- Japan

- /

- Metals and Mining

- /

- TSE:5612

After Leaping 29% Nippon Chutetsukan K.K. (TSE:5612) Shares Are Not Flying Under The Radar

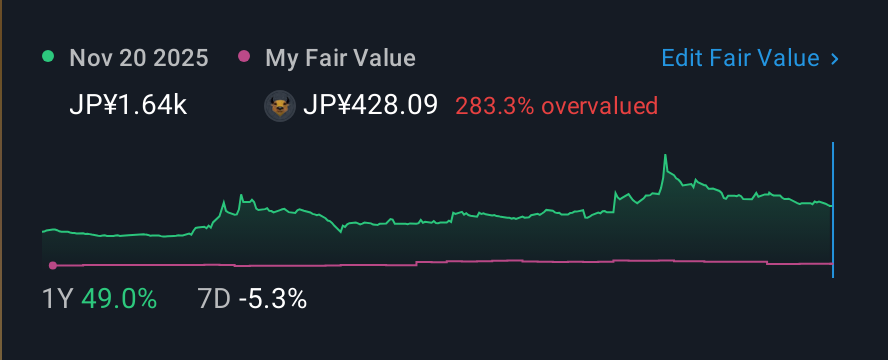

Despite an already strong run, Nippon Chutetsukan K.K. (TSE:5612) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 56%.

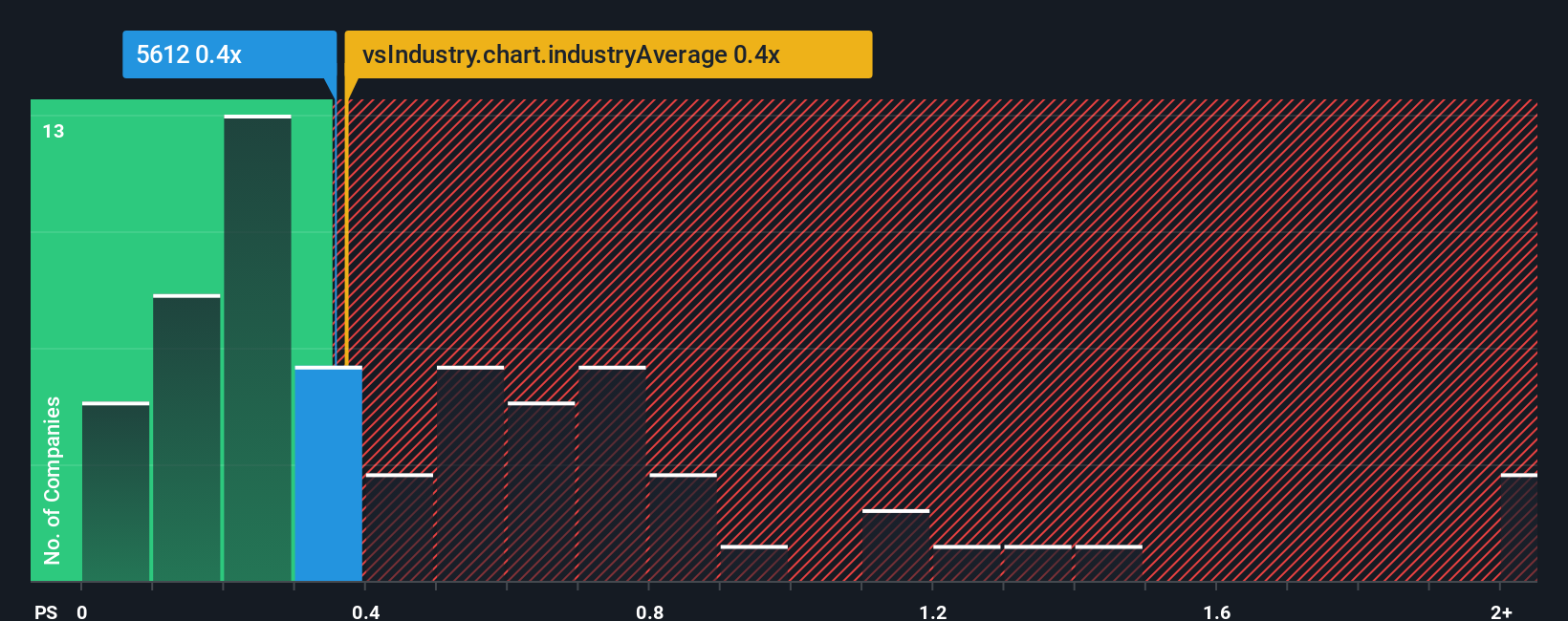

Even after such a large jump in price, there still wouldn't be many who think Nippon Chutetsukan K.K's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when it essentially matches the median P/S in Japan's Metals and Mining industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Nippon Chutetsukan K.K

What Does Nippon Chutetsukan K.K's Recent Performance Look Like?

It looks like revenue growth has deserted Nippon Chutetsukan K.K recently, which is not something to boast about. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. Those who are bullish on Nippon Chutetsukan K.K will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nippon Chutetsukan K.K will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Nippon Chutetsukan K.K?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nippon Chutetsukan K.K's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 12% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 3.9% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why Nippon Chutetsukan K.K's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Its shares have lifted substantially and now Nippon Chutetsukan K.K's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we've seen, Nippon Chutetsukan K.K's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 3 warning signs for Nippon Chutetsukan K.K (2 don't sit too well with us!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nippon Chutetsukan K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5612

Nippon Chutetsukan K.K

Manufactures and sells ductile iron pipes and lids, polyethylene gas pipes, and valves primarily in Japan.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives