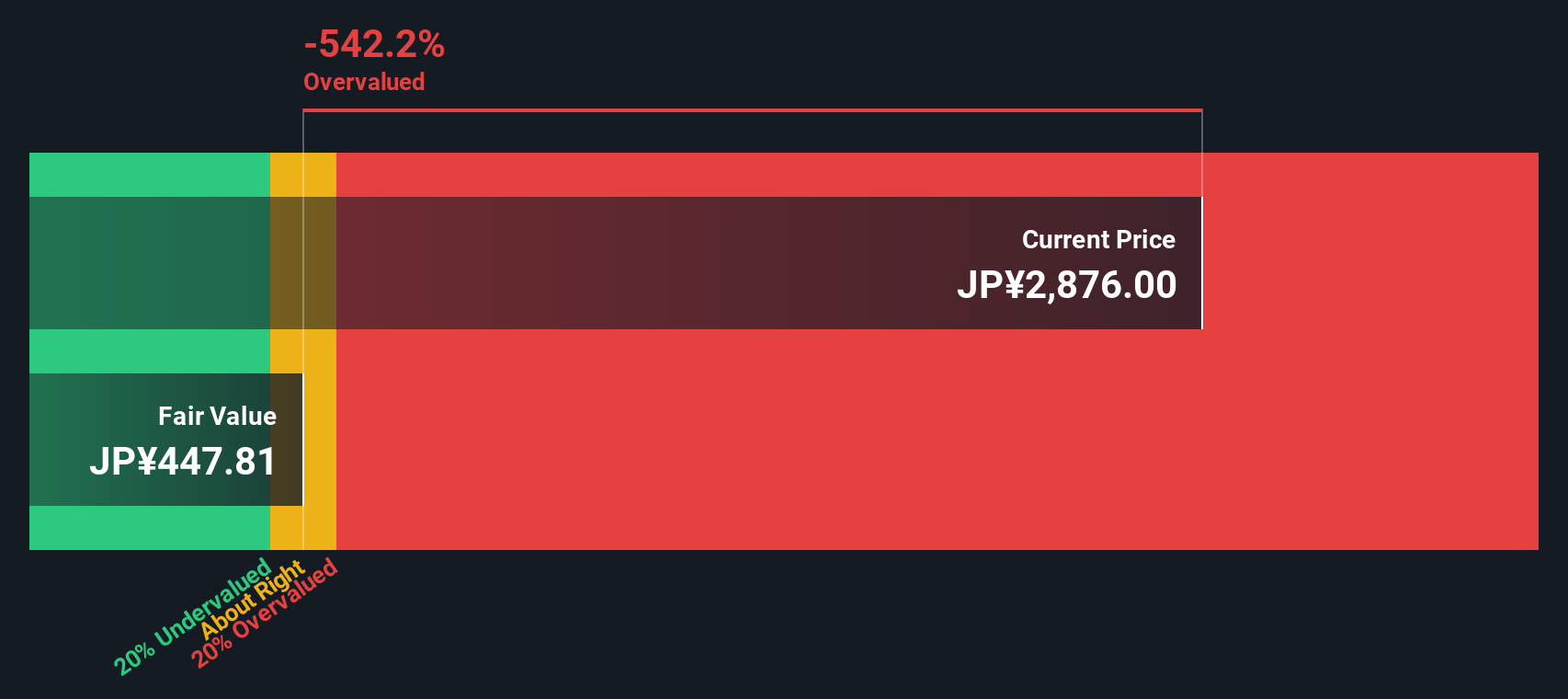

Another View: DCF Model Paints a Harsher Picture

Taking a different approach, our SWS DCF model suggests a much lower fair value for Mitsubishi Materials. According to this estimate, the company's shares are trading well above intrinsic value. This could indicate that the stock is significantly overvalued if these cash flow forecasts are realized. Does this cast doubt on the market's optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi Materials for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi Materials Narrative

If you have a different view or want a deeper look at the numbers, you can piece together your own story and insights in just a few minutes. Do it your way

A great starting point for your Mitsubishi Materials research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investment Moves?

Open the door to fresh opportunities. There is a world of stocks to uncover that could transform your portfolio, and you won’t want to miss what’s next.

- Tap into tomorrow’s tech surge by checking out these 25 AI penny stocks, with artificial intelligence innovators driving major change in global markets.

- Pave your path to regular income as you review these 15 dividend stocks with yields > 3%, featuring companies that offer reliable dividend yields above 3%.

- Get ahead of the curve by examining these 27 quantum computing stocks, where quantum computing breakthroughs are sparking the next era of opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5711

Mitsubishi Materials

Engages in the manufacture and sale of processed copper products and electronic materials, cemented carbide products, and businesses related to renewable energy in Japan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success