- Japan

- /

- Metals and Mining

- /

- TSE:5451

Yodoko (TSE:5451): Evaluating Valuation Following Stock Split, Name Change, and Shareholder Benefit Revamp

Reviewed by Simply Wall St

Yodoko (TSE:5451) has rolled out updates to its shareholder benefit program, introducing new criteria for eligibility and commemorative perks following both a 1-to-5 stock split and a company name change.

See our latest analysis for Yodoko.

Yodoko's thoughtful shareholder initiatives come on the back of robust momentum. While the share price has soared 16% year-to-date, it is the 29% total shareholder return over the past year and remarkable 299% gain across five years that really stand out. These moves suggest management is intent on sustaining investor enthusiasm and rewarding long-term holders, even as near-term share price action takes a breather after a strong multi-year run.

If this kind of steady performance has you looking for other growth stories, it's a great moment to broaden your search and discover fast growing stocks with high insider ownership

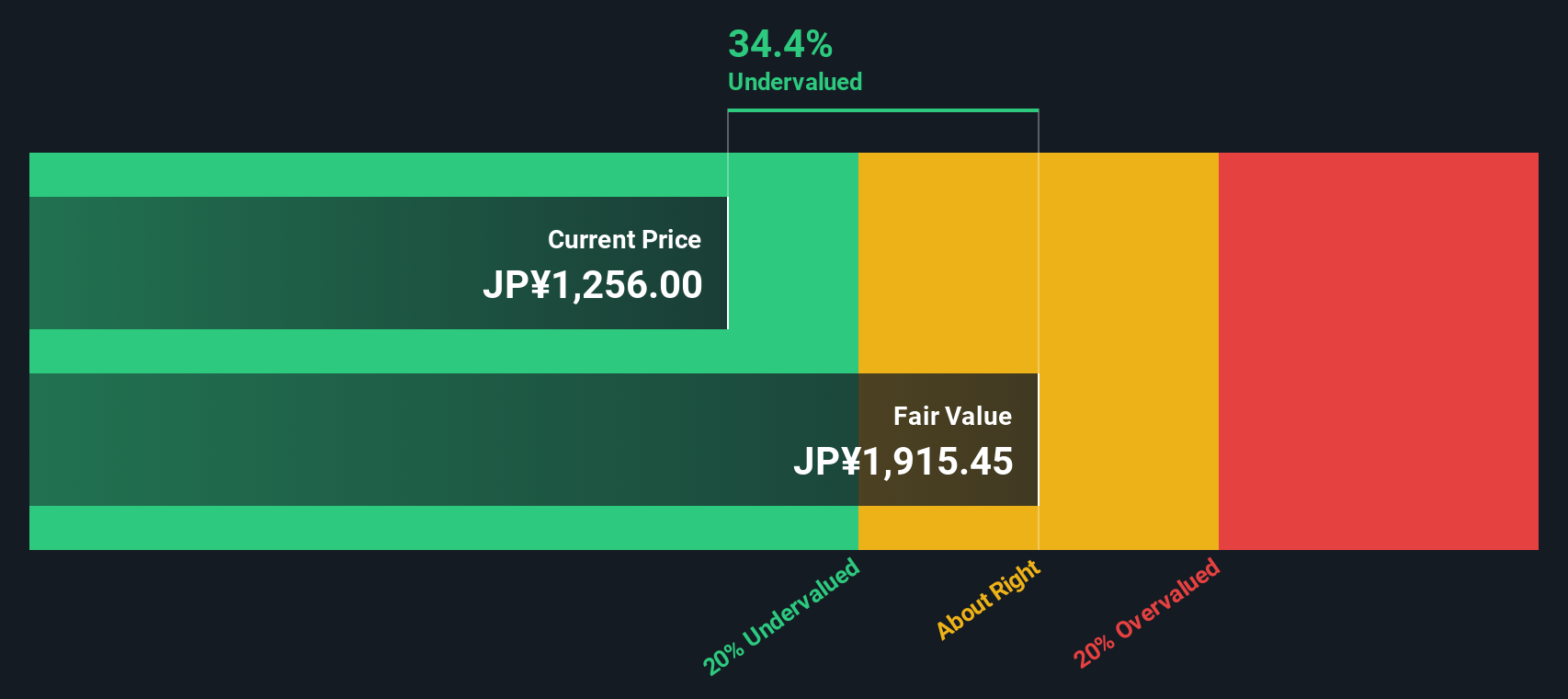

But with the stock’s impressive multiyear climb and new incentives now in play, is there still an undervalued opportunity here? Or have markets already priced in Yodoko’s future growth?

Price-to-Earnings of 13.6x: Is it justified?

Yodoko’s shares are trading at a price-to-earnings (P/E) ratio of 13.6x, slightly below the broader Japanese market's P/E of 14.3x but noticeably above the industry and peer averages.

The P/E ratio indicates what investors are willing to pay for each yen of Yodoko’s earnings. For companies in the metals and mining sector, this multiple reflects the balance of expected growth and the risk profile. Even with a strong streak of profit growth, the market appears to be pricing in optimism about the company’s future earnings potential.

Compared to the Japanese Metals and Mining industry average P/E of 12.5x as well as the peer group’s average of 9.6x, Yodoko looks expensive. This premium suggests the market is expecting outperformance or views the company as less risky than its peers, but it could also raise questions about how much upside is left if those expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.6x (OVERVALUED)

However, shifts in sector sentiment or a slowdown in earnings growth could quickly alter Yodoko’s premium valuation narrative.

Find out about the key risks to this Yodoko narrative.

Another View: Discounted Cash Flow Perspective

To challenge the P/E ratio analysis, let's consider the SWS DCF model. According to this approach, Yodoko’s shares trade at ¥1,295, substantially above our estimated fair value of ¥783.4. This suggests the stock could be overvalued from a cash flow perspective. This raises the question: is optimism already baked into the price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yodoko for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yodoko Narrative

If you see things differently or want to draw your own conclusions from the numbers we've discussed, you can build your outlook in just a few moments. Do it your way

A great starting point for your Yodoko research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors use every edge. Don’t let these unique opportunities pass you by. Try different themes and see which ones could fit your goals today.

- Target rapid innovation as you access these 24 AI penny stocks set to harness artificial intelligence in tomorrow’s booming markets.

- Supercharge your income potential by checking out these 17 dividend stocks with yields > 3% for companies rewarding shareholders with robust dividend yields above 3%.

- Position yourself for growth and stability with breakthroughs in medical tech by following these 32 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5451

Yodoko

Engages in the manufacture and sales of steel products for industrial and consumer products in Japan.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives