As global markets face a mix of challenges, including a record federal government shutdown in the U.S., concerns over AI-related stock valuations, and fluctuating consumer sentiment, investors are navigating an increasingly complex landscape. Amid these conditions, identifying undervalued stocks can offer potential opportunities for those looking to balance risk and reward; such stocks may provide value by trading below their intrinsic worth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥18.51 | CN¥36.83 | 49.7% |

| Yonghui Superstores (SHSE:601933) | CN¥4.61 | CN¥9.17 | 49.7% |

| TESEC (TSE:6337) | ¥2080.00 | ¥4130.24 | 49.6% |

| STEICO (XTRA:ST5) | €19.88 | €39.56 | 49.7% |

| Roche Bobois (ENXTPA:RBO) | €34.80 | €69.34 | 49.8% |

| Nordisk Bergteknik (OM:NORB B) | SEK13.65 | SEK27.10 | 49.6% |

| Nichicon (TSE:6996) | ¥1282.00 | ¥2557.40 | 49.9% |

| IbidenLtd (TSE:4062) | ¥13710.00 | ¥27270.03 | 49.7% |

| eDreams ODIGEO (BME:EDR) | €7.20 | €14.30 | 49.6% |

| Allcore (BIT:CORE) | €1.34 | €2.66 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

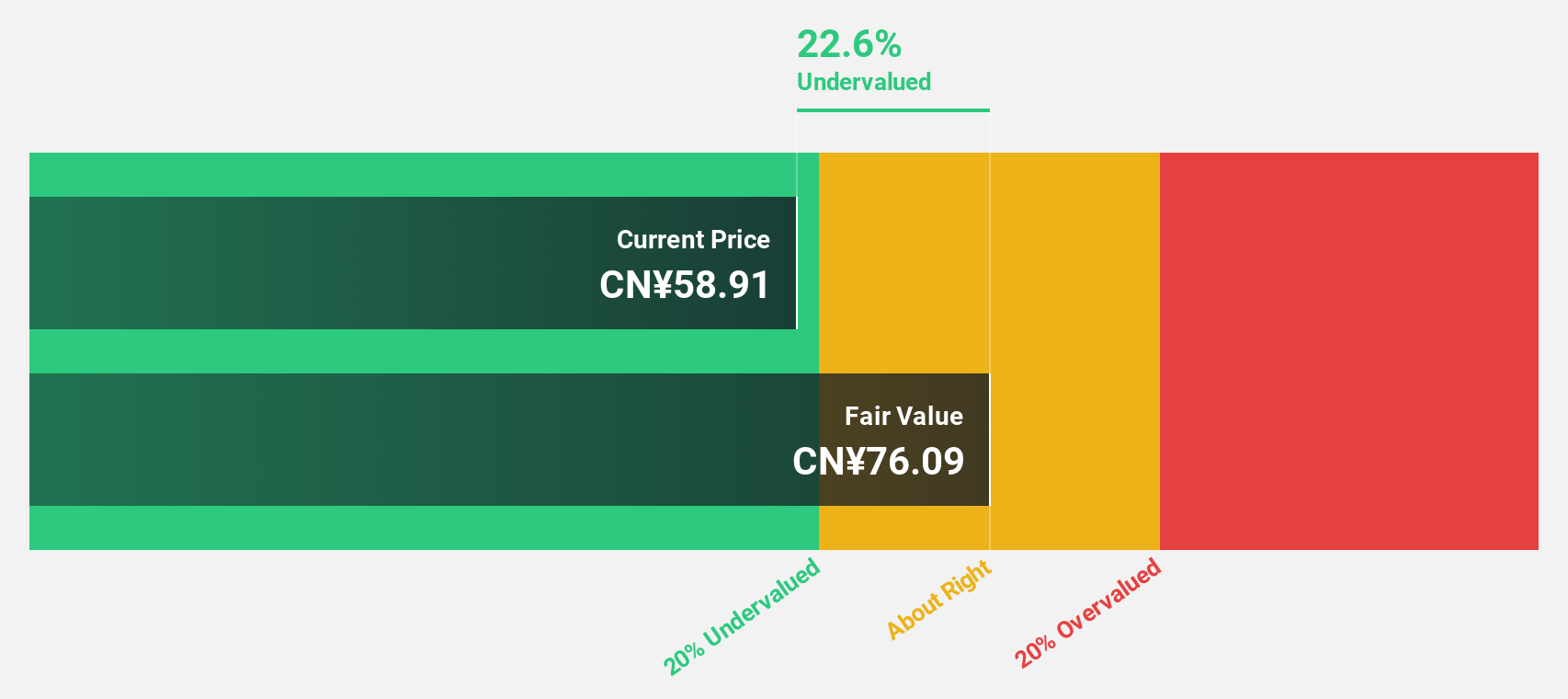

Ninebot (SHSE:689009)

Overview: Ninebot Limited focuses on the design, research and development, production, sale, and servicing of transportation and robot products globally, with a market cap of CN¥41.71 billion.

Operations: Ninebot Limited generates revenue through the development, manufacture, and distribution of transportation and robotic products on a global scale.

Estimated Discount To Fair Value: 33%

Ninebot is trading at CN¥60.08, significantly below its estimated fair value of CN¥89.62, suggesting it may be undervalued based on cash flows. Analysts agree the stock price could rise by 36.8%. Despite earnings projected to grow at 25.4% per year—slower than the Chinese market average—recent results show robust growth with net income rising to CN¥1.79 billion from CN¥969.67 million last year, highlighting strong cash flow potential and profitability improvements.

- The analysis detailed in our Ninebot growth report hints at robust future financial performance.

- Click here to discover the nuances of Ninebot with our detailed financial health report.

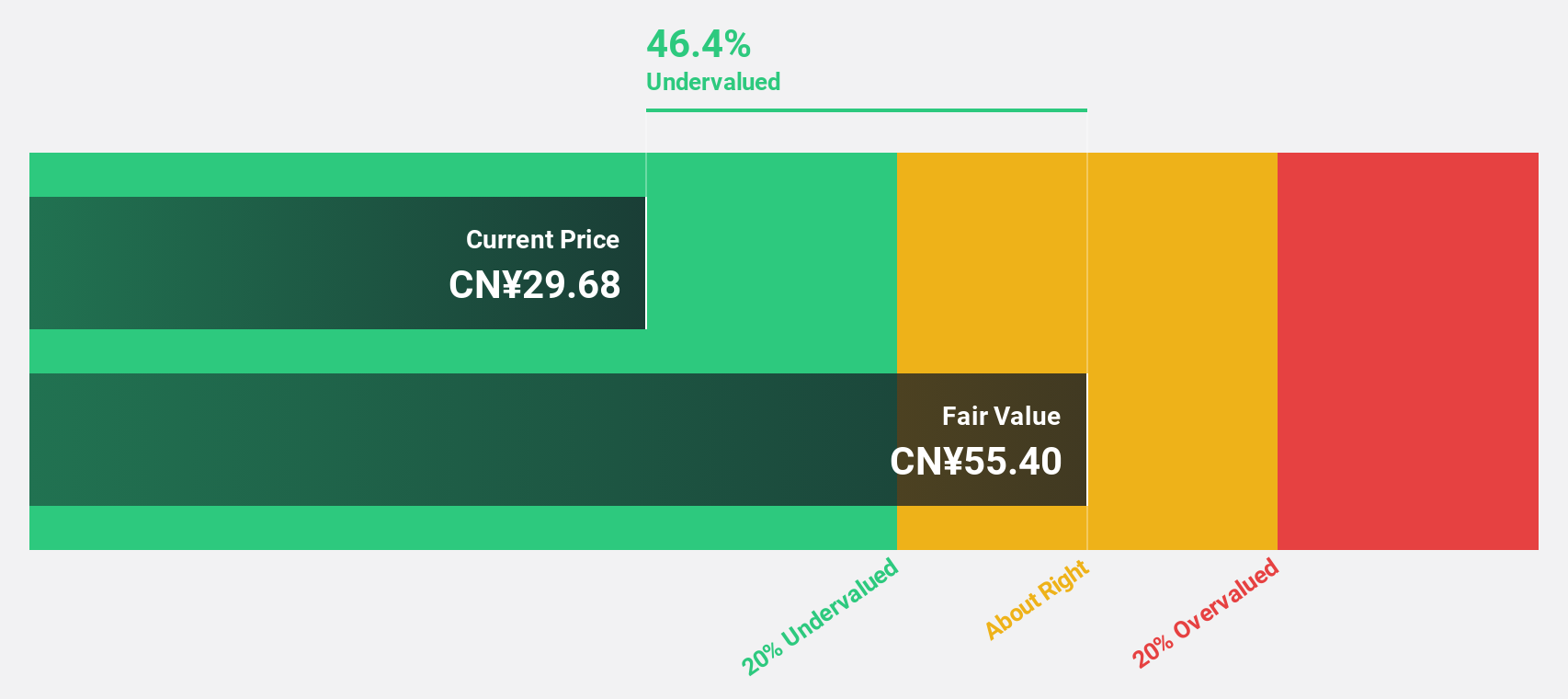

Sinolong New Materials (SZSE:301565)

Overview: Sinolong New Materials Co., Ltd. specializes in the manufacturing of polymer and film materials, with a market cap of CN¥10.64 billion.

Operations: Sinolong New Materials Co., Ltd. generates its revenue primarily from the production of polymer and film materials.

Estimated Discount To Fair Value: 46.7%

Sinolong New Materials is trading at CN¥29.49, well below its estimated fair value of CN¥55.33, highlighting potential undervaluation based on cash flows. Despite a decline in net income to CN¥66.82 million for the nine months ending September 2025 from CN¥115.24 million the previous year, earnings are forecasted to grow significantly over the next three years. However, profit margins have decreased from 6.4% to 2.9%, which may impact future profitability assessments.

- Our growth report here indicates Sinolong New Materials may be poised for an improving outlook.

- Navigate through the intricacies of Sinolong New Materials with our comprehensive financial health report here.

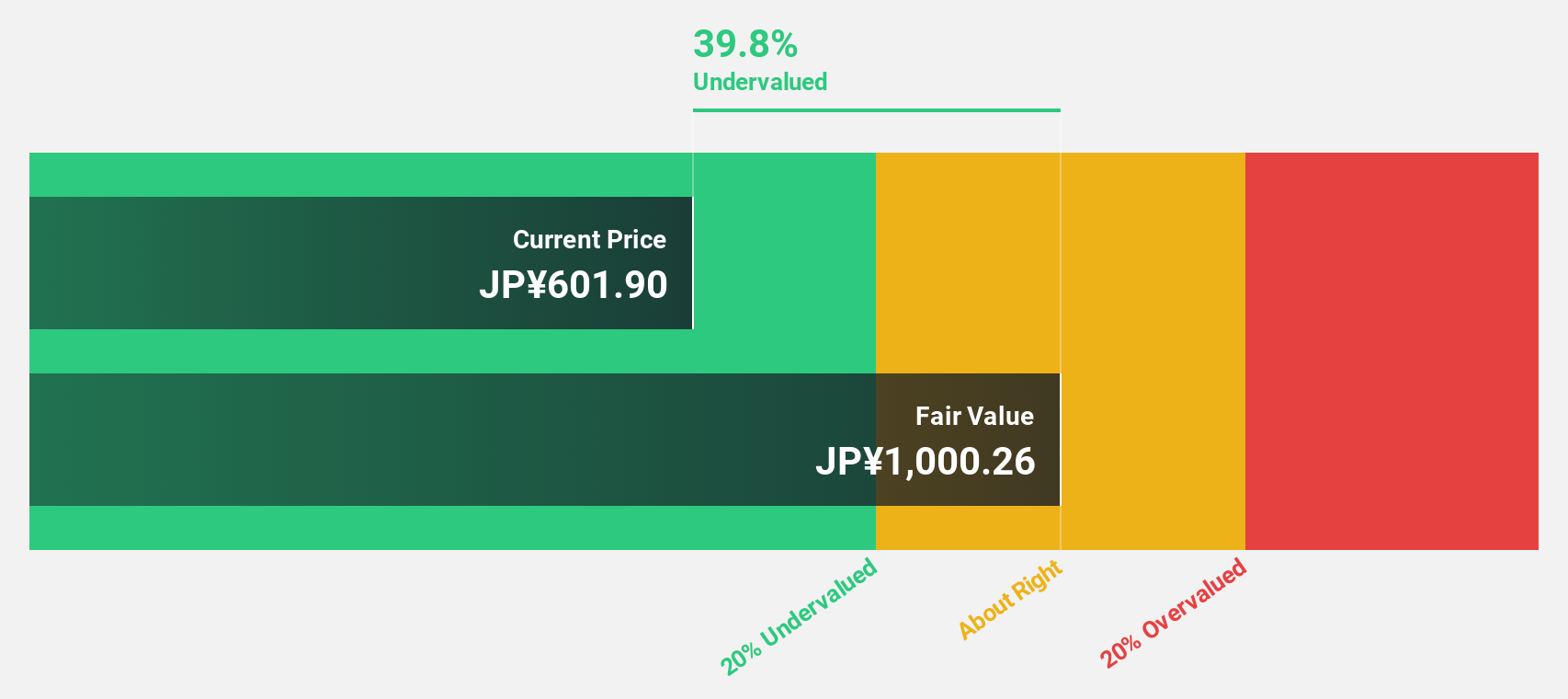

Nippon Steel (TSE:5401)

Overview: Nippon Steel Corporation operates in steelmaking and fabrication, engineering, chemicals and materials, and system solutions both in Japan and globally, with a market cap of ¥3.18 trillion.

Operations: The company's revenue segments include Steelmaking and Steel Fabrication at ¥8.13 billion, Engineering and Construction at ¥399.37 million, Chemicals and Materials at ¥256.89 million, and System Solutions at ¥361.41 million.

Estimated Discount To Fair Value: 41.4%

Nippon Steel is trading at ¥618.1, significantly below its fair value estimate of ¥1055.55, suggesting undervaluation based on cash flows. However, the company faces challenges with a forecasted loss of ¥60 billion for the fiscal year ending March 2026 and a dividend not well covered by earnings. Despite these issues, revenue growth is expected to outpace the JP market at 5.2% annually, although profitability remains uncertain in the near term due to market conditions and restructuring costs.

- Upon reviewing our latest growth report, Nippon Steel's projected financial performance appears quite optimistic.

- Take a closer look at Nippon Steel's balance sheet health here in our report.

Turning Ideas Into Actions

- Investigate our full lineup of 496 Undervalued Global Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301565

High growth potential with adequate balance sheet.

Market Insights

Community Narratives