- Japan

- /

- Basic Materials

- /

- TSE:5233

Taiheiyo Cement (TSE:5233): Assessing Valuation After Shareholder-Backed Value Enhancement Plan Unveiled

Reviewed by Simply Wall St

Palliser Capital, a major shareholder in Taiheiyo Cement (TSE:5233), unveiled a detailed plan to unlock value at the company. The proposal calls for a strategic review of its U.S. subsidiary, asset monetization, and improvements in capital allocation.

See our latest analysis for Taiheiyo Cement.

After Palliser Capital's value plan went public, Taiheiyo Cement’s stock caught a wave of momentum, reflected in this week’s double-digit share price gains. Zooming out, the company has not only delivered an 18.6% year-to-date share price return but also boasts a striking 29% total shareholder return over the past year and a stellar 126% total return for investors who stuck around since 2022. This is clear evidence that long-term holders have been rewarded while renewed interest is building around its strategic transformation.

If Taiheiyo Cement’s renewed energy piqued your interest, this could be an ideal moment to broaden your view and discover fast growing stocks with high insider ownership

But with shares surging and a promising value plan on the table, investors might wonder if Taiheiyo Cement is still undervalued, or if the market is already pricing in the company’s future growth story.

Price-to-Earnings of 9.2x: Is it justified?

At a price-to-earnings (P/E) ratio of 9.2x, Taiheiyo Cement’s shares appear undervalued compared to both industry peers and fair value benchmarks, with the most recent close at ¥4,203.

The price-to-earnings ratio compares the company’s current share price to its per-share earnings, providing a quick sense of how much the market is willing to pay for a company’s profits. In the materials sector, a lower P/E can suggest undervaluation if earnings are stable or rising.

Taiheiyo Cement stands out for trading at a significant discount, not only to its peer average P/E of 12.7x but also below the broader Basic Materials industry average of 12.5x. The company’s fair P/E, estimated at 15.9x, points to a level the market may eventually re-rate toward as earnings normalize or improve.

Explore the SWS fair ratio for Taiheiyo Cement

Result: Price-to-Earnings of 9.2x (UNDERVALUED)

However, slowing revenue growth or unexpected shifts in global demand could limit upside potential and put pressure on Taiheiyo Cement's valuation in the future.

Find out about the key risks to this Taiheiyo Cement narrative.

Another View: SWS DCF Model Weighs In

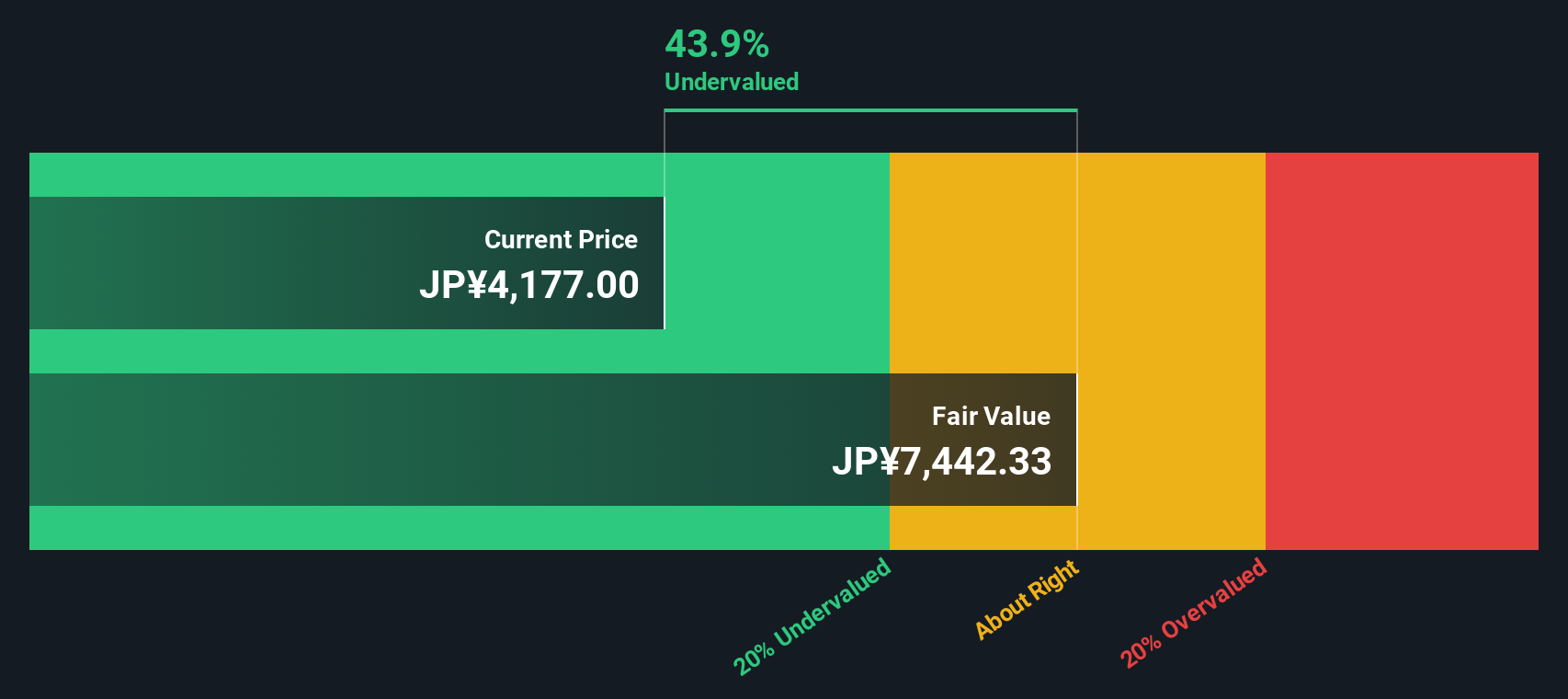

While Taiheiyo Cement looks undervalued on traditional price-to-earnings comparisons, our DCF model suggests shares are trading at a remarkable 42.7% discount to their estimated fair value. This deeper, cash flow-based method bolsters the undervaluation argument, but could it be missing shifting industry fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiheiyo Cement for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiheiyo Cement Narrative

If you think there’s more to Taiheiyo Cement’s story or want to run your own numbers, you can build your own view in just a few minutes. Do it your way

A great starting point for your Taiheiyo Cement research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your strategy a step further and put yourself in front of tomorrow’s biggest opportunities. These unique stock ideas could give your portfolio an edge.

- Tap into next-level healthcare solutions and turbocharge your research with these 33 healthcare AI stocks driving innovation across medical technology and patient care.

- Unlock the income power of reliable stocks yielding over 3%, starting with these 17 dividend stocks with yields > 3% for those focused on steady, long-term returns.

- Seize your chance to join the digital asset revolution by examining these 80 cryptocurrency and blockchain stocks at the forefront of blockchain and cryptocurrency advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiheiyo Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5233

Taiheiyo Cement

Engages in the cement, mineral resources, environmental, construction materials, and other businesses in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives