- Japan

- /

- Metals and Mining

- /

- TSE:5449

Osaka Steel (TSE:5449) Net Profit Margin Drops to 0.5%, Challenging Premium Valuation Narratives

Reviewed by Simply Wall St

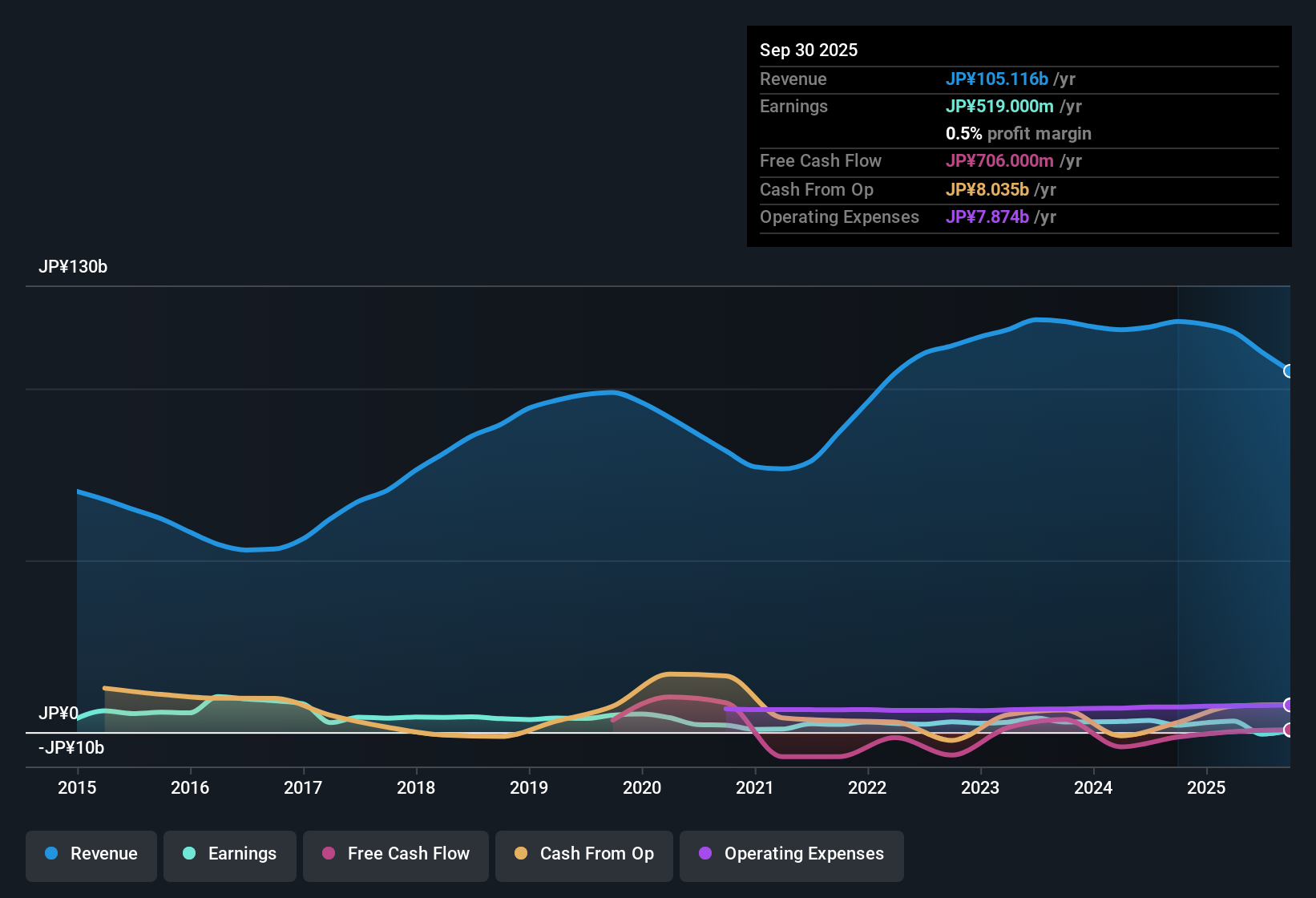

Osaka Steel (TSE:5449) reported a net profit margin of 0.5%, down from 1.7% a year ago, as the company continues to face negative earnings growth in its latest results. Over the past five years, earnings have slipped by an average of just 0.01% per year, and with profit margins now lower than the previous year, investors are left weighing high valuation multiples against subdued profitability trends.

See our full analysis for Osaka Steel.Next up, we'll see how these headline figures compare to the main narratives tracked by the market and the Simply Wall St community. We will consider which themes are supported and where the results differ from expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Quality Holds Up Despite Lower Margins

- Osaka Steel’s current net profit margin has dropped to 0.5% from 1.7% last year. The latest report highlights that the company continues to record high quality earnings, even in the face of shrinking margins.

- What stands out from the prevailing market view is that although profit margins have contracted and negative earnings growth persists,

- the company’s characterization of its earnings as “high quality” suggests underlying results may be more resilient than the headline margin decline implies.

- However, any prolonged margin weakness makes it harder for Osaka Steel to benefit from a cyclical recovery unless profitability improves.

Valuation Soars Far Above Peers

- The company trades at a price-to-earnings ratio of 149.7x, far exceeding the industry average of 13x and peer average of 9.6x. This means investors are currently paying a steep premium for each yen of earnings generated.

- The prevailing market view observes that optimism around valuation is not well supported by profit trends,

- as subdued or contracting profit margins stand in stark contrast to the high P/E multiple.

- This raises questions about whether Osaka Steel truly deserves such a premium when compared to sector peers operating at much lower multiples given similar headwinds.

Fair Value Gap Prompts Investor Caution

- With a current share price of 2,596 and a DCF fair value estimate of 1,745.50, Osaka Steel is trading at a notable premium compared to its own modeled fair value. This may give prospective investors pause.

- The prevailing market view notes that such a wide valuation gap,

- especially in the absence of any material uptick in profitability or margin recovery,

- puts even more focus on future earnings delivery to justify the current premium in Osaka Steel’s share price.

See our latest analysis for Osaka Steel to understand how quality, valuation, and market expectations come together in this unique pricing scenario. See our latest analysis for Osaka Steel.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Osaka Steel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Osaka Steel’s stretched valuation, slipping margins, and ongoing earnings pressures raise concerns about paying a premium for lackluster performance.

If you want opportunities where valuation and price are much more aligned, uncover potential bargains with these 834 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5449

Osaka Steel

Engages in the production and sale of steel sections, bars, steel billets and processed steel products for the construction, civil engineering, shipbuilding, steel towers, and industrial machinery manufacturing applications in Japan.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives