- Japan

- /

- Metals and Mining

- /

- TSE:5706

Mitsui Kinzoku (TSE:5706): Examining the Valuation After a 24% Weekly Share Surge

Reviewed by Simply Wall St

See our latest analysis for Mitsui Kinzoku Company.

Mitsui Kinzoku Company’s share price momentum is truly striking, with gains accelerating rapidly in recent months. After its 323% share price return year to date, the company now boasts a staggering 333% total shareholder return over the past year, reflecting a surge in optimism about its growth potential.

If sharp rallies like this have you scanning for more opportunities, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But as excitement builds around Mitsui Kinzoku Company's skyrocketing returns, the question remains: is there still value for new investors, or has the market already factored in all the future growth potential?

Price-to-Earnings of 23.9x: Is it justified?

Mitsui Kinzoku Company’s stock is trading at a price-to-earnings (P/E) ratio of 23.9x, elevating it far above both its industry peers and its fair value benchmarks. With a last close price of ¥19,500, the current valuation invites scrutiny from investors seeking to understand if this premium is warranted.

The P/E ratio captures how much the market is willing to pay today for a yen of earnings. This makes it a vital metric for measuring growth expectations and relative value in the Materials sector. For Mitsui Kinzoku, such a high P/E hints at notable optimism regarding future profit generation. However, closer analysis suggests this optimism may be overstretched, as the company’s projected earnings growth lags behind the broader JP market and its own industry.

Compared to its peer group, Mitsui Kinzoku’s P/E of 23.9x is well above the JP Metals and Mining industry average of 12.4x. This signals a significant premium. More tellingly, this P/E also exceeds the company’s own “fair” ratio of 17.3x, a level that regression analysis suggests the market could eventually revert toward. This raises the possibility that current valuations may not be fully justified by fundamentals alone.

Explore the SWS fair ratio for Mitsui Kinzoku Company

Result: Price-to-Earnings of 23.9x (OVERVALUED)

However, slowing revenue growth and a price significantly above analyst targets could rapidly shift sentiment if financial performance does not keep pace with recent optimism.

Find out about the key risks to this Mitsui Kinzoku Company narrative.

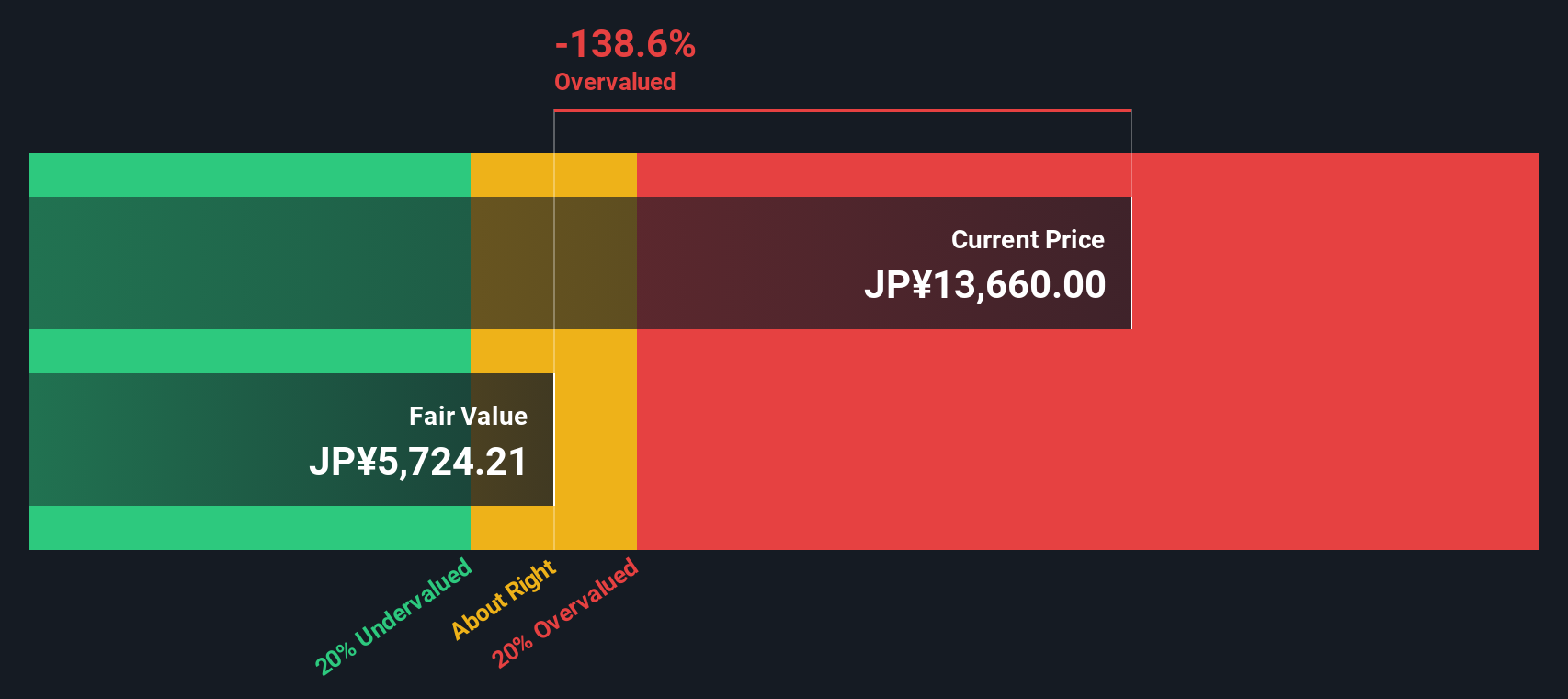

Another View: Discounted Cash Flow Tells a Different Story

Looking at Mitsui Kinzoku Company through the lens of our DCF model, the valuation stands in sharp contrast. According to this method, the current share price far exceeds the company’s estimated fair value. This raises the question: is the market’s optimism getting ahead of itself, or is there something the DCF model is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui Kinzoku Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui Kinzoku Company Narrative

If you would rather dig into the details yourself, or want to shape your own view, you can design your own analysis in just minutes with Do it your way.

A great starting point for your Mitsui Kinzoku Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at just one opportunity. If you want to uncover your next smart move, use the Simply Wall Street Screener and grow your portfolio your way.

- Spot early-stage growth potential by checking out these 3585 penny stocks with strong financials that consistently demonstrate strong financials and momentum.

- Capitalize on new tech trends and see which companies are building the future by reviewing these 25 AI penny stocks.

- Boost your income potential and secure reliable payouts with these 16 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5706

Mitsui Kinzoku Company

Engages in the manufacture and sale of metal products in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives