- China

- /

- Auto Components

- /

- SHSE:600081

Undiscovered Gems None Presents 3 Promising Small Cap Stocks

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by geopolitical shifts and domestic policy changes, small-cap stocks have recently captured attention by reaching record highs alongside their larger counterparts. Amidst this backdrop, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals, innovative potential, and resilience in the face of economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.72% | -3.47% | -13.16% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Dongfeng Electronic TechnologyLtd (SHSE:600081)

Simply Wall St Value Rating: ★★★★★★

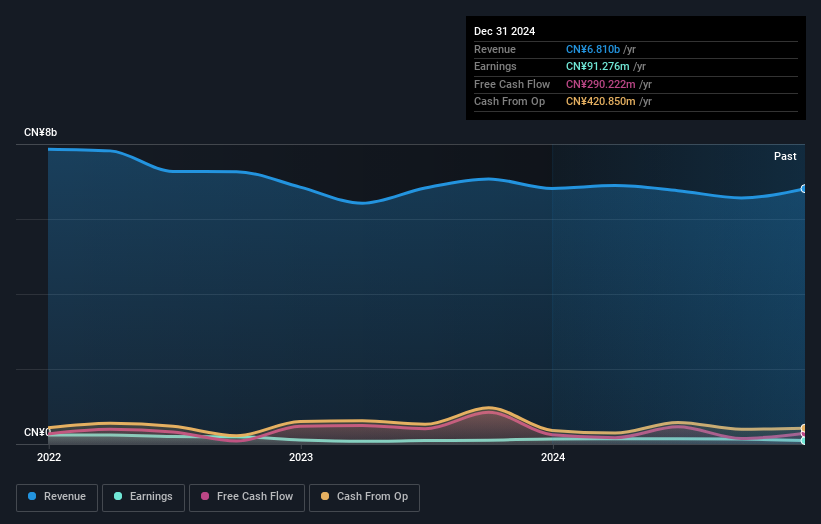

Overview: Dongfeng Electronic Technology Co., Ltd. is involved in the research, development, procurement, manufacture, and sale of automotive parts and accessories in China with a market capitalization of CN¥6.01 billion.

Operations: Dongfeng Electronic Technology Co., Ltd. generates revenue primarily from the sale of automotive parts and accessories in China. The company has a market capitalization of CN¥6.01 billion, reflecting its presence in the automotive sector.

Dongfeng Electronic Technology, a smaller player in the auto components sector, recently reported sales of CN¥5.06 billion for the first nine months of 2024, slightly down from CN¥5.32 billion last year. Earnings per share dipped to CN¥0.1075 from CN¥0.1277, reflecting a challenging market environment despite a notable one-off gain of CN¥75 million in the past year. Impressively, its earnings growth of 27% outpaced the industry's 10%, and it reduced its debt-to-equity ratio from 13.6% to 8.1% over five years, signaling strong financial management amidst fluctuating revenues and profits declining annually by about 1%.

Mitani Sekisan (TSE:5273)

Simply Wall St Value Rating: ★★★★★★

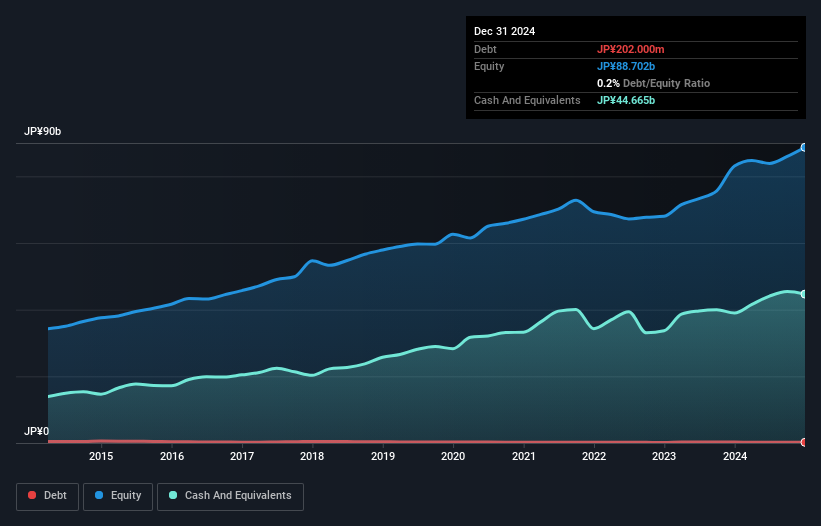

Overview: Mitani Sekisan Co., Ltd. is a Japanese company that specializes in the production and sale of concrete products, with a market capitalization of ¥110.57 billion.

Operations: The company generates revenue from the production and sale of concrete products.

Mitani Sekisan, a smaller player in its sector, has shown promising financial health with a debt to equity ratio dropping from 0.5% to 0.3% over the last five years. The company is trading at a considerable discount, about 67.5% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Despite earnings growth of 14.7% annually over five years, it hasn't outpaced industry averages recently but remains free cash flow positive and covers interest payments comfortably. Recent buybacks totaling ¥133.8 million indicate confidence in its valuation and future prospects as it prepares for upcoming earnings announcements.

- Click to explore a detailed breakdown of our findings in Mitani Sekisan's health report.

Examine Mitani Sekisan's past performance report to understand how it has performed in the past.

FuSheng Precision (TWSE:6670)

Simply Wall St Value Rating: ★★★★★☆

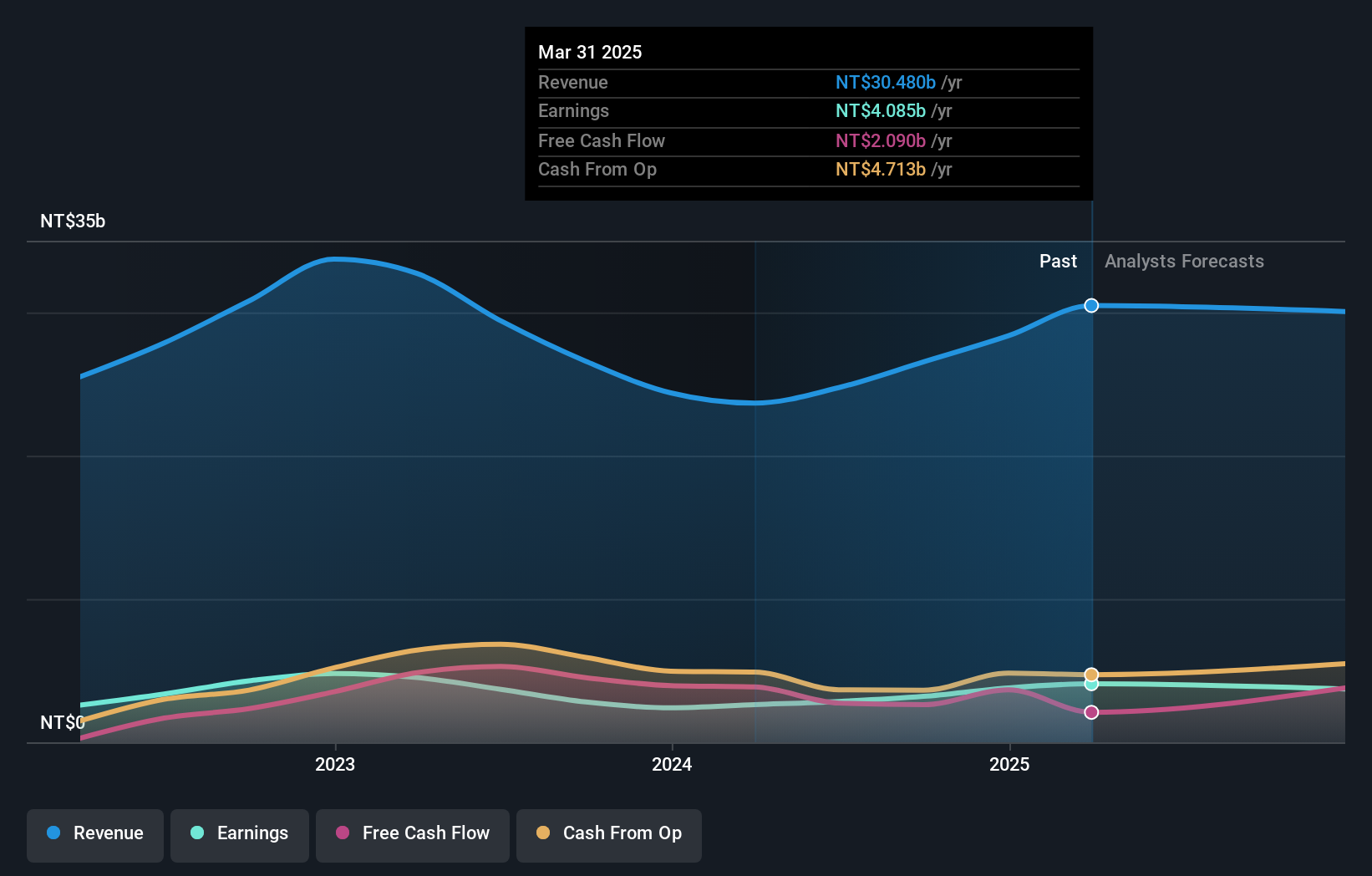

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and globally, with a market cap of NT$42.88 billion.

Operations: FuSheng Precision's primary revenue stream is from its Golf Division, contributing NT$23.09 billion, followed by the Sports Assembly Division at NT$2.44 billion. The company's net profit margin has shown notable trends over recent periods.

FuSheng Precision, a smaller player in the market, recently showcased impressive financial performance with third-quarter sales reaching TWD 7.02 billion, up from TWD 5.23 billion last year. Net income surged to TWD 827 million compared to TWD 470 million a year ago, reflecting its robust growth trajectory. Despite an increase in its debt-to-equity ratio from 12.5% to 13% over five years, the company maintains more cash than its total debt and has positive free cash flow of approximately US$2.62 billion as of September 2024. FuSheng is trading at about 40% below estimated fair value, indicating potential undervaluation in the market context.

Taking Advantage

- Reveal the 4642 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600081

Dong Feng Electronic TechnologyLtd

Engages in the manufacture and sale of automotive parts and accessories in China.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives