- Japan

- /

- Metals and Mining

- /

- TSE:5471

The Bull Case For Daido Steel (TSE:5471) Could Change Following Breakthrough in Rare Earth-Free Magnets – Learn Why

Reviewed by Sasha Jovanovic

- Daido Steel has advanced to mass production of neodymium magnets that do not require rare earth elements, reflecting a significant development in specialty steel innovation.

- This achievement addresses worldwide concerns about sourcing rare earth materials and could reshape supply dynamics for high-performance magnets across industries.

- To better understand the investment narrative, we will review how this technological milestone could influence Daido Steel's competitive position.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Daido Steel's Investment Narrative?

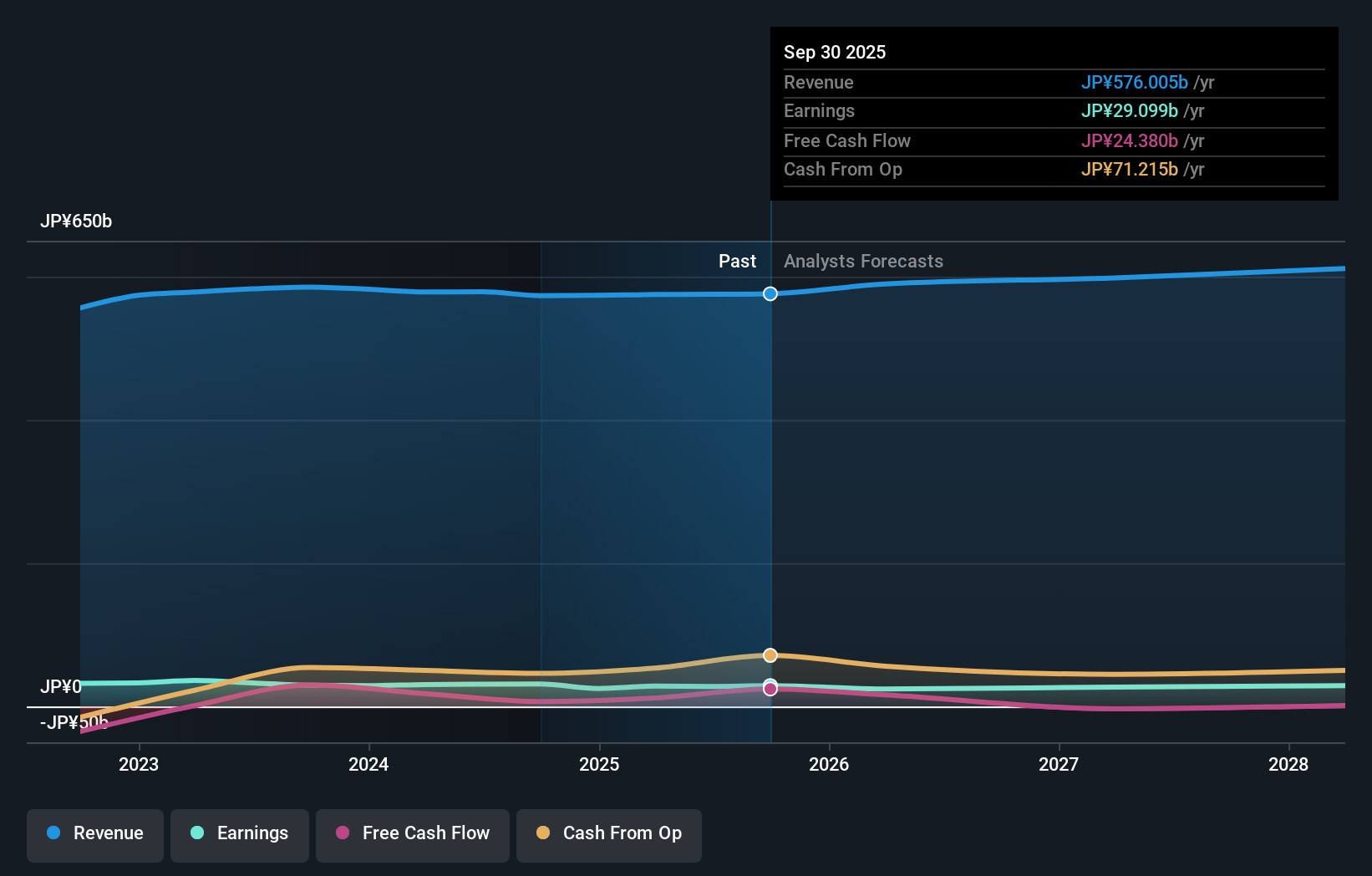

The investment case for Daido Steel centers on the company’s ability to innovate within specialty steel and magnetic materials, maintain shareholder returns, and stay competitive despite a modest growth outlook. The recent breakthrough into mass production of rare earth-free neodymium magnets introduces a catalyst that could shift both demand drivers and margin prospects. Previously, Daido’s short-term outlook was shaped by steady profitability, sustainable but unspectacular dividend increases, and ongoing share buybacks, all underpinned by fair valuation metrics. This news, however, adds potential for greater differentiation versus peers and could mitigate some key risks tied to raw material sourcing. Board independence, previously a concern, still warrants monitoring, as does the pace of revenue and earnings growth, especially with revenue projected to underperform the market. The question now is whether this magnet technology can convert into tangible improvements for shareholders and offset persistent structural weaknesses.

In contrast, board independence concerns remain an issue that investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on Daido Steel - why the stock might be worth as much as ¥1072!

Build Your Own Daido Steel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daido Steel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Daido Steel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daido Steel's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5471

Daido Steel

Engages in the manufacture and sale of steel products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives